The prices of many cryptocurrencies are down and in the red. BTC, ETH, and several other major cryptos have experienced dips in the last 24 hours. What’s causing this?

Ali posted a tweet that addresses the crypto market turbulence following the Federal Reserve’s latest monetary policy decision. The tweet offers insights into why Bitcoin experienced a significant downturn despite a widely anticipated rate adjustment.

The Federal Reserve implemented a 25 basis point rate cut. The move was anticipated by 97% of market participants. However, contrary to what might be expected from such a predicted action, Bitcoin’s value declined around the $100,000 mark.

Ali explains that market movements are driven less by current events and more by future expectations. The rate cut itself was already factored into market prices. However, the Fed’s revised outlook for 2025 caught investors off guard.

What you'll learn 👉

Adjusted Federal Reserve Projections

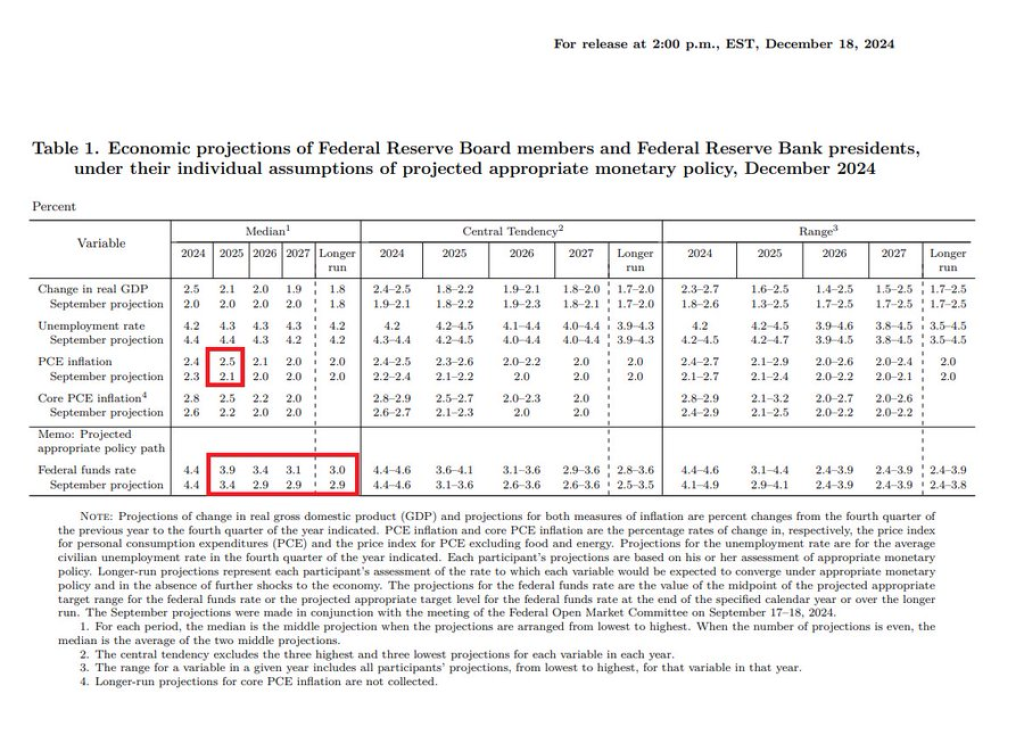

The Federal Reserve’s updated forecasts paint a more challenging picture than previously anticipated. The number of expected rate cuts for 2025 has been reduced from three to two.

Additionally, inflation projections have been revised upward. With this, 2025’s forecast has increased from 2.1% to 2.5%, and 2026 is still showing above-target inflation at 2.1%.

Recent inflation indicators have shown concerning patterns. The three-month annualized Core CPI stands at 4%, while Core PCE is approaching 3.5%, with PPI also showing upward momentum. These metrics suggest inflation remains more persistent than desired.

Read Also: Cardano (ADA) Versus Algorand (ALGO): Which Crypto Is Better to Hold in 2025?

Powell’s Pivotal Comment

A key moment came during Federal Reserve Chairman Powell’s press conference when he described the day’s decision as a closer call. This admission of internal debate within the Fed caused the US Dollar to surge to levels not seen since 2022. This then increased the pressure around risk assets like Bitcoin and other cryptocurrencies.

The market reaction stems not from the rate cut itself but from the realization that inflation might prove more stubborn than expected. This has caused the Federal Reserve to maintain a more hawkish stance than anticipated.

While this has created immediate market uncertainty, Ali suggests maintaining composure and avoiding panic selling, noting that markets often find opportunities within periods of uncertainty.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.