The crypto market has faced a notable dip lately. At publication, the market cap has fallen by 1.30% to $2.04 trillion, while trading volume has plummeted by 40.36% to $36.02 billion.

Bitcoin (BTC) trades at $58,229.23 at press time, a 1.17% decline in the past day. This decline comes as a response to broader market trends and signals underlying concerns about future market movements.

What you'll learn 👉

Bitcoin Price Analysis

Crypto analyst Karan Singh Arora’s tweet expresses frustration with Bitcoin’s performance on a Sunday morning, questioning when better days will arrive for the crypto.

The tweet hints at circulating rumors suggesting that the current bull run may have concluded. It also alludes to speculation that a new all-time high for Bitcoin might not occur until 2026 which affects the broader crypto market.

Analyst Julio Moreno analysis indicate that if Bitcoin breaches the $56k mark, the risk of a deeper correction will increase.This potential decline highlights the precarious nature of Bitcoin’s valuation.

Additionally, Bitcoin dominance is rising, suggesting that altcoins are experiencing even more declines. The current market environment indicates a tough period for altcoins, with their losses exacerbated by Bitcoin’s retracements.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read also: How Much Will Shiba Inu (SHIB) Be Worth in 2025 If Bitcoin Price Hits $100K?

Key Metrics To Watch

A key metric to watch is the Puell Multiple index, which is currently in a “Decision Zone” between 0.6 and 0.8, according to Grizzly from Cryptoquant. Historically, when this index falls below 0.6, it has often signaled a good opportunity for Dollar-Cost Averaging.

Source: Cryptoquant

On the other hand, when the index rises above 0.8, it typically precedes bullish behavior, driving prices to new all-time highs. Presently, the Puell Multiple index’s position suggests that if it dips below 0.6, it might present a favorable buying opportunity for investors looking to capitalize on potential market reversals.

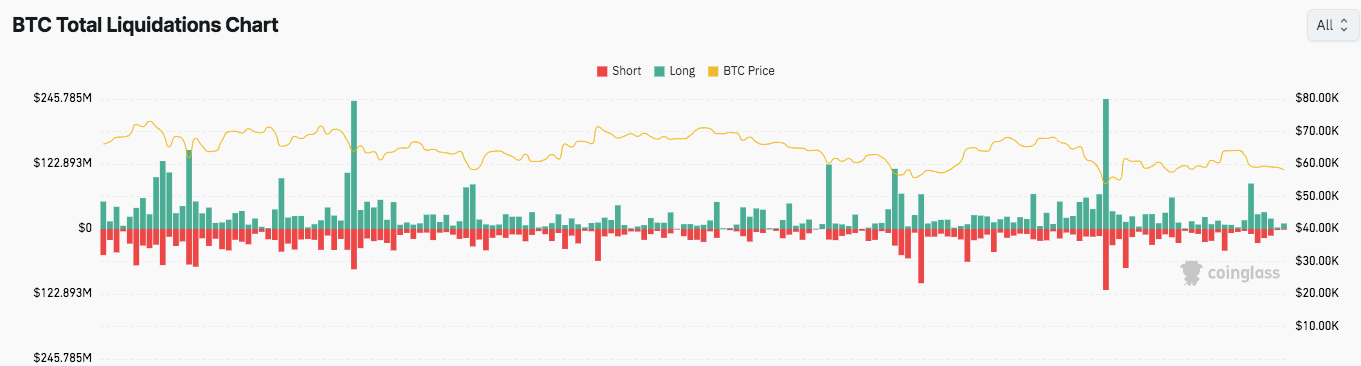

Source: Coinglass

Moreover, the Bitcoin market is witnessing liquidations across both long and short positions. This trend reflects a market filled with uncertainty and fluctuating trader sentiment. Traders who anticipated price increases faced liquidations when Bitcoin’s price remained stable.

Captain just hit his first 100x among a lot 2-5xs. Want to be a part of a profitable community?

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.