Raydium price is back on traders’ radar after jumping 9% over the past day, now trading above $3.29. What’s catching even more eyes is the spike in trading volume, up over 100%, as market watchers track renewed momentum around one of Solana’s biggest DeFi platforms. At the center of the noise is a tweet from crypto expert Cooker.hl, spotlighting the protocol’s aggressive buyback strategy.

As Cooker.hl explained, Raydium has already scooped up more than 67 million RAY tokens, a haul worth about $208 million. The program is still active, snapping up at least 30,000 tokens daily. And in just the past three months, it’s added another 5.7 million tokens to the pile, valued at roughly $17.8 million.

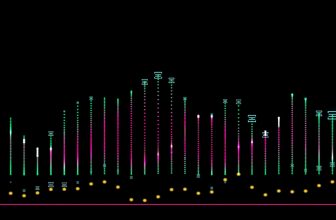

Charts from Blockworks Research back this up. One graph tracks daily buybacks, showing heavy activity between 40,000 and 150,000 tokens per day from March to May. Another chart shows the bigger picture, a steep and steady climb in the total amount of RAY bought back. While the daily pace has slowed a bit since the March highs, the program hasn’t stopped. It eeps chipping away, creating a constant stream of buying pressure that traders can’t ignore.

I have been keeping an eye on the @RaydiumProtocol buyback program for the last few months now. The program has bought back a total of 67,085,691 (Approx. $208,604,062). The program continues to buyback over 30,000+ $Ray per day.

— Cooker.hl | Kms.eth | Cooker (@CookerFlips) May 25, 2025

In the last 3 months alone, Raydium has bought… pic.twitter.com/stntCqqRpo

What you'll learn 👉

Raydium Price Technical Analysis: $4 Resistance in Focus

The RAY chart shows the token testing a long-standing descending trendline. The RAY price remains just below the 200-day simple moving average (SMA), positioned at $4.017. This moving average has previously rejected upward movements, making it a key resistance level.

The $3.40 to $3.50 range appears to be the immediate challenge, with RAY price consolidating below it for several sessions. If buyers manage to push the token above both the diagonal trendline and the 200-day SMA, further upside toward $5.00 could become feasible. On the downside, $2.80 and $3.00 serve as nearby support levels.

RAY Volume Surge and RSI Patterns Indicate Building Momentum

Daily RSI values stand at 57.85, suggesting the token has not yet entered overbought territory. It has remained between 50 and 65 for several weeks, indicating consolidation with a slight bullish bias. The uptick in trading volume adds to the momentum, reflecting increased market participation.

Short-term traders are likely monitoring whether Raydium price can break and hold above the $4.00 threshold. A decisive move past this level would not only break the trendline but also clear the 200-day SMA, both of which are widely followed by technical analysts.

Read Also: XRP Ledger vs Chainlink: What the Messari Report Really Tells Us

Raydium Ecosystem Position Strengthens

Raydium is still one of the biggest decentralized exchanges on Solana, holding around 40% of the ecosystem’s market share. This strong position supports its buyback model, which works to reduce the circulating supply while keeping token liquidity stable.

With daily buybacks continuing and price action approaching a key level, market participants are watching closely to see if momentum carries RAY price beyond current resistance. Whether the token advances past $4 or retraces toward lower supports may depend on broader Solana market sentiment and sustained buyback pressure.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.