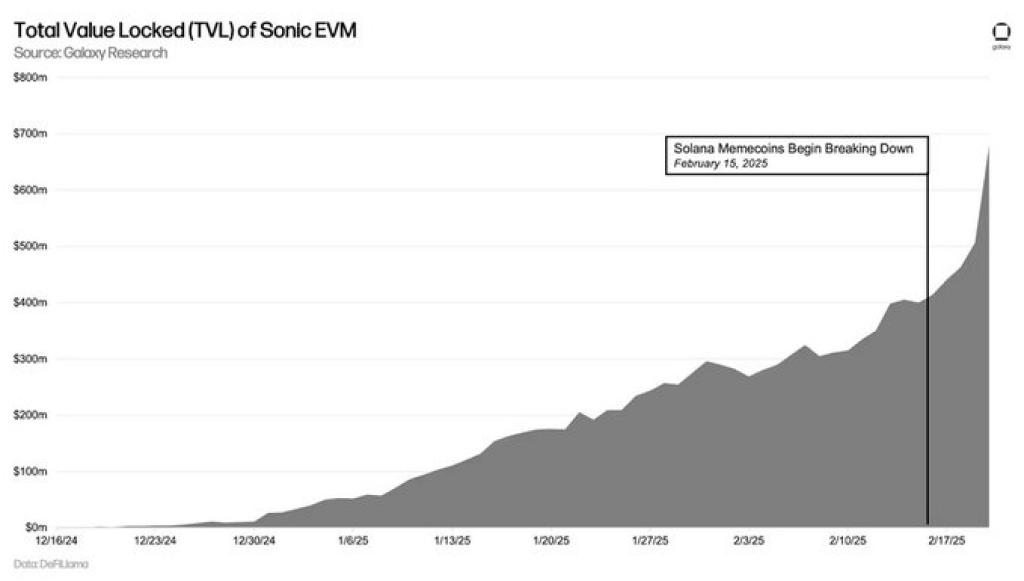

The price of Sonic (prev FTM) saw a 50% increase in February 2025, even as the broader cryptocurrency market faced downward pressure. Data from DeFiLlama indicates that the Total Value Locked (TVL) in Sonic EVM surged past $700 million, showing strong investor interest. A key development occurred on February 15, 2025, when Solana-based meme coins started losing value, prompting a liquidity shift that favored Sonic’s price.

Crypto expert Miles Deutscher pointed out on X that Sonic remained one of the few ecosystems demonstrating sustained growth amid a market downturn. He stated, “Total value locked (TVL) on $S has surged since people started leaving Solana and has managed to hold its value during this market pullback.” At writing, Sonic price sits at $0.7189.

What you'll learn 👉

Sonic’s TVL Growth and Market Performance

Sonic EVM’s TVL showed a steady upward trend starting in December 2024, beginning from near-zero levels and exceeding $200 million by early January 2025. Throughout January and early February, the TVL maintained consistent growth, reaching around $500 million before experiencing a significant increase following the February 15 event.

The surge after Solana meme coins lost momentum suggests a correlation between Solana’s liquidity outflows and Sonic’s rapid inflows. The absence of major retracements or resistance levels during this period indicates strong investor confidence and sustained demand.

Key Market Shift in February

The chart data highlights February 15, 2025, as a pivotal moment, with Sonic’s TVL experiencing a sharp rise immediately after Solana-based meme coins began to lose value. Investors appeared to reallocate funds into Sonic’s ecosystem, leading to a parabolic increase in TVL beyond $700 million.

This movement aligns with Deutscher’s observation that Sonic benefited from market shifts while other ecosystems struggled. The timing of Sonic’s price jump suggests that traders sought alternative assets amid Solana’s volatility.

Read Also: How Much Will 3,000 PI Coins Be Worth if Bitcoin Bounces Back to $100K?

Sonic Price Support Levels and Future Prospects

Technical patterns indicate that Sonic’s TVL found early support between $200 million and $300 million in January, establishing a foundation for further growth. The $500 million level in early February served as another milestone before the rapid spike in mid-February. Unlike other assets facing market corrections, Sonic’s price has maintained its upward trajectory.

Looking at Sonic price from a technical viewpoint, there’s solid support around $0.2499, which has stopped drops before. Moving up, the $0.4834 level is the main obstacle blocking further gains. If the price pushes above this point, it might continue climbing.

Moreover, the sustained inflows into Sonic suggest that investors continue to view the ecosystem as a viable alternative. If market conditions remain uncertain, Sonic could attract additional capital from other struggling ecosystems, reinforcing its growth trend.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.