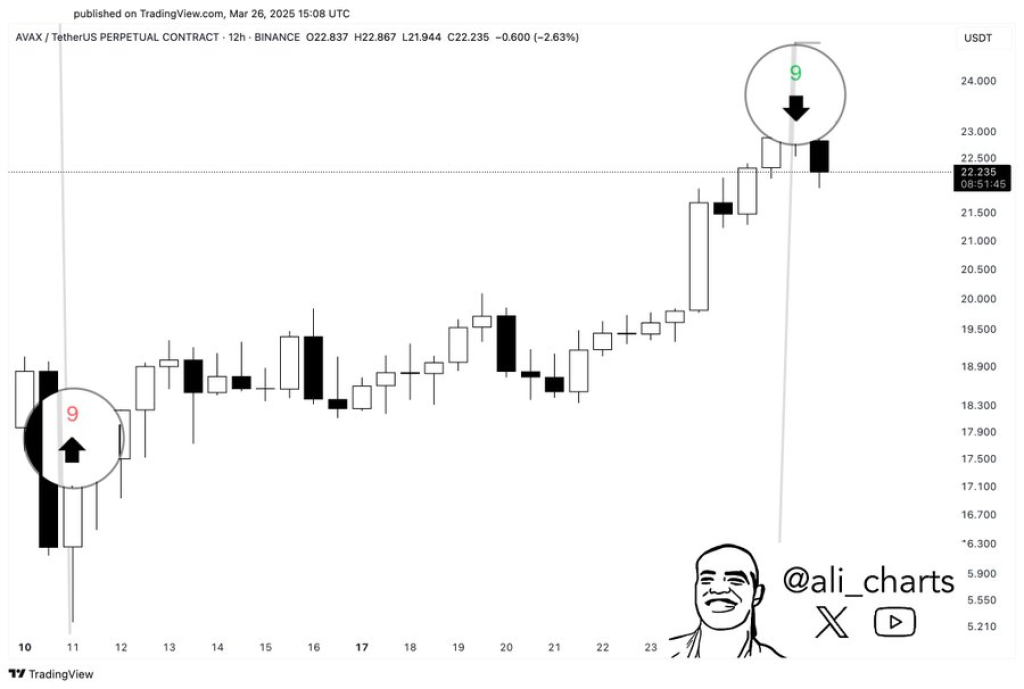

The TD Sequential indicator that perfectly caught Avalanche’s recent bottom is now flashing a sell signal. This comes after AVAX enjoyed a solid 50% price jump from its lows.

Crypto analyst Ali pointed this out in a recent post, saying “The TD Sequential now presents a sell signal after calling the bottom and a 50% move in Avalanche AVAX.” He based this on AVAX’s 12-hour chart against USDT on Binance.

What you'll learn 👉

What Is the TD Sequential Signal

TD Sequential helps traders spot when trends might be running out of steam. It uses a simple count from 1 to 9, with the “9” marking potential turning points in the market.

For AVAX, the indicator showed a “9” buy signal on March 11. This turned out to be spot-on. After this signal appeared, AVAX price bottomed around $15 and climbed steadily to nearly $23, giving traders a nice 50% gain.

Fast forward to March 26, and we’re seeing another “9” – but this time it’s after a big run-up and pointing downward. This suggests the rally might be getting weak and could use a breather or pull back soon.

How Low Can AVAX Price Go?

AVAX has been stuck in a downtrend since late last year. For about four months, it kept making lower highs along a falling trendline.

The good news is that AVAX price recently broke above this trendline with conviction. This breakout lined up perfectly with the TD Sequential buy signal, giving traders double confirmation.

Right now, the price is doing what prices often do after breakouts – coming back to test the broken trendline. This is totally normal market behavior. The new sell signal from TD Sequential matches this temporary weakness as some traders take profits.

Critical Price Levels to Watch for Avalanche Price

Keep your eyes on how AVAX behaves around that broken trendline. If it touches the line and bounces up strongly, that’s a good sign the uptrend is real.

If it drops back below the trendline, though, we might be looking at a fake breakout, and the downtrend could continue.

Read Also: We Asked AI to Predict SUI Price in April

In a positive scenario, a successful test of the trendline could send AVAX toward prior resistance around $25, then $30, and possibly beyond $35 if momentum stays strong.

The downside case would see AVAX fail at the trendline and slide under $20, potentially testing support around $17 or lower.

What used to be a ceiling (the trendline) is now trying to act as a floor. This is a make-or-break moment for AVAX’s price. Either it confirms its newfound strength and pushes higher, or bears take back control and push prices lower again.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.