AAVE price is on a tear right now. Over the past day, the price has jumped over 22%, hitting around $264.80 as of this writing. Trading volume is also way up, more than 60%, which shows a lot of investors are jumping in. it is also the top gainer in the market today.

What’s behind the surge? A lot of eyes are on the U.S. Senate, which just passed a key step in the GENIUS Act. That’s a bill focused on regulating stablecoins, and it’s causing a buzz across the DeFi world.

Top analyst Karan Singh Arora pointed it out on X, explaining that AAVE could be one of the big winners here. Since AAVE plays a major role in the DeFi lending space, clearer rules around stablecoins could mean a more stable and attractive environment for the platform to grow.

$AAVE surged over 22% in last 24 hrs 🚀

— Karan Singh Arora (@thisisksa) May 20, 2025

Rrecently US 🇺🇸 Senate has passed the closure vote for GENIUS Act.

This bill is aimed at regulating stablecoins.$AAVE is a key player in DeFi which can be benefitted from the Act.

This Act is seen as a win for DeFi, offering clearer… pic.twitter.com/1M9bRy19Bf

Read Also: Double-Digit XRP Price? New Data Reveals the Bullish Case Everyone Missed

What you'll learn 👉

Senate Move Boosts Confidence in DeFi Tokens

The GENIUS Act is expected to introduce clearer guidelines around the issuance and operation of stablecoins in the U.S. market. It aims to build a structure that encourages responsible innovation while keeping consumers safe.

AAVE works as a decentralized system that needs stablecoin funds for its lending and borrowing features. Clear rules for stablecoins could create more stable conditions for systems like AAVE, building trust with big institutions and bringing in more money.

AAVE Technical Breakout Suggests Strength Behind the Rally

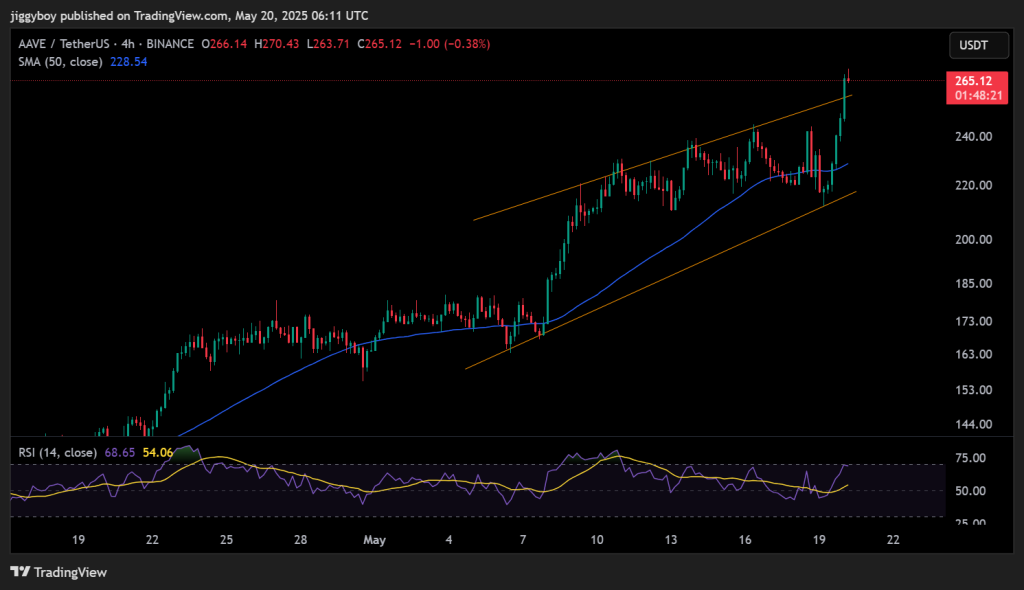

On the 4H chart, AAVE price has broken out of a well-formed ascending channel that started in early May. The price broke above the upper trendline that had been blocking upward movement.

The 50-period Simple Moving Average (SMA) is at $228.54 and continues to act as good support. Price has stayed above this level for the last two weeks. The RSI sits at 68.65, getting close to overbought territory, which hints that we might see a short pause before prices move higher again.

AAVE Total Value Locked Surges

Another data point fueling the rally is the rise in total value locked (TVL) on the Aave protocol. As reported by ICODrops, Aave’s TVL has surged to $30 billion, marking a 25% increase in tandem with the price action.

TVL is a key metric in assessing the health of DeFi platforms. A rise in locked funds often reflects stronger user engagement and higher trust in the protocol’s underlying mechanisms. This metric, combined with the regulatory developments, contributes to the narrative of renewed investor interest in AAVE.

.@aave TVL surges to $30 billion, the $AAVE price increases by 25%https://t.co/tqcgNfoHpo pic.twitter.com/7XyY7llKSF

— ICO Drops (@ICODrops) May 20, 2025

AAVE Outlook Hinges on Retest of Breakout Level

The current resistance zone sits between $270 and $275. If AAVE price maintains its position above this range, the next psychological target may be the $300 level. However, if momentum fades and the price falls back into the channel, support is expected at $230, close to both the lower trendline and the SMA.

Overall, the combination of regulatory developments, rising TVL, and a confirmed technical breakout has brought strong attention to AAVE’s recent movement in the market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.