The U.S. Securities and Exchange Commission (SEC) has slowed down the approval process for Solana ETF. They did this by rejecting the 19b-4 filings from the Chicago Board Options Exchange for proposed ETFs by VanEck and 21Shares.

This decision is largely due to concerns about Solana potentially being classified as a security, which complicates its regulatory approval.

The Solana ETF Filing Process

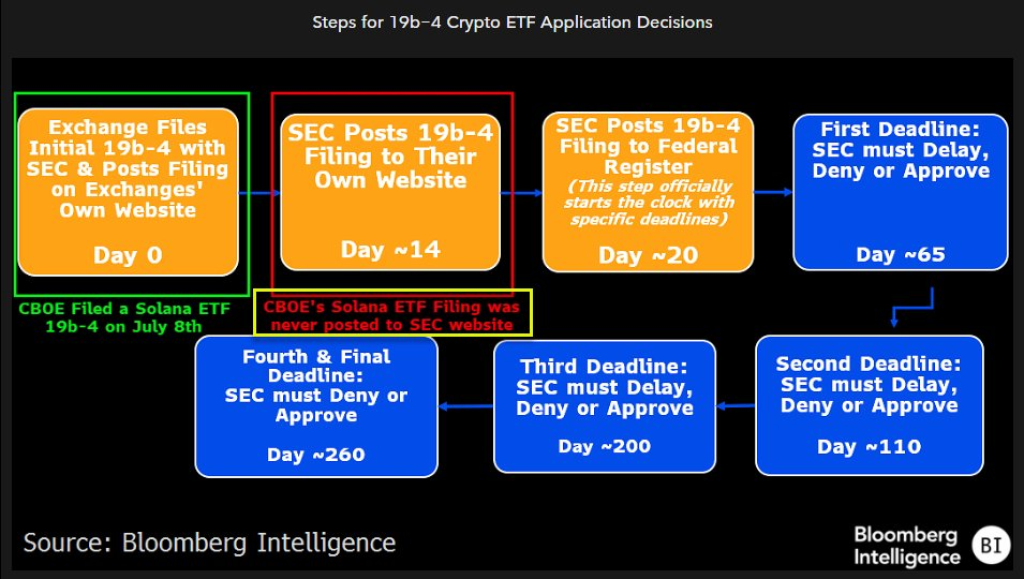

Bloomberg analyst Eric Balchunas shared insights on Twitter last night regarding the Solana ETF filings. He posted, “Nice flow chart showing how the Solana ETF filings never made it past Step 2 (the SEC failed to ack them) = DOA. So the exchanges withdrew 19b-4s altho the issuers’ S-1s are still active. A snowball’s chance in hell of approval unless there’s change in leadership”.

Balchunas’ tweet highlights the complex process of 19b-4 filings for cryptocurrency ETFs, specifically focusing on the Solana ETF filed by CBOE. The analyst points out that these filings never progressed beyond the second step, as the SEC failed to acknowledge them, effectively rendering them “dead on arrival” (DOA).

The process for crypto ETF applications involves several steps, starting with the exchange filing the initial 19b-4 with the SEC and ending with the final deadline for the SEC to deny or approve the application. In the case of the Solana ETF, the process stalled at the second step when the SEC did not post the 19b-4 filing to their website.

As a result of this inaction, the exchanges withdrew their 19b-4 filings. However, it’s worth noting that the issuers’ S-1 filings remain active, though their chances of approval appear slim. Balchunas suggests that a significant change, such as new leadership at the SEC, might be necessary for these filings to have any chance of approval.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The SEC’s reluctance to move forward with Solana ETFs underscores the ongoing regulatory challenges in crypto. As we look towards 2025, the reality of Solana ETFs coming to market seems uncertain at best, barring any significant shifts in regulatory stance or leadership.

Read also: This Analyst Warns of a Solana Price Crash – Has SOL Already Peaked?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.