Chainlink (LINK) shows signs of an imminent price movement, according to technical analysis shared by Ali Charts on X.

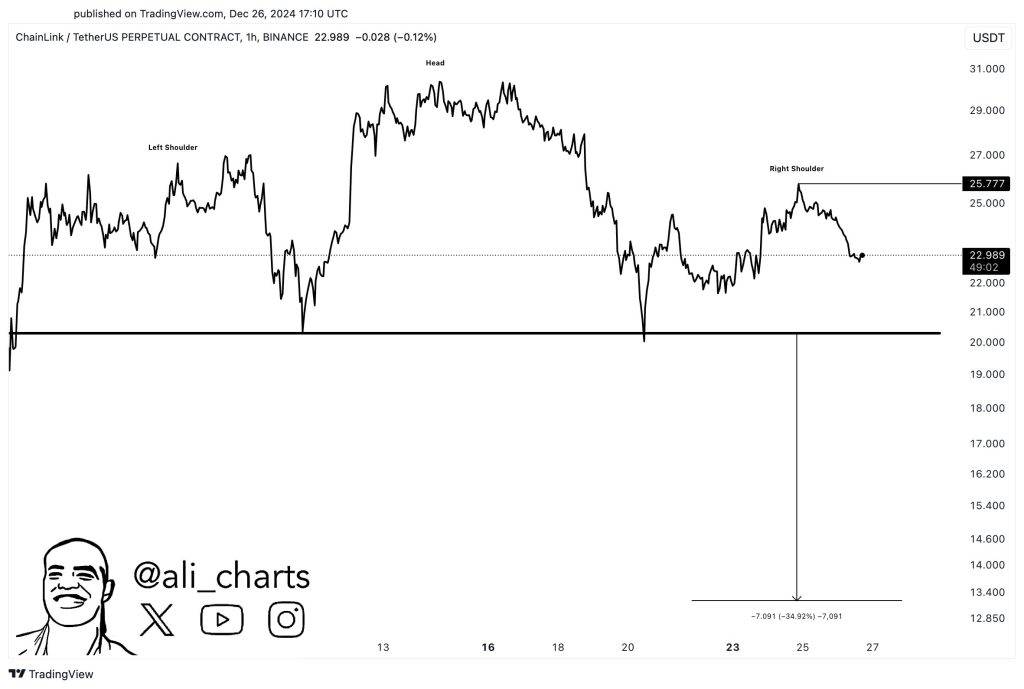

Ali suggests that LINK could drop to $14 if a head-and-shoulders pattern in the hourly price chart is confirmed. The analysis points to a potential bearish scenario based on technical indicators.

What you'll learn 👉

Head-and-Shoulders Pattern Formation

The pattern identified on the LINK hourly chart consists of three key peaks. The left shoulder formed when the price reached the $23.5-$27 range before retreating.

The head emerged as the price rallied to a higher peak around $30, followed by a decline. Finally, the right shoulder formed around $25.8 when the price rose again but failed to surpass the head’s height.

The neckline, positioned around $20.5, acts as a pivotal support level connecting the two lows that formed during the pattern. According to the analysis, a decisive breakdown below the neckline could signal further downward movement.

Target Calculation and Price Prediction

The target for this potential move is calculated by measuring the distance between the head and the neckline and projecting it downward.

The difference of approximately $9.5 suggests a possible decline from the neckline’s $20.5 level to $10. This is almost in line with Ali’s tweet, which warns of a potential drop to as low as $14 if the pattern is confirmed.

Currently, LINK is trading around $22.95, slightly above the neckline, and declining by 2.53% over the past day. This indicates that while the bearish pattern has not been confirmed, the price remains at a critical juncture.

Read also: Expert Maps Stellar (XLM) Price Path to $1, But There’s a Catch

Role of Volume in Confirmation

Volume plays a major role in determining whether the pattern will materialize. A breakdown below the neckline must be accompanied by increased trading volume to validate the bearish momentum. Without this volume spike, the pattern may fail, and LINK could see a reversal.

If the $20.5 neckline holds as support, the bearish setup could be invalidated, allowing LINK to rebound. However, should LINK breach this level with strong volume, the predicted drop to $14, with the potential for a further dip, becomes more likely.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.