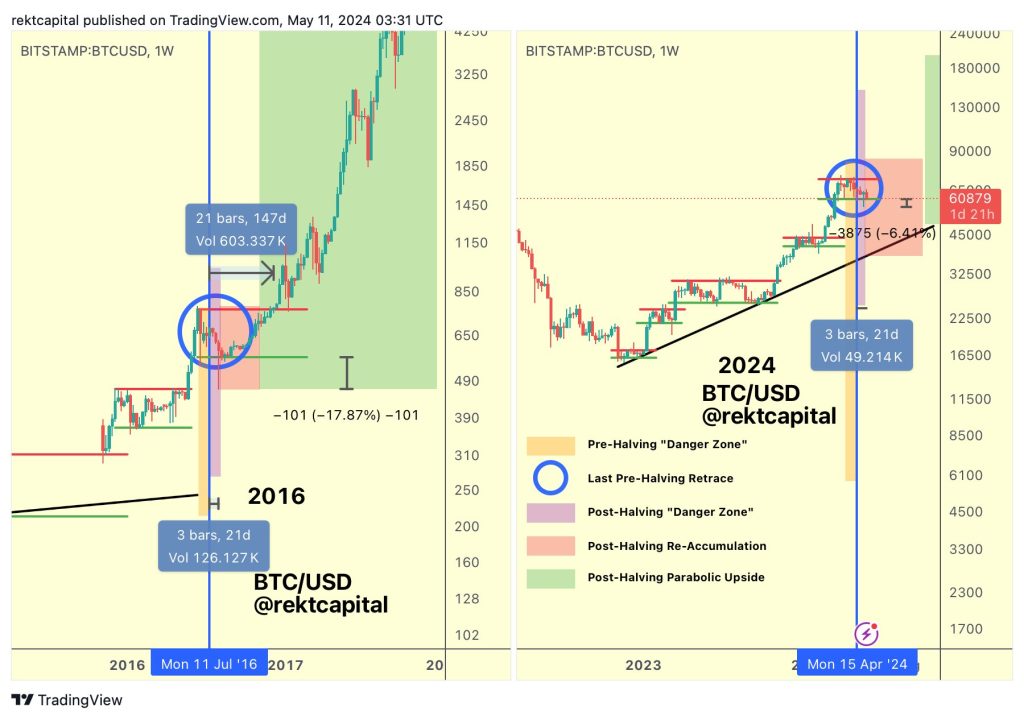

The cryptocurrency market, known for its volatility, presents predictable patterns around Bitcoin’s halving events. Cryptocurrency analyst Rekt Capital shared insights on these specific phases, which he terms the “Danger Zones.” These periods are critical for traders and investors who monitor Bitcoin’s price behavior for optimal trading strategies.

What you'll learn 👉

Pre-Halving “Danger Zone”

Every four years, Bitcoin experiences a halving event that impacts its supply dynamics and typically precedes significant price fluctuations. According to Rekt Capital, the Pre-Halving “Danger Zone” occurs 14-28 days before the event. This cycle, Bitcoin witnessed an 18% drop approximately 30 days before the halving, closely resembling the 2016 halving period when the decline started 28 days prior. This orange-marked phase warns investors of potential downturns, providing them an opportunity to strategize their holdings.

Following the halving, Bitcoin enters another volatile phase: the Post-Halving “Danger Zone,” marked in purple. Historical data from 2016 shows a sharp 11% decline 21 days after the halving. This pattern repeated in the current cycle, with a 6.5% drop occurring 14 days post-halving. These movements underscore the market’s reaction to new supply rates and investor sentiment, stabilizing only after these declines.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Strategic Implications for Market Participants

For market participants, understanding these patterns is crucial. The “Danger Zones” signify heightened risk but also potential opportunities for buying or selling at advantageous positions. Bitcoin needs to maintain a support level above $60,600 by the end of this week to conclude the current post-halving “Danger Zone.” Successfully navigating these periods can result in significant gains or protective measures against potential losses.

As Bitcoin continues to demonstrate predictable yet significant pre and post-halving price movements, traders can leverage these insights for better decision-making. Recognizing the timing and implications of these “Danger Zones” allows investors to plan their strategies with greater precision, potentially maximizing returns in a market that remains difficult to predict.

Read also: Major Bitcoin (BTC) Rally Is Finally Starting: These Two Metrics Reveal There’s No Going Back

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.