Bitcoin price has climbed about 6% over the past four days, with yesterday alone seeing a 3% jump. Cryptocurrency analytics firm Santiment has provided some explanation for this growth.

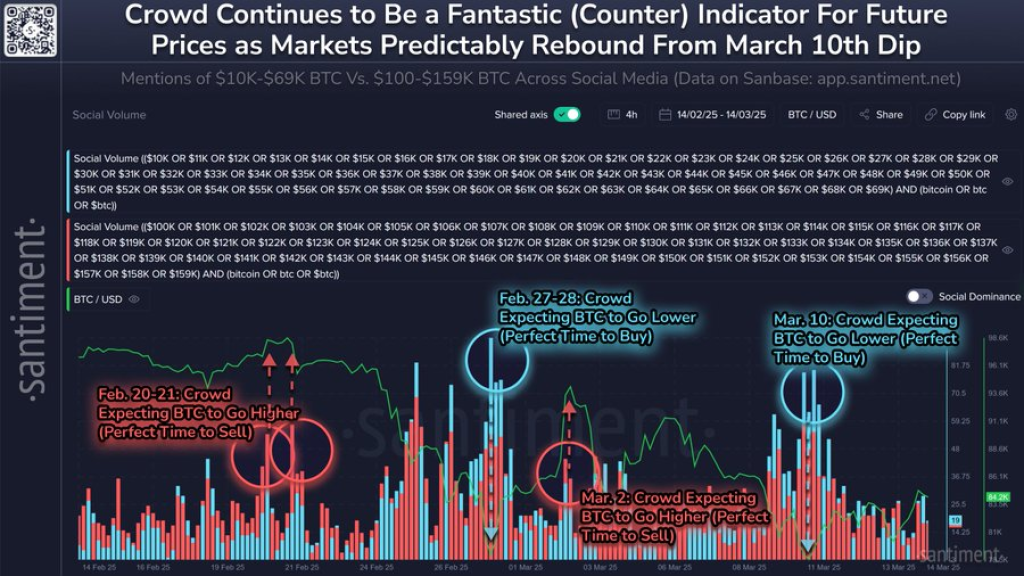

Santiment points out that Bitcoin rally back to $84,500 on Friday shows what typically happens when Monday traders prematurely call for selling. As expected, fear and uncertainty peaked when BTC dropped to $78,000, with social media flooded by predictions of further price drops.

This pattern mirrors what happened in late February, when retail traders were convinced prices would keep falling, only to watch them temporarily rise at the beginning of March.

Source: Santiment – Start using it today

Over the past month, Bitcoin has maintained a price range between $70,000 and $100,000. This makes crowd predictions below $70,000 a good gauge for excessive fear, while predictions above $100,000 indicate overenthusiasm. Historically, markets move opposite to crowd expectations.

When many traders predict Bitcoin prices in the $10,000-$69,000 range, it often signals an upcoming reversal or buying opportunity, especially during downtrends when fear is high. Similarly, clusters of predictions in the $100,000-$159,000 range frequently precede a reversal or selling signal, particularly during uptrends when greed increases.

Santiment suggests traders might find some predictability in volatile crypto markets by trading against popular sentiment. This approach could potentially help navigate Bitcoin’s price swings more effectively.

BTC Price Analysis: How High Can Bitcoin Price Go?

Looking at recent price action, Bitcoin price broke above the $83,635 level yesterday, a threshold that has been a critical support and resistance zone. This level is now being retested as support, which could determine where prices head next.

BTC price is currently trading around $83,780, just above that key $83,635 level. The price consolidation in this area suggests the market is waiting for confirmation before making its next significant move.

If Bitcoin successfully holds above $83,635 and confirms this as support, we could see a movement toward $86,754, the next resistance level. With continued momentum, a further rally might take Bitcoin toward $90,663, representing a major resistance point.

However, if Bitcoin fails to hold above $83,635, a drop below this level could trigger further downward pressure. The next significant support would likely appear around $82,000 or lower, suggesting a continuation of the bearish trend seen earlier.

Read also: Kaspa Already Overvalued? Expert Warns $1 Not Yet Realistic – KAS Price Prediction

The $83,635 level serves as a crucial pivot point for Bitcoin’s price right now. A successful defense of this support could see Bitcoin climb toward $86,000 and potentially $90,000. Failing to maintain this level might result in a deeper correction for the cryptocurrency.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.