After a horrible February, crypto investors are now hoping that March could be slightly better for the market. After breaking below $80k for the first time in months, the Bitcoin price managed to stabilize and is now trading above $82k.

However, this February will be remembered because of the huge launch of PI Coin that just yesterday hit its respective ATH of around $2.9.

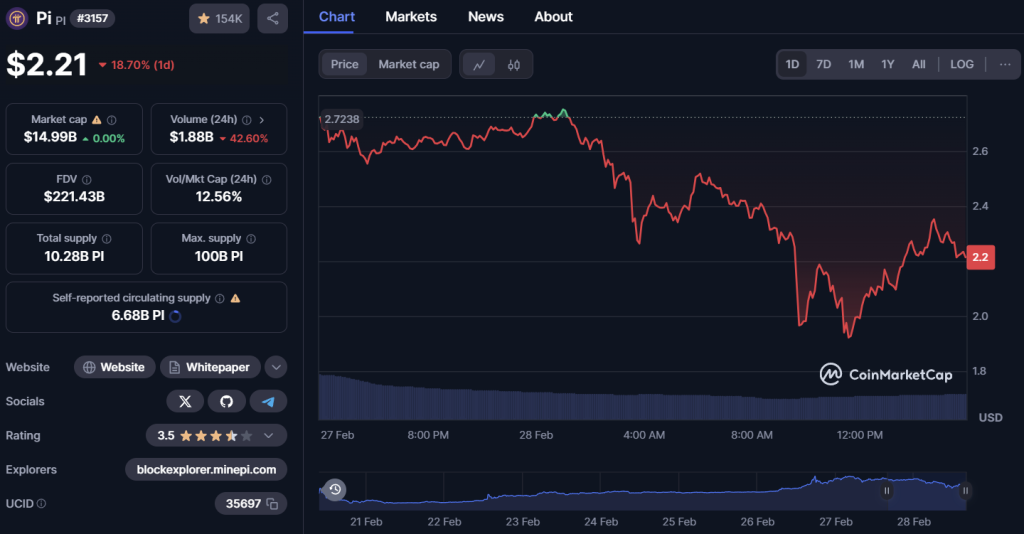

PI Coin is now trading around $2.22 after today’s crash. To be clear, PI was mostly immune to market’s behavior this month since the price was pumping after everything else went down. But, that changed today and PI Coin crashed around 25%.

Let’s have a look at why you should potentially sell your PI Coins now.

What you'll learn 👉

Economic Concerns

The crypto market has seen turbulence lately, and PI Coin is no exception despite its initial resistance. Much of this instability stems from broader economic uncertainties we’re seeing globally. The initial optimism around crypto-friendly policies has been overshadowed by growing concerns about inflation, possible new tariffs, and unpredictable regulatory developments.

Big institutional investors who jumped into Bitcoin earlier might start pulling back if economic conditions continue to deteriorate, creating downward pressure across the entire crypto space.

Recent security breaches haven’t helped either. The massive $1.4 billion Bybit hack sent shockwaves through the market, reminding investors of the inherent risks in crypto holdings. These factors combined suggest we may see more volatility ahead, not less.

Early Miners Taking Profits

PI Coin’s dramatic rise has created a perfect exit opportunity for early adopters. Those who mined PI in its early stages essentially got their coins for free, and even after today’s significant drop, they’re sitting on enormous gains. With returns approaching 300% since the Open Mainnet launch, many early miners are understandably cashing out.

This profit-taking behavior creates a problematic dynamic – as more early holders sell, the price faces increasing downward pressure. Today’s 25% crash might just be the beginning if larger miners decide to liquidate their positions, potentially triggering a cascading sell-off that could drive prices significantly lower.

Read also: How Much Will 3,000 PI Coins Be Worth if Bitcoin Bounces Back to $100K?

Limited Exchange Support and Liquidity Problems

Perhaps the most concerning issue for PI holders is the limited exchange support. Despite its growing popularity, PI hasn’t secured listings on major exchanges like Binance yet. This means most trading happens on smaller, less regulated platforms where liquidity can dry up quickly.

The practical implication is that during a market downturn, selling PI could become increasingly difficult. Without deep order books on established exchanges, prices can collapse much faster as sellers compete for limited buyer interest. If regulatory concerns delay major exchange listings further, PI holders might find themselves stuck with assets that are difficult to convert back to cash at favorable prices.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.