Kaspa (KAS) is known for its unique blockDAG architecture and impressive scalability is starting to attract comparisons with one of the most active blockchain platforms in the world, Solana.

Kaspa currently processes between 35,000 and 40,000 regular transactions daily. These are actual user transactions and do not include block rewards (coinbase transactions), which follow a different pace because of Kaspa’s high-speed, parallel-block structure.

Solana, on the other hand, is in a different league for now. In early 2024, Solana was pushing over 200 million transactions every single day. Even during quieter periods like January 2025, the blockchain consistently recorded more than 100 million transactions daily. For example, on January 2, it processed over 104 million. These high numbers are largely due to its use in DeFi, NFTs, stablecoins, and other decentralized applications.

So the question is, what happens if Kaspa starts handling this same scale of daily transactions, somewhere between 100 million and 200 million, by 2030?

What you'll learn 👉

Can Kaspa Match Solana Throughput

Solana has long been famous for its speed. It is one of the few chains that boasts a throughput of up to 65,000 transactions per second. But after Kaspa’s Crescendo upgrade in May, many believe the game has changed.

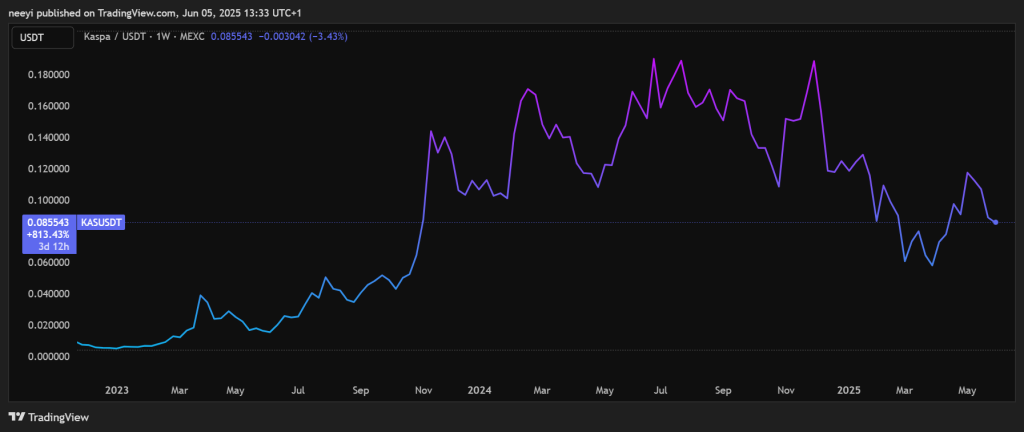

Kaspa’s transaction capacity reportedly spiked and the protocol has the architecture to handle much more. Reports during the Crescendo rollout showed Kaspa reached over $700,000 in daily transaction value, yet the price still ranged between $0.11 and $0.13.

Kaspa Sees Transaction Spike Following Crescendo Update

— Kaspa Daily (@DailyKaspa) May 7, 2025

Kaspa network activity has surged significantly, with daily transactions nearing 700,000 following the recent Crescendo update.

The update, which enhances block processing efficiency and prepares the network for future… pic.twitter.com/rugVKVhZMx

This shows a lot of potential upside. Some analysts even suggest Kaspa might one day compete with Solana directly in terms of transaction volume, and if that happens, it could completely reshape the Kaspa price outlook.

The Odds and Price Possibilities for KAS in 2030

We asked ChatGPT to give us the odds of Kaspa processing Solana’s current daily volume of around 200 million transactions by the year 2030. Here is what came back.

Scenario 1: Kaspa Handles 100 Million Transactions Daily by 2030

Odds: 45%

This is the more likely scenario, especially if Kaspa continues to build momentum with developers, integrate with DeFi applications, and attract more real-world usage. At 100 million transactions daily, Kaspa would be processing 2,500 times more user transactions than it currently does.

Assuming similar transaction-based valuation models and increased adoption, the Kaspa price could rise significantly. From the current $0.08 and a market cap of about $2.2 billion, the price could hit somewhere between $1.50 and $2, putting its market cap around $40 billion if supply remains the same.

Scenario 2: Kaspa Fully Matches Solana at 200 Million Transactions Daily

Odds: 20%

This scenario is more aggressive but not impossible. It would require Kaspa to not just scale technically, but also grow its ecosystem massively, including adoption in NFTs, stablecoins, DeFi, and developer tooling like Solana has.

If this happens, and Kaspa matches Solana in both transaction volume and ecosystem value, its price could push toward $3 to $4, potentially reaching a $70 billion market cap. This would represent a 35x to 50x jump from current levels, even without reducing total token supply.

Read Also: Data Reveal Stellar (XLM) Is Just Starting: Analyst Raises Urgency as Rally Nears

Right now, Kaspa is still early in its growth journey. But the blockDAG architecture gives it a unique edge that could allow it to scale faster than traditional blockchains. While matching Solana’s daily transaction volume by 2030 may seem like a stretch today, it is not out of the question.

For now, all eyes are on the developers, community, and real-world use cases that will shape KAS’s journey from here to 2030.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.