The price of AAVE saw a sharp decline due to a broader market downturn not so long ago. Prominent analyst Sjuul from AltCryptoGems noted on X that the token’s price has shown signs of stabilization near a critical support zone. However, the situation remains uncertain as the market awaits confirmation of the next move.

Sjuul emphasized that AAVE’s price is consolidating around a key support level but cautioned traders about the possibility of a bearish retest at a previously broken resistance. It suggested that price acceptance above this resistance level could signal a potential bullish reversal.

What you'll learn 👉

Support and Resistance Define AAVE’s Current Position

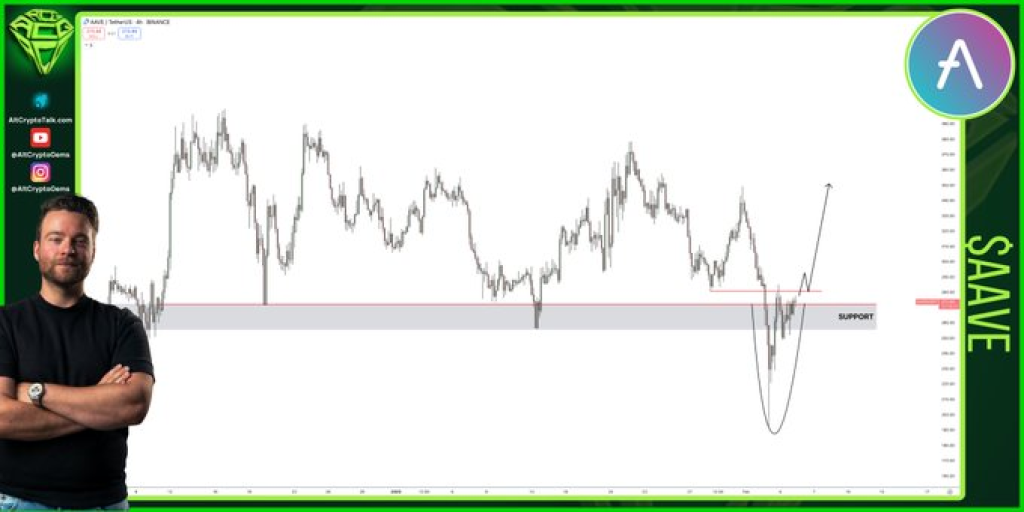

The AAVE chart highlights a horizontal support zone that has been repeatedly tested, indicating strong buying interest in this area. However, the price remains close to this support, suggesting a decisive move may be imminent.

A red horizontal line on the chart marks a previous support level that now acts as resistance. This level, broken during the recent market downturn, is critical for AAVE’s price recovery. The chart also displays a potential bullish scenario, where the price could reclaim this level and continue to rise.

Traders should closely monitor this resistance, as rejection here could result in further downside, while a break and hold above it could spark renewed optimism.

Market Sentiment Points to Indecision

Moreover, the chart suggests that market sentiment for AAVE remains indecisive. The price has formed a rounded bottom pattern, often indicative of consolidation, as it hovers near support. This consolidation indicates a pause in downward momentum, but it also reflects uncertainty among traders regarding the token’s next direction.

Read Also: XRP and XCN Can’t Compete? This $0.0003 Altcoin Could Be a Better Play, But Time is Running Out

Whether the price of AAVE breaks above the resistance or falls below support will likely set the tone for AAVE’s upcoming trend. Both the technical chart and the tweet highlight the importance of these levels in shaping the token’s trajectory.

The analysis underscores two potential scenarios for AAVE: a bullish breakout if the price reclaims the resistance or a bearish continuation if the support fails. For now, traders are advised to watch for confirmation of price direction before making decisions. These levels will remain critical indicators for AAVE’s price future performance.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.