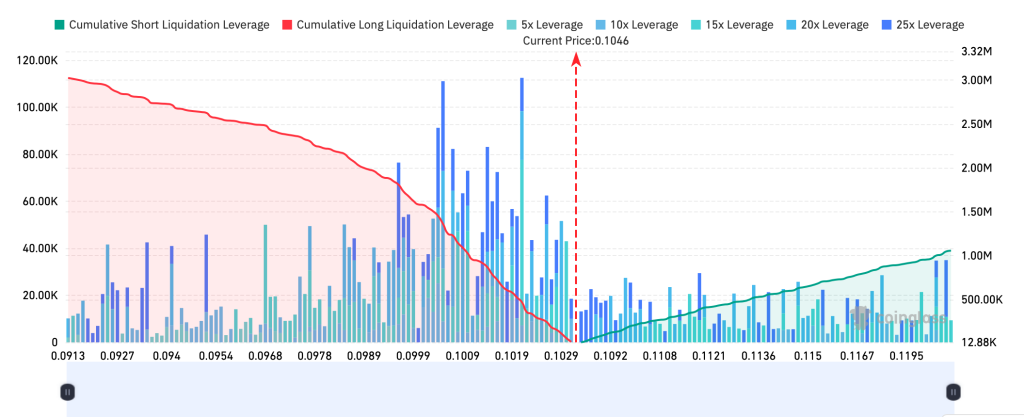

The latest liquidation heatmap from Kaspa Daily gives us a clear view of the battle unfolding around the $0.10 level, and why it now represents one of the most critical price zones for Kaspa (KAS) in the near term.

At the time of the chart’s release, KAS is trading just above $0.1046, but leveraged positions are piling up just beneath that. A large cluster of long leverage is stacked between $0.099 and $0.103, especially concentrated among traders using 10x, 15x, and even 25x leverage.

So, this creates a dangerous setup – because if the Kaspa price drops just slightly from here, a wave of long liquidations could be triggered, especially below $0.10. Once that key level breaks, the forced selling effect from highly leveraged positions could accelerate downward price action, leading to a cascade of liquidations that intensifies the drop.

The chart shows this through the steep decline in the red curve, which represents cumulative long liquidation leverage. That curve begins to slope downward sharply right after $0.103 and continues until around $0.096 -marking this range as highly vulnerable to sharp downside moves.

What you'll learn 👉

📉 Why Leverage Below $0.10 Adds to the Risk

When too many long positions stack up too close to one another, it only takes a small dip to force those traders to close out – automatically triggering more selling and often pushing price even lower in a chain reaction. This is what analysts call “cascading liquidations”, and it’s one of the fastest ways a crypto asset can see a short-term correction.

Because of how much leverage is exposed between $0.099 and $0.104, $0.10 has now become the line in the sand for bulls. If that level fails to hold, the sell pressure that follows could easily knock KAS down another few percentage points in a matter of minutes.

Meanwhile, short liquidation leverage is more evenly distributed and significantly lighter. The green curve, representing cumulative short positions, rises gradually and steadily from the current price up to $0.12. There’s no sharp spike in exposure, meaning that shorts are not as vulnerable to a squeeze unless the price sees a much larger move upward.

That also suggests less resistance from short-sellers, making it theoretically easier for bulls to push upward if buying pressure returns – but only if $0.10 holds first.

Read also: Why Kaspa Might Soon Power the Fastest Smart Contracts in Crypto

🧠 Final Takeaway

This is one of those moments where price may not be moving much – but tension is building fast under the surface.

Bullish sentiment still dominates, but the amount of long leverage stacked below current price means any slip below $0.10 could flip that sentiment instantly. What looks like a calm chart today could become a fast-moving sell-off tomorrow if liquidation zones are triggered.

If KAS holds $0.10 and bounces, it could flush weak hands and give bulls room to push toward $0.115 or higher. But if that level fails, expect rapid downside movement into the $0.095–$0.090 range, driven by forced liquidations.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.