SUI is on a strong upward trend, breaking past its previous downtrend and jumping nearly 40% in value. This performance has helped SUI climb to the 11th position in market cap rankings, moving ahead of Avalanche (AVAX) and Chainlink (LINK). Grayscale has also launched a new Sui trust, showing growing institutional interest in this digital asset.

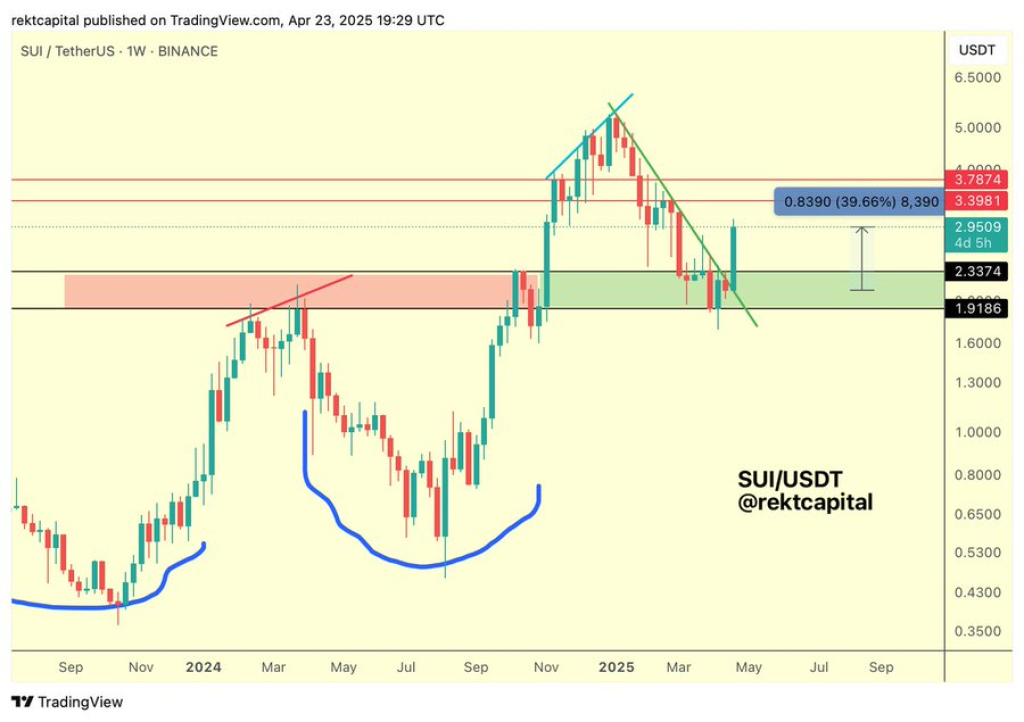

Crypto analyst Rekt Capital pointed out that “SUI has broken its Downtrend, rallying almost +40% since doing so.” This is a significant development for SUI price action. The weekly chart shared by Rekt Capital shows that SUI had been following a downward path from its all-time high of around $6.00 earlier in 2025, but has now broken through this pattern.

The breakout is strong, with SUI rising nearly 40% after breaking the downtrend line. This suggests buyers are returning to the market with confidence. Another positive sign is what traders call an inverse head and shoulders pattern forming on the chart. This pattern typically signals that a downtrend is ending and an uptrend may be beginning.

“The market structure for SUI is looking much more positive now,” explains Rekt Capital. The price has successfully reclaimed the $2.33 level, which lines up with a retest of the broken downtrend line. This provides technical confirmation that SUI’s upward move has solid backing.

SUI Climbs Market Rankings as Institutional Interest Grows

SUI has now reached the 11th position in cryptocurrency market cap rankings. As Rekt Capital noted, “SUI is now 11th in Market Cap, flipping both $AVAX & $LINK.” This rise through the rankings shows increasing investor interest in the Sui blockchain ecosystem.

The growing attention isn’t just coming from individual traders. Grayscale Investments, one of the largest digital asset management companies, has created a dedicated Sui trust. “On the fundamental side of things, Grayscale opened a #SUI trust today, showing institutional growth,” Rekt Capital highlighted in his analysis.

Read Also: AI Predicts: What Will 1,000 SUI Tokens Be Worth by End of 2025?

This move by Grayscale is important because it gives professional and accredited investors a regulated way to invest in SUI without having to buy and store the cryptocurrency directly. Industry watchers, including Rekt Capital, see this as a strong endorsement of SUI’s future potential.

Grayscale’s entry into the SUI market comes right as the token is showing strong technical performance, creating favorable conditions for further growth. As Rekt Capital points out, “Institutional adoption often follows strong technical setups, and SUI is delivering on both fronts.”

Rekt Capital identifies resistance levels for SUI price at $3.39 and $3.78. However, if SUI maintains its position above the important $2.33-$2.50 support zone, the path seems clear for continued upward movement. With ongoing momentum and increasing institutional backing, SUI could potentially challenge its previous highs near $5.00-$6.00 in the months ahead.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.