According to on-chain data shared by Kaspa Daily, centralized exchange balances of Kaspa (KAS) have dropped significantly in April. Gate.io alone has seen around 110 million KAS leave its exchange, while MEXC recorded an additional outflow of 25 million. This large-scale movement of Kaspa off exchanges usually signals one thing: accumulation.

What we’re likely seeing here is a supply squeeze in the making. Fewer KAS tokens on exchanges means less available for immediate sale. That lowers the selling pressure and increases the chances for price to climb, especially when demand starts to pick up. As Kaspa Daily pointed out, exchange holdings are now at their lowest since early December.

Kaspa On-Chain Analysis: Signs of a Supply Squeeze as Price Tests Key Support

— Kaspa Daily (@DailyKaspa) April 24, 2025

Kaspa is showing a notable shift in market structure, driven by tightening supply and rising long-term holder confidence.

Exchange holdings have now dropped to their lowest levels since early… pic.twitter.com/Yqe8aUOzEx

At the same time, over 67% of all KAS hasn’t moved in over three months. That’s a massive signal of conviction from long-term holders. When more people are choosing to hold rather than sell, it creates a tighter market. If buying pressure increases, the KAS price could react sharply. This type of environment often acts as the foundation for big upward moves.

What you'll learn 👉

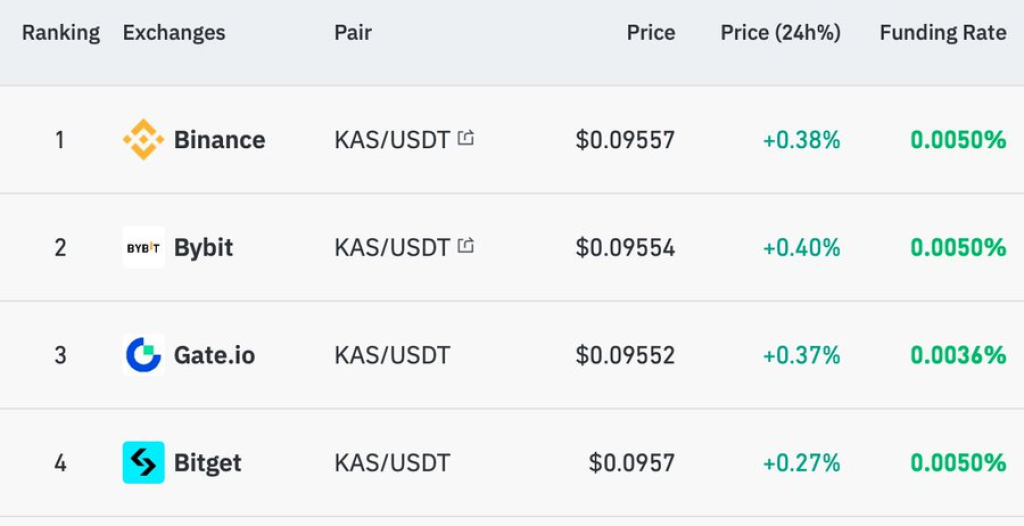

KAS Funding Rates and Sentiment Turn Bullish

Another key piece of data from Kaspa Daily shows that the Kaspa funding rate is now positive across all major exchanges. This is an important metric. A positive funding rate means traders are paying a premium to keep their long positions open. In simpler terms, more traders are betting the KAS price will go up.

This kind of sentiment shift usually appears before a major price move. It’s not a guarantee, but it shows that the market is leaning bullish right now. Combine that with shrinking supply, and you have a setup that’s worth watching closely.

Kaspa Price Analysis: Can KAS Break the $0.10 Barrier?

Right now, all eyes are on the $0.09 to $0.10 zone. This level has a history. It acted as strong support during late 2024 and early 2025, holding up the KAS price multiple times. But in March 2025, Kaspa finally broke below this level, triggering a dip that took the price much lower.

Now, KAS is right back at that same zone, but this time from the other side. What used to be support has now turned into resistance. And that makes this moment critical.

The current monthly candle is strong and green, up nearly 49% so far. It shows serious bullish strength. But we’re not out of the woods yet. KAS is still trading just below the $0.10 mark, and this area is acting as a gatekeeper.

If Kaspa closes this month above $0.10, it would be a clear bullish signal. It could open the door to much higher prices. The next major target would likely be around $0.18 to $0.20, which is around KAS all-time high. On the other hand, if KAS gets rejected at this level again, the price might cool off and revisit lower supports around $0.06 or even $0.05.

Read Also: Should You Throw $1,000 Into Kaspa Right Now? KAS Price Outlook

Kaspa Daily has been spot on in identifying key metrics driving the current trend. Between the shrinking supply, bullish funding rates, and critical resistance level, Kaspa is standing at a crossroads. If the KAS price can break and hold above $0.10, it may not take long before the market starts eyeing a move toward $0.20.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.