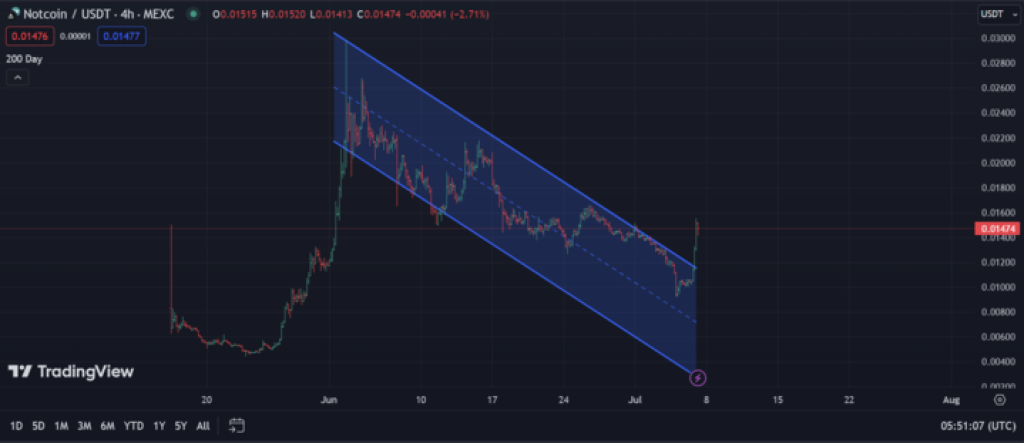

Notcoin (NOT) price hit an all-time high of around $0.029 back in June. However, since then, it has started trading in the descending channel (blue lines).

The price has finally broken above the top of the channel following a 50% price pump and price action suggests it could be the start of a long rally.

The Relative Strength Index Indicator (RSI) for Notcoin on the daily chart, is currently at 48. The price is neither overbought nor oversold, and it has a lot of room to run upward. The move to 48 started after the RSI 14-day average bounced from the support at 33.

One could still take the RSI reading of 48, as slightly bearish, until it breaks above 50, which is a buyer zone.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read Also: JasmyCoin Outperforms Other Altcoins Again – Will JASMY Price Rally Continue?

The Moving Average Convergence Divergence (MACD) Indicator shows that the Signal and MACD lines are below the zero line, showing that the price market is still bearish. This could be positive for NOT as it also shows that the price has a lot of room to run before getting overbought

It is also worth noting that the RSI and MACD indicators are lagging indicators, meaning that they do not respond swiftly to price changes. They do not correctly reflect the ongoing price action but only give data based on past activities.

Captain Faibik, a crypto analyst with close to 100k followers on X, also confirmed the descending channel breakout in a post about Notcoin. Based on their analysis, the popular crypto influencer expects a 100% rally from the breakout points to the top of a channel. In his own words, he is “expecting a 2x bullish rally.”

Based on the price action, traders can start to time their entries and look for additional confirmations to ride the potential bullish wave that’s about to follow.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.