The price of Bitcoin has seen some steady declines, dipping from around $109,200 to around $101,000 at the time of writing. The general market has also been hit by this decline, with major tokens like XRP, BNB, SOL, DOGE, PEPE, and more being in red over the last 24 hours. Market analyst Ali has highlighted several crucial insights that shed light on the current market conditions.

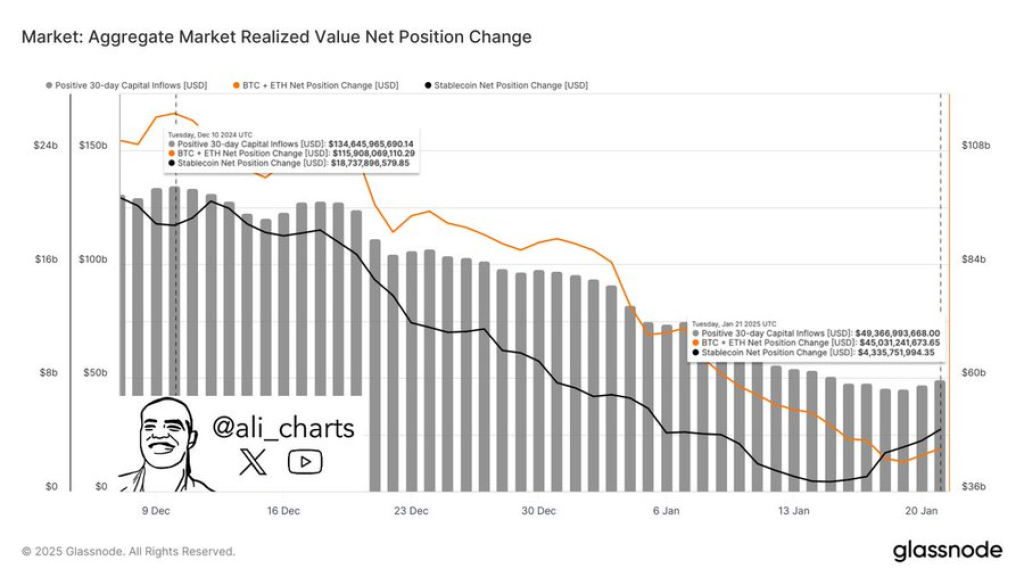

According to Ali’s recent analysis, the dramatic decline in cryptocurrency market capital inflows is the primary driver behind today’s market downturn. Ali’s data reveals a stark contraction that signals serious investor hesitation. The market has seen capital inflows nosedive by 63.3%, plummeting from $134.65 billion to just $43.37 billion since December 10, 2024.

This massive reduction isn’t just a number—it represents a profound shift in investor confidence. When capital inflows drop so precipitously, it indicates several critical market dynamics:

First, institutional and retail investors are pulling back from cryptocurrency investments. The significant withdrawal of funds suggests growing uncertainty about short-term market prospects. Investors are becoming more cautious, potentially waiting for clearer market signals before recommitting capital.

Second, the liquidity crunch means fewer new funds are entering the market. Reduced liquidity typically leads to increased price volatility, as smaller trading volumes can cause more dramatic price swings. For Bitcoin and other cryptocurrencies, this translates into increased vulnerability to market sentiment and external economic factors.

Read Also: Analyst Dumps Ripple (XRP) Tokens to Buy Onyxcoin: Makes Bullish XCN Price Prediction

Historical Halving Cycles Suggest BTC Has Not Topped Yet

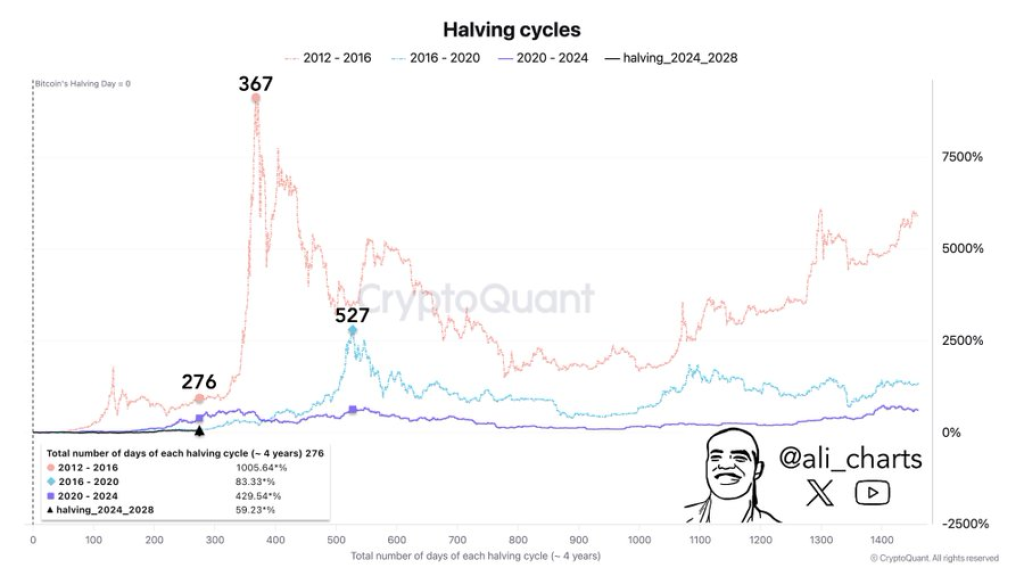

Ali’s deep dive into Bitcoin’s historical patterns reveals intriguing insights about market tops in relation to halving events. With 276 days having passed since the latest Bitcoin halving, the analyst draws parallels with previous cycles.

In 2013, the market peak emerged 367 days after the halving. The 2017 and 2021 cycles demonstrated even longer trajectories, with market tops materializing 527 days post-halving. Based on these historical trends, investors might anticipate the next market peak occurring somewhere between 90 and 250 days from now.

Read Also: Bitcoin Indicators Turn Bearish: Will BTC Price Dip Trigger Altcoin Season This Time?

While the current market conditions might seem challenging, Ali’s analysis provides a nuanced perspective. Historical data suggests that cryptocurrency markets are cyclical, and current downturns can be part of a larger, more complex market evolution.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.