An analysis from Zen on X indicates that Bitcoin (BTC) may not see a major rally in the short term. Despite price fluctuations, Zen’s insights suggest potential consolidation before any upward momentum.

The analyst emphasizes that BTC’s recent dip was expected and highlights several key levels that traders should monitor. In a tweet, Zen reiterated his forecast that Bitcoin would dip to specific levels.

Besides, his prediction was accurate, as BTC experienced a decline to around $66,500, confirming the expected downward movement. Zen explained that this dip provided an opportunity for those looking to short BTC, and he noted that the market might consolidate further before any major upward movement.

Zen remains bullish on Bitcoin over the long term but advises caution in the near term. He suggests that the cryptocurrency is unlikely to see a substantial price increase immediately, with a consolidation period anticipated until November.

What you'll learn 👉

Key Resistance and Support Levels

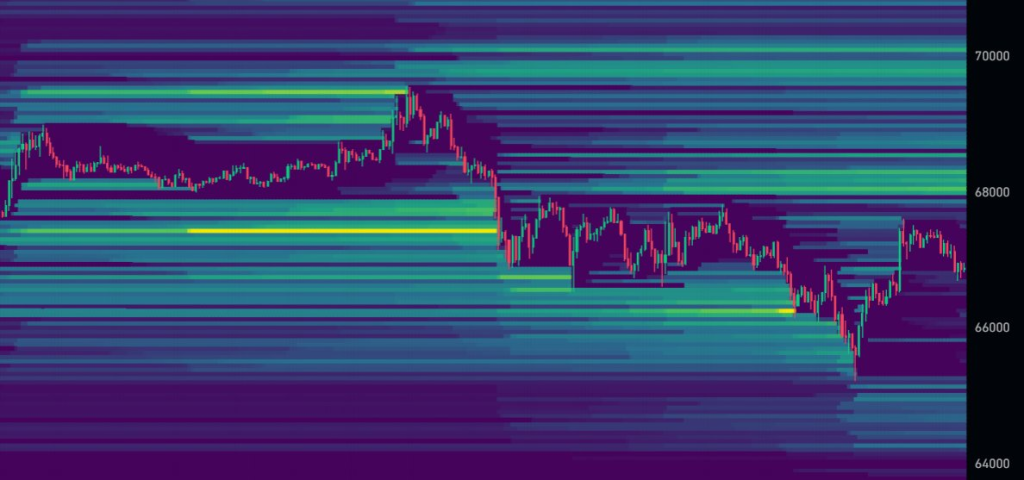

Zen’s analysis identifies various resistance and support zones that will play crucial roles in BTC’s price action. The $70,081 level, marking the July high, is considered a strong resistance.

If BTC approaches this point, traders could see selling pressure, capping any short-term rallies. Another critical level is $68,300, which reflects the Developmental Yearly VWAP (Volume Weighted Average Price) Value Area High, suggesting substantial trading activity.

On the support side, the $66,450 level, the September high, has been serving as a current support point after BTC’s dip. Other essential levels include $64,601 (July close) and $63,309 (September close), indicating further potential support areas if BTC breaks below the current range.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Liquidity Pools and Potential Price Action

Liquidity analysis from Zen’s tweet identifies clusters of orders both above and below the current BTC price. Liquidity pools above at $68,062, $68,561, and $70,121 suggest that BTC could encounter resistance at these levels, where traders might choose to take profits.

Conversely, liquidity pools below at $65,788, $65,088, and $64,444 indicate areas of buying interest. If BTC dips to these zones, traders may see increased buying, preventing further declines.

The data implies that BTC could consolidate around the $66K area, with a likely re-test of this level before any decisive upward move. Zen’s analysis also hints at a potential gap-fill toward $64K, which could attract further buying interest.

Read also: Why Is BOOK OF MEME (BOME) Price Going Up Today?

Analyst’s Bullish Long-Term Outlook

Despite the near-term consolidation, Zen remains optimistic about Bitcoin’s prospects on higher timeframes. The reference to “Day gap equilibrium” around $64K suggests a scenario where BTC may briefly dip to attract liquidity before a more extended price rally.

Zen’s long-term outlook aligns with this analysis, emphasizing that while short-term fluctuations are expected, the overall trend remains bullish. Zen’s analysis encourages traders to watch the outlined key levels, especially around the $66K mark.

While short-term dips and consolidation might be on the horizon, BTC’s broader accumulation phase could set the stage for a more substantial rally in the coming months.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.