Kaspa (KAS) is shaking things up again, and this time, it’s not just about price action. According to Kaspa Daily on X, over 70% of the token’s circulating supply hasn’t moved in more than three months. That’s a strong signal that holders are locking in and sitting tight. Meanwhile, there’s nearly $12 million in short positions stacked just above $0.09, which could get wiped out fast if the price keeps climbing.

A chart titled “Supply Not Moved in Over 3 Months” shows how this trend has built up. Back in December 2024, only about 59% of KAS supply was inactive. Fast forward to June 2025, and that number has jumped to over 70%. What’s more, this rise in dormancy kicked off in January, right when KAS price started its big run from $0.06 to almost $0.30.

This metric tracks coins that haven’t moved in 90 days or more. When that number goes up, it usually means long-term holders are in control, and the liquid supply on exchanges is shrinking. That can tighten things up fast if new buyers start coming in. On top of that, Kaspa Daily also shared that nine new wallets holding over 10 million KAS each popped up between March and May, a sign that some big players might be quietly loading up.

In the past 90 days, 9 new wallets have joined the ranks of Kaspa whales, each now holding over 10 million KAS.

— Kaspa Daily (@DailyKaspa) June 8, 2025

This steady rise in large holders signals growing confidence and quiet accumulation beneath the surface.

Smart money doesn’t shout. It stacks. pic.twitter.com/ffxMhpVA1y

What you'll learn 👉

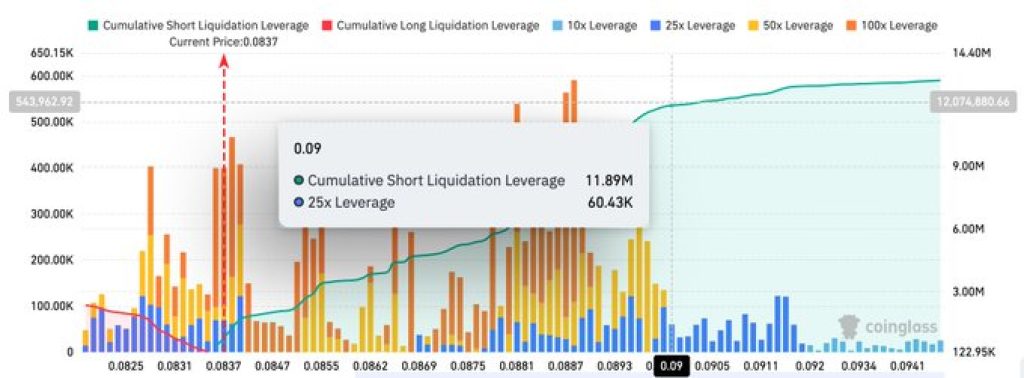

Kaspa Short Liquidity Cluster Forms at $0.09

Coinglass data confirms that a major cluster of short positions is concentrated just above the $0.09 mark. These positions, taken with 25x and 50x leverage, are vulnerable to forced closure if the KAS price moves higher. A break above this level could lead to liquidations totaling nearly $12 million.

The liquidation chart shows minimal resistance above $0.091. If the current price of $0.0837 rises beyond this threshold, it could lead to a sharp price increase as short positions unwind and add upward pressure.

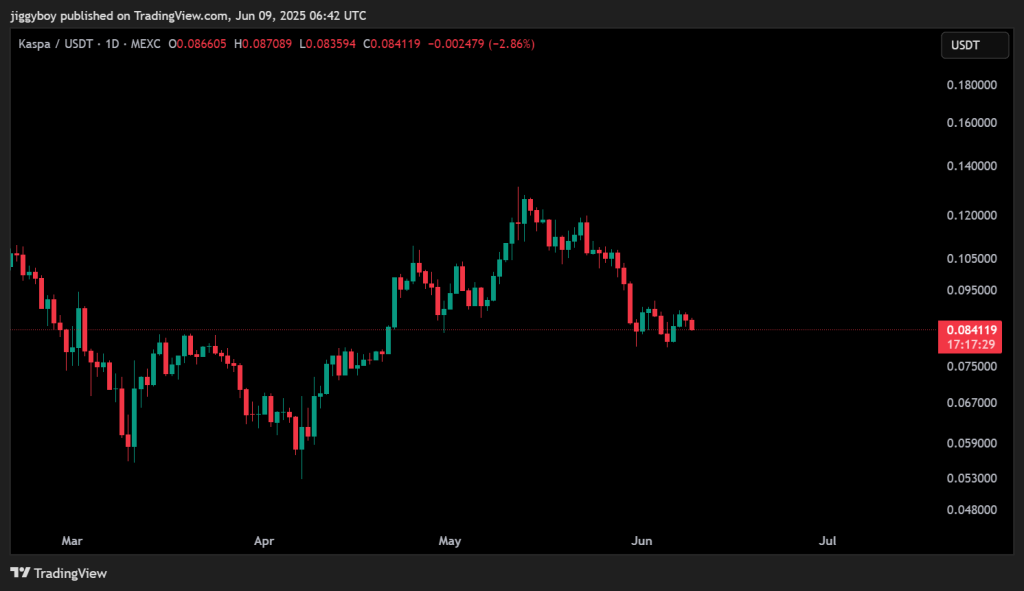

Moreover, Kaspa recent price action shows clear consolidation near the $0.083 to $0.087 range following a pullback from its May highs. After rallying from around $0.058 to nearly $0.13 between April and mid-May, the price entered a downward phase before stabilizing just above key support.

The $0.0825 level has acted as a short-term floor, while $0.087 remains the immediate resistance. If KAS price pushes above $0.087 and approaches the $0.09 mark, the dormant supply and short squeeze potential may amplify market reactions.

KAS Market Structure and Whale Accumulation

The current structure presents a setup where low circulating supply intersects with leverage-driven risk. Whale accumulation also continues quietly, as noted in a post from Kaspa Daily, stating that large holders are increasing without drawing attention.

This combination of reduced sell pressure, rising long-term holding, and clustered short positions creates a complex environment. Market participants are closely watching the $0.09 level, where any upward move could trigger a broader reaction across both spot and derivative markets.

Read Also: Bitcoin (BTC) Price Just Tapped Its Strongest Support – Is a $115K Breakout Imminent?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.