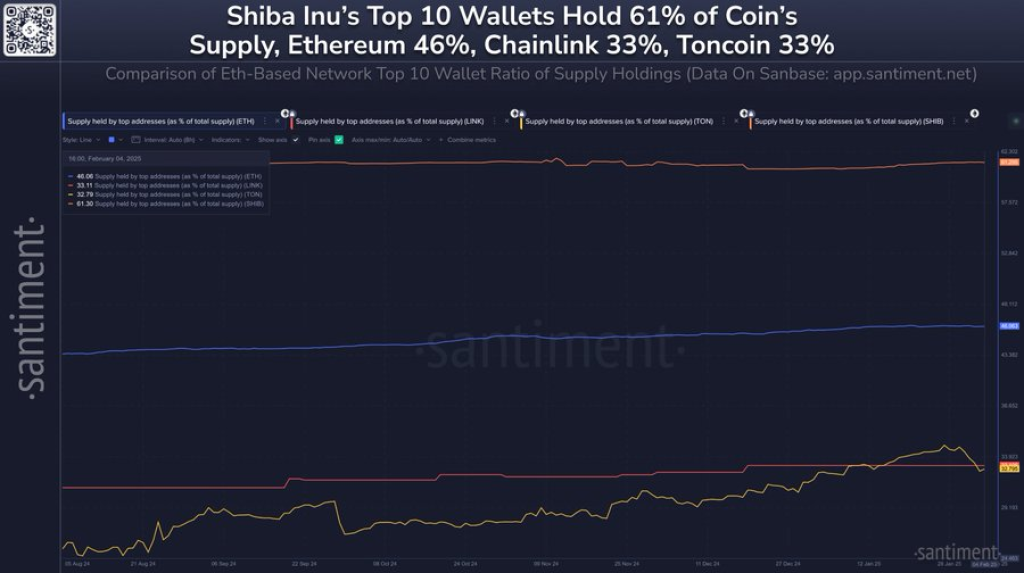

The distribution of token supply can reveal crucial insights about market stability and potential risks. An analysis by Santiment shows a pattern across several major altcoins that could trigger significant market movements.

The information? The top 10 wallet holders control substantial portions of different cryptocurrencies’ total supply. Shiba Inu stands out with 61.3% of its supply concentrated in just ten wallets, a figure that raises immediate red flags for potential market manipulation.

By comparison, other major cryptocurrencies show more balanced distributions. Ethereum demonstrates a more decentralized approach, with top wallets holding 46.1% of the supply. Chainlink and Toncoin present similar profiles, each with around 33% of their total supply controlled by their largest holders.

What you'll learn 👉

The Risks of Concentrated Ownership

When a small number of wallets command such significant portions of a cryptocurrency’s supply, the implications are profound. These large holders possess the power to dramatically influence price movements. A coordinated sell-off could trigger sharp price drops, leaving smaller investors vulnerable to sudden market shifts.

Investors typically prefer more evenly distributed cryptocurrencies. A lower concentration of holdings suggests a reduced risk of market manipulation and provides greater confidence in the asset’s long-term stability. Santiment’s analysis shows the importance of monitoring these supply dynamics.

Read Also: Top Analyst Favours Buying Onyxcoin (XCN) Over Solana: Here Are Their Reasons

What This Means for Investors

The concentration of holdings doesn’t necessarily spell doom, but it does signal potential volatility. For Chainlink (LINK) and Toncoin (TON), these metrics suggest investors should remain vigilant. The behavior of top holders could significantly impact market movements in the near future.

Santiment recommends monitoring the ratio of top holders for different altcoins, providing a transparent view of potential market risks and opportunities.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.