The latest Consumer Price Index data is creating both opportunities and risks for Bitcoin investors. January 2025’s inflation figures have exceeded expectations, potentially setting the stage for significant Bitcoin price movements in either direction.

January’s Consumer Price Index for Urban Consumers showed a concerning uptick, rising 0.5 percent on a seasonally adjusted basis. This follows December’s increase of 0.4 percent, marking the fastest monthly price growth since August 2023. The annual inflation rate has now reached 3 percent, a level not seen since June 2024.

Transportation costs have emerged as a major contributor to inflationary pressures. The sector saw a 3.2 percent increase compared to January 2024, with motor vehicle insurance playing an outsized role—jumping 11.8 percent year-over-year. Food and energy prices also saw notable increases, adding to the broader inflationary trend.

What you'll learn 👉

BTC Technical Analysis Points to Key Levels

According to MasterCryptoHq, Bitcoin price action following the CPI data release has been particularly telling. After briefly dipping to $94,000 and flushing out leveraged long positions, Bitcoin has shown resilience by bouncing back.

MasterCryptoHq identifies $99,200 as the crucial resistance level to watch, suggesting that a breakthrough above this point could propel Bitcoin toward the psychologically significant $102,000 mark.

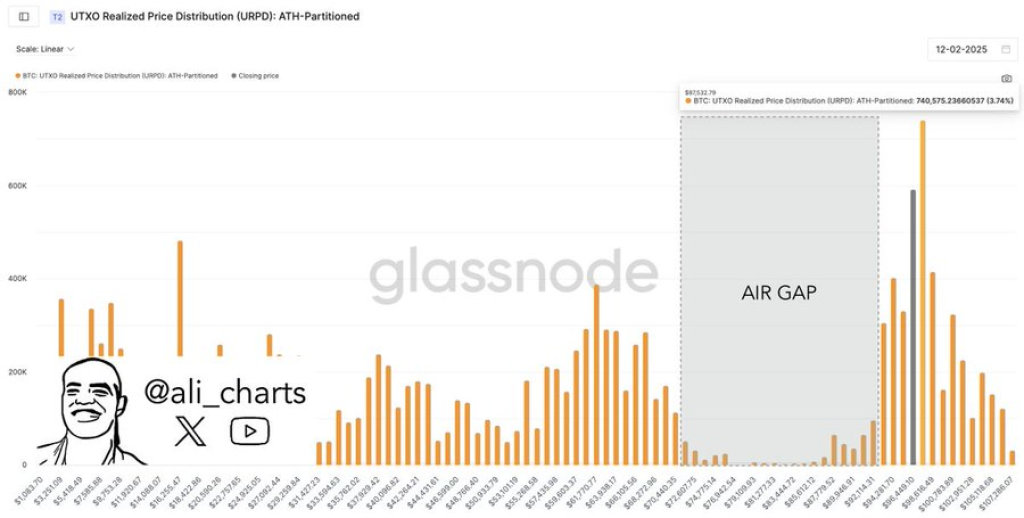

Adding depth to this analysis, prominent crypto analyst Ali points to $97,530 as another critical resistance level for Bitcoin (a daily close above this area could trigger more upsides). However, Ali’s analysis reveals a potentially concerning lack of strong support below $92,110.

The $92,000 level has held strong in the past few weeks as BTC experienced constant dips to this level. As the analyst now reveals, this key level is weak, and if the price falls back to it, it may not be able to hold.

According to Ali, there appears to be a significant support gap between $90,000 and $70,000, suggesting that if current support levels fail, Bitcoin could experience a substantial correction.

What This Means for Traders

The combination of higher-than-expected inflation data and technical analysis from both MasterCryptoHq and Ali paints a picture of a market at a crucial decision point. The liquidity map highlighted by MasterCryptoHq shows major liquidation levels clustering around $99,000 and $102,000, indicating that these price points could trigger significant market movements.

Read Also: Onyxcoin Pumps 20%, Elite Analysts Predicts XCN Price Is ‘Gearing for the next Leg Up’

The market appears to be caught between bullish momentum and underlying economic concerns, with the latest CPI data adding another layer of complexity to Bitcoin’s price trajectory.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.