The crypto market is reeling from another tough week. Broader financial markets have been unsteady, dragging Bitcoin down with them.

Investors are jittery, and the selling pressure keeps mounting. Analysts point to a mix of economic and market-specific triggers. Let’s break down what’s fueling this latest plunge.

What you'll learn 👉

Bitcoin Price Crashes Amid Shaky Markets

Bitcoin’s price tells a stark story. It sits at $80,385 as of this writing, per CoinGecko data. That’s a 5.59% drop in the last 24 hours. Over the past week, it’s fallen 17.38% from around $98,000. The slide mirrors a shaky broader market, amplifying crypto’s woes.

The broader market has been wobbly all week, amplifying Bitcoin’s descent. The crypto market’s struggles continue, with total capitalization now down to $2.66 trillion.

Trading has slowed substantially, with the daily volume dropping 5.29%. Bitcoin remains the dominant force, accounting for $236.23 billion in daily trades. The situation is straightforward – Bitcoin’s downward slide is pulling the entire crypto ecosystem with it, leaving investors nursing mounting losses as the pain spreads through the market.

The downturn isn’t isolated. It’s tied to a shaky global financial landscape, with BTC no longer dodging broader trends. Analysts note this week’s turbulence has hit risk assets hard, and crypto is no exception.

Trump’s Tariffs Spark Crypto Market Jitters

Trade policies are shaking things up, says Wu Blockchain on X. Trump clarified his tariff timeline, targeting drug trafficking—especially fentanyl—at U.S. borders. He’s slapping 25% tariffs on Mexican and Canadian goods starting March 4, 2025.

Trump’s statement clarified the confusion over the deadline for punitive tariffs on Canadian and Mexican goods. The April deadline relates to “reciprocal tariffs,” while the 25% tariffs on Mexican and Canadian goods will take effect on March 4. He also threatened an additional…

— Wu Blockchain (@WuBlockchain) February 27, 2025

On top of that, he’s adding a 10% tariff on Chinese goods, building on February 4’s 10% levy. A separate April 2 deadline for “reciprocal tariffs” aims to match other countries’ levies on U.S. goods. These moves are rattling global markets.

Wu Blockchain reports Canada and Mexico are pushing back against the March 4 tariffs. China’s response to the extra 10% tariff adds more tension as fears of inflation and economic retaliation grow.

The Kobeissi Letter ties this to a broader shift. Since Trump’s January 20 inauguration, crypto markets have shed $800 billion.

Bitcoin’s correlation with the Nasdaq 100 and S&P 500 hit 0.88 at its 2024 peak. It’s moving opposite gold, which jumped 50% in a year, showing markets no longer see BTC as a hedge. Trade war uncertainty is spooking investors.

Liquidity is another casualty. Kobeissi points to a February 1 “flash crash” that erased $760 billion in 60 hours. The U.S. dollar, now at its strongest against the Canadian dollar since 2003, is soaking up capital. Retail investors, spooked by instability, are pulling out, worsening the crypto price drop.

Crypto markets in trade wars:

— The Kobeissi Letter (@KobeissiLetter) February 27, 2025

Since trade war worries began on January 20th, crypto markets have erased -$800 BILLION.

For 10+ years, Bitcoin was viewed as a decentralized HEDGE against uncertainty, but something changed.

Why is crypto falling? Let us explain.

(a thread) pic.twitter.com/NQiRiD5Be5

Liquidations and Whale Plays Slam BTC

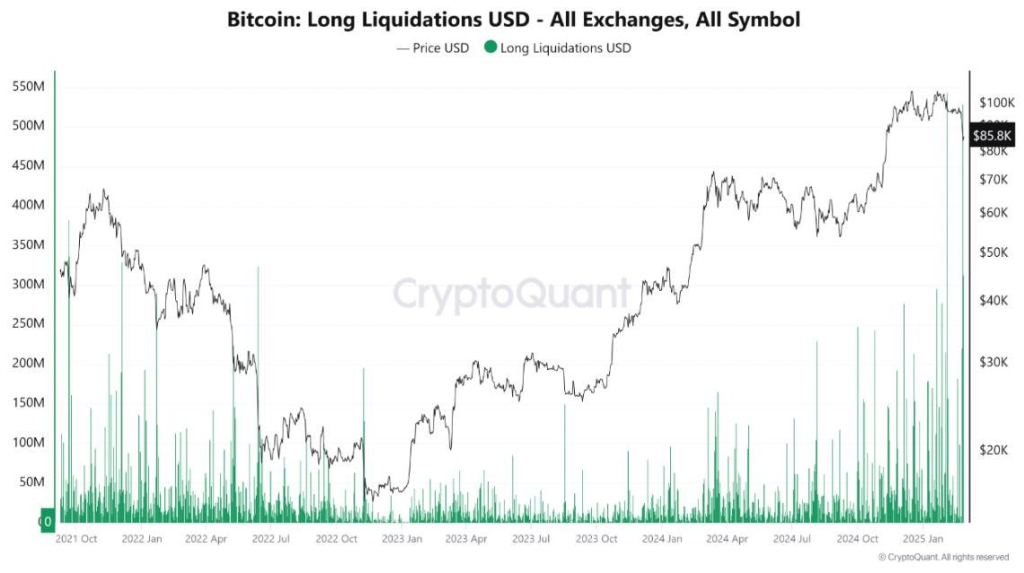

Market dynamics are piling on the pressure. Analyst CW highlights the biggest long liquidation in BTC since October 2021.

