Let’s be honest – it’s been a horrible few months for crypto traders. Prices have been in a downtrend since the beginning of summer, and September hasn’t been pleasant so far either. It’s actually been quite the opposite.

Specifically, Ethereum has had awful price action throughout the whole bull run and is now trading below the $2.4k level after plummeting 8% this week.

Bitcoin isn’t doing much better, with the price hovering around $56k after a 7% plunge during the same period.

So, a lot of traders are now wondering – did Bitcoin already peak in March?

What you'll learn 👉

Analyzing the Bull Run: Is There More to Come?

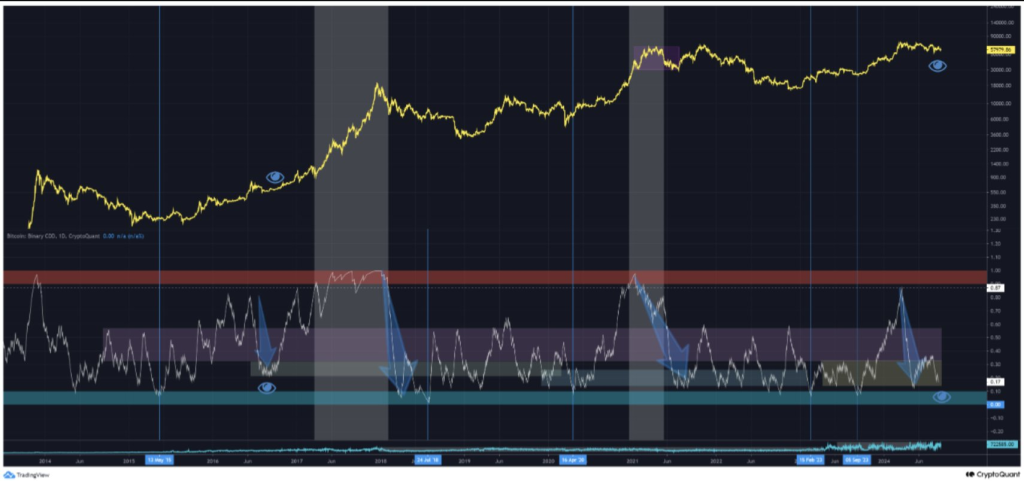

CryptoQuant, a respected blockchain analytics platform, posted an analysis on this topic, and they definitely think Bitcoin hasn’t reached a cycle top yet.

According to their report, “In March 2024, Bitcoin reached a new all-time high, leading many to question whether this marked the final market top. However, based on on-chain data analysis, it appears that March’s peak was likely an ‘initial top’ rather than the ultimate one.”

The analysis focuses on a key indicator of long-term holder activity called Binary CDD (Coin Days Destroyed). While this metric showed some profit-taking around March 2024, it hasn’t reached the levels typically seen before a final market top.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Long-Term Holders: The Key to Understanding Market Dynamics

CryptoQuant’s report emphasizes the importance of long-term holder behavior in determining market peaks. They note, “The absence of large-scale selling by long-term holders indicates that the market has not fully matured, and we are still far from the final peak of the bull market.”

This insight suggests that while we may have seen an “interim top” in March, leading to a period of consolidation, it likely wasn’t the ultimate peak of this bullish cycle. The market appears to be in a “cooling-off” phase, adjusting both price and time.

Read also: Starknet Price Pumps as STRK Trading Volume Hits $120 Million

The report concludes by stating, “Before we reach the final top, we will likely see renewed activity from long-term holders, with Binary CDD reaching the red zone, signaling the next round of price adjustments.”

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.