The XCN price had a crazy week after bouncing over 125% from local lows at $0.08. Now, Onyxcoin’s token is trading around $0.20 and after a couple of months of horrible price action, XCN holders can smile again.

With this in mind, we decided to ask AI to predict the XCN price for the next 30 days and estimate whether XCN is a good buy right now if you have $1,000 to spare.

What you'll learn 👉

XCN Price Prediction

Currently trading at $0.020, XCN has seen a 125% surge this week after bouncing from January lows of $0.008. This recovery comes after a steep collapse from January highs of $0.036, leaving many traders wondering if this is a genuine reversal or just temporary relief.

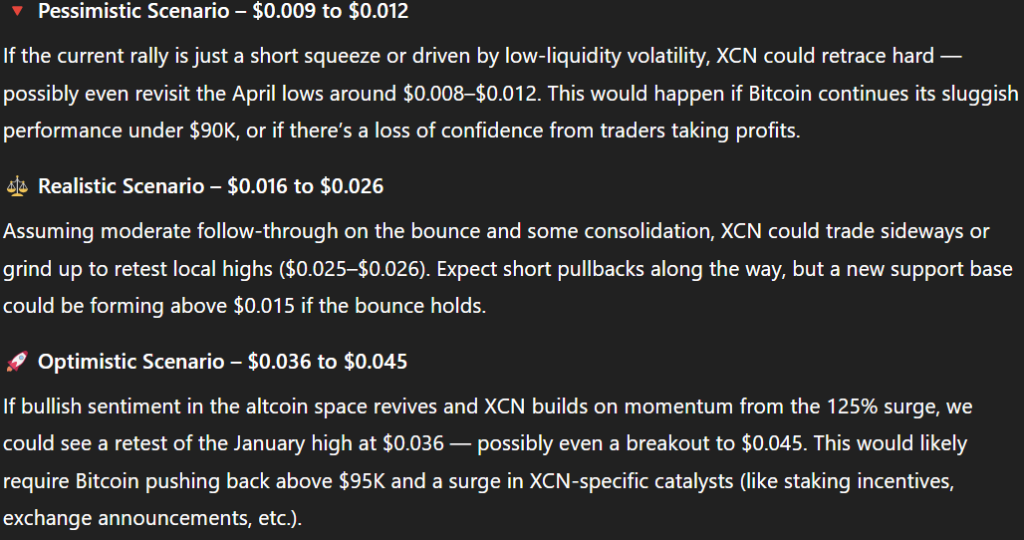

If we look at the pessimistic scenario, XCN could retrace to somewhere between $0.009 and $0.012. This would likely happen if the current rally turns out to be nothing more than a short squeeze or driven by low-liquidity volatility. Such a pullback might occur if Bitcoin continues to perform sluggishly under $85K, or if traders start taking profits, causing confidence to wane.

A more realistic outlook suggests the XCN price could trade between $0.016 and $0.026 over the next month. This scenario assumes moderate follow-through on the recent bounce followed by some consolidation. We might see XCN retest local highs around $0.025-$0.026, with short pullbacks along the way. If the bounce holds, a new support level could form above $0.015.

In an optimistic scenario, we could see XCN reaching $0.036 to $0.045. This would require a revival of bullish sentiment across the altcoin market while XCN builds on its recent momentum. For this to happen, Bitcoin would likely need to push back above $95K, and XCN would need some specific catalysts such as new staking incentives or major exchange announcements.

Is XCN Worth Your $1,000 Investment?

Several factors influence XCN’s potential performance. Looking at chart structure and history, XCN surged 18x in January before crashing 75% – a pattern common among speculative tokens. However, the bounce from $0.008 to $0.020 shows strength, and this kind of V-shaped recovery often signals accumulation.

The 125% weekly gain will naturally attract fresh attention but also creates potential for heavy profit-taking. Short-term holders might dump their positions if momentum slows. Additionally, with Bitcoin hovering around $84K – well off its all-time high of $109K – the broader market isn’t in full bull mode. The ongoing tariff war tensions aren’t helping either. Altcoins like XCN are currently trading more on speculation than fundamentals, making them highly sensitive to Bitcoin’s price movements.

Read also: Here’s Why Onyxcoin (XCN) Price Is Pumping

Another consideration is that XCN is still finding its narrative. Without new product updates or strong ecosystem growth in the next month, sustaining this rally could prove difficult.

So, is throwing $1,000 at XCN right now worth it? This is definitely a high-risk, high-reward trade. You could potentially double or triple your money if bullish momentum continues, but you could also lose half or more if this turns out to be a dead cat bounce.

For high-risk traders looking for short-term gains with quick entries and exits, XCN might be a reasonable speculative bet – but only with a tight stop-loss in place. Long-term investors focused on fundamentals and stable growth should probably look elsewhere, as XCN remains too volatile and unproven.

If you’re interested but cautious, consider dollar-cost averaging by splitting your $1,000 into smaller amounts and scaling in if XCN pulls back to $0.014 or lower. This approach helps manage risk while still giving you exposure to potential upside.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.