The drop kicked off on OKX and Binance as whales moved in after the Chinese New Year holidays. A record-breaking liquidation of long positions followed, wiping out late or over-leveraged traders betting on a rise.

CW sees a potential upside. Excessive long positions were stifling Bitcoin’s growth, and their wipeout could clear the way forward. Whales are now accumulating BTC, with Bitfinex buyers grabbing long positions at a rapid clip. This suggests big players are prepping for a re-uptrend, even as the price keeps sliding short-term.

The numbers back this up. Bitcoin’s daily volume shows heavy trading amid the chaos. Liquidations hit investors who entered late or used high leverage, a risk Bookmap’s 2025 insights warned about. For now, the market remains in a sell-off grip, but whale activity hints at a shift down the road.

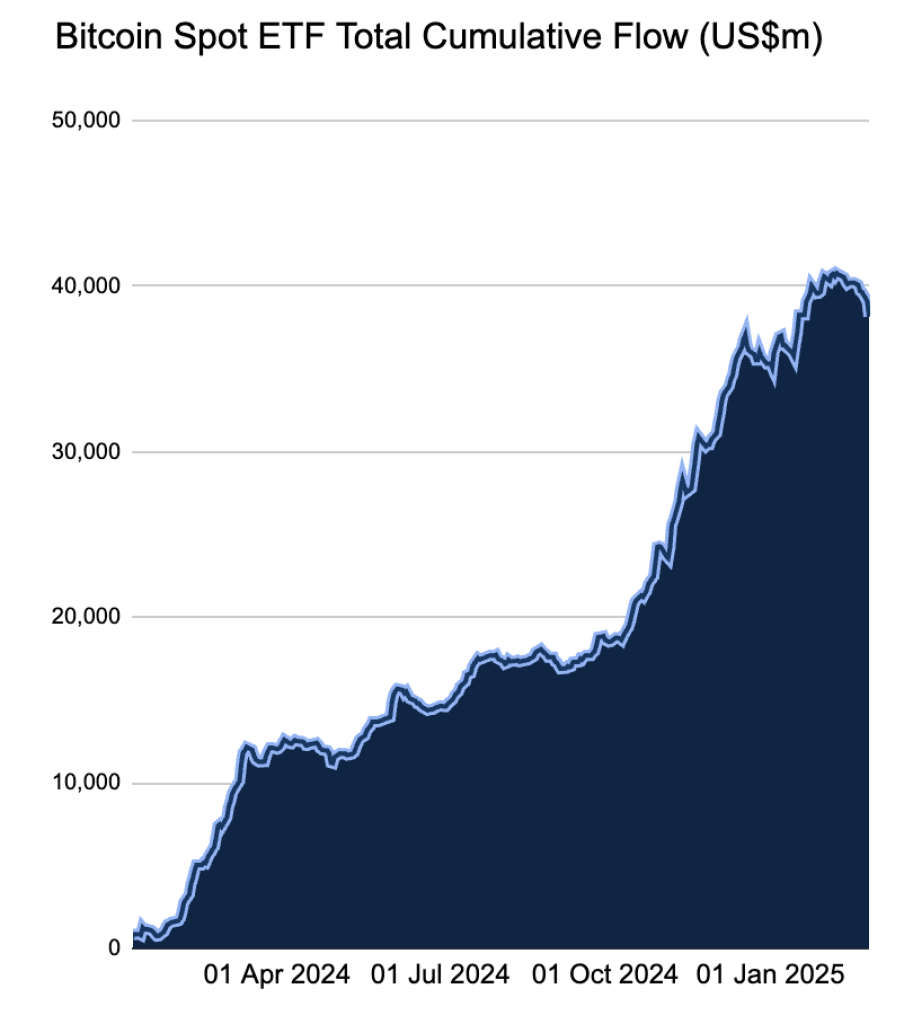

Daan Crypto Trades on X flags another blow: ETF outflows. Bitcoin ETFs saw nearly $1 billion exit this week, the second-largest single-day outflow this cycle. Six straight days of withdrawals total $2.1 billion, mostly from retail hands. Price keeps trending down alongside these flows, showing absorption isn’t kicking in yet.

BTC ETF Outflows and Market Shifts Fuel Volatility

The Kobeissi Letter digs into crypto’s changing role. From 2015 to 2023, Bitcoin and gold were substitutes; now they’re diverging. Gold ETFs bought 52 tonnes last week— the most since July 2020—while BTC ETFs bleed cash.

Retail capital flooded crypto post-election, with $2 billion in Bitcoin ETF inflows in two days, plus millions joining via Trump’s memecoin launch. That herd is now fleeing.

Tuesday’s $1 billion Bitcoin ETF outflow marked a record, with liquidity drying up fast. Kobeissi notes crypto’s $2.8 trillion market cap—down from $3.7 trillion in five weeks— reflects this exodus. “Air pockets” in price action, like BTC dropping $5,000 in minutes, stem from these massive retail moves.

Institutional plays add more fuel. Ethereum shorts surged 500% since November, piling on $2 billion in bets. Volatility is widening as crypto’s $2.8 trillion scale—10 times its size during the last trade war—magnifies swings. Daan Crypto Trades advises watching flows: big outflows with stagnant price often signal a reversal. For now, Bitcoin and crypto remain on edge.

Read also: Will Jupiter (JUP) Price Break Resistance Amidst Incoming Buybacks?

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.