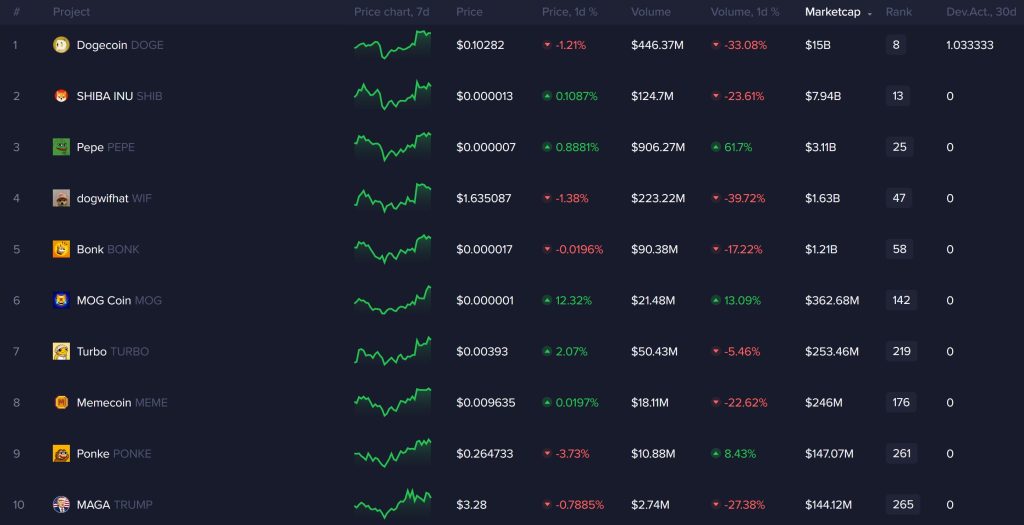

Meme coins has been on the “up and down” ride this bull run. After huge pumps in March, most of them failed to make their holders happy throughout the year.

Three of these tokens, Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) have the largest market caps amongst the top 100 meme coins and investors are asking what’s next for these coins.

Santiment’s experts shared with their 190k followers on X recent insights into the key on-chain and social indicators for these coins. The analysis sheds light on what could be expected for these tokens in the coming weeks.

What you'll learn 👉

PEPE’s Social Dominance and Sentiment

The PEPE price has seen fluctuations tied to its social dominance. This chart below indicates that whenever PEPE garners more attention on social media, its price tends to rise, and when it doesn’t, the opposite happens.

Santiment’s data suggests that PEPE is highly sensitive to speculative trading, and traders should be mindful of social trends. Moreover, the weighted sentiment also aligns with these movements, showing a predictive relationship where increased positive sentiment tends to precede price rises.

Right now, its weighted sentiment and social dominance are showing sharp fluctuations, and PEPE may continue to follow its rollercoaster-like trend. Traders monitoring sentiment indicators could anticipate potential PEPE price swings.

Shiba Inu’s MVRV Ratios Indicate Recovery

Shiba Inu (SHIB) has shown a correlation between its price movements and the MVRV (Market Value to Realized Value) ratio.

For those unfamiliar, this is a a ratio that compares an asset’s market capitalization (market value) to its realized capitalization (realized value or the aggregate value of all coins based on the price at which they last moved, essentially representing the cost basis or acquisition price of all coins).

SHIB’s 30-day MVRV ratio reveals that short-term holders are largely at a loss, often a signal of a buying opportunity for investors. The 365-day MVRV, meanwhile, remains neutral, indicating resilience among long-term holders.

As the MVRV ratio moves toward neutral territory, SHIB’s price may recover in the near term. Historical patterns suggest that deep negative MVRV values often lead to price increases, especially as short-term sentiment improves.

Read Also: Fantom (FTM) Price Pumps 50%, But Is This a Bull Trap?

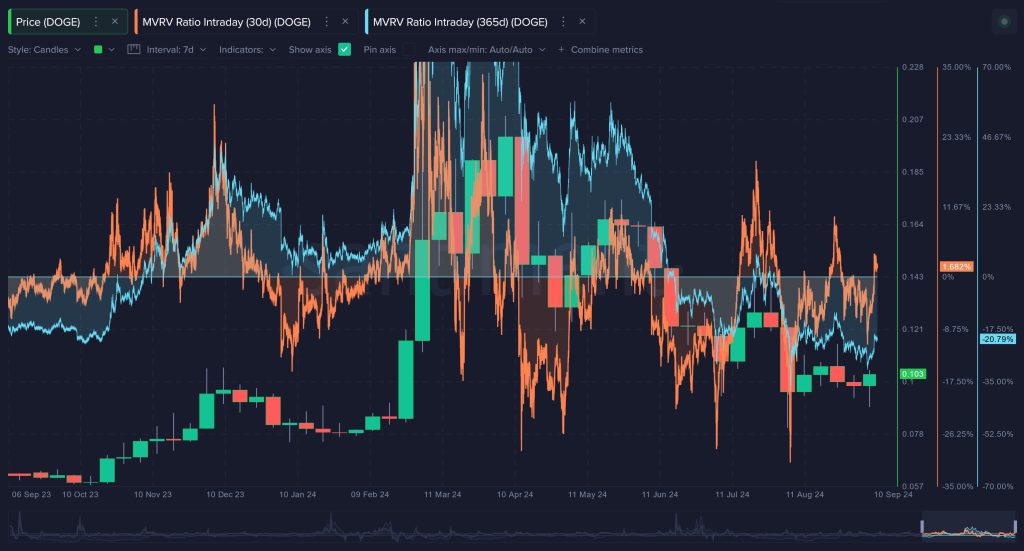

Will Dogecoin Price Recover?

Dogecoin’s (DOGE) price continues to follow a prominent volatility trend. The analyst suggests DOGE’s price has a strong correlation to the MVRV ratios. The 30-day MVRV ratio fluctuates strongly, reflecting short-term speculative trading.

Moreover, the 365-day MVRV is still negative, which indicates that long-term holders are now losing money.

Finally, sentiment-driven traders may continue to see opportunities in DOGE’s price fluctuations, as the social indicators reflect rising interest when the token is discussed more frequently online. The data points toward the likelihood of continued volatility, with the potential for price recoveries as sentiment shifts.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.