Top crypto analyst Finish (@0xFinish) outlined his views on the forthcoming altcoin season. In a tweet, he discussed the current status of Bitcoin and Ethereum, and identified potential leading narratives. Finish contended that despite Bitcoin hitting its ATH and rallies in some altcoins, the true frenzy typically associated with an altcoin season has yet to begin.

What you'll learn 👉

Analyzing Market Conditions

Through his market analysis, Finish sees telltale signs that conditions are not yet ripe for an altcoin frenzy. He states the market has not witnessed the excessive greed, multi-million dollar profits, or huge sell-offs that typically drain liquidity preceding previous altcoin frenzies. Despite strong performances in select altcoin plays like the Ethereum Insignia (EIGN) airdrop, Finish argues there is still room for more narratives to emerge before the cycle’s climax.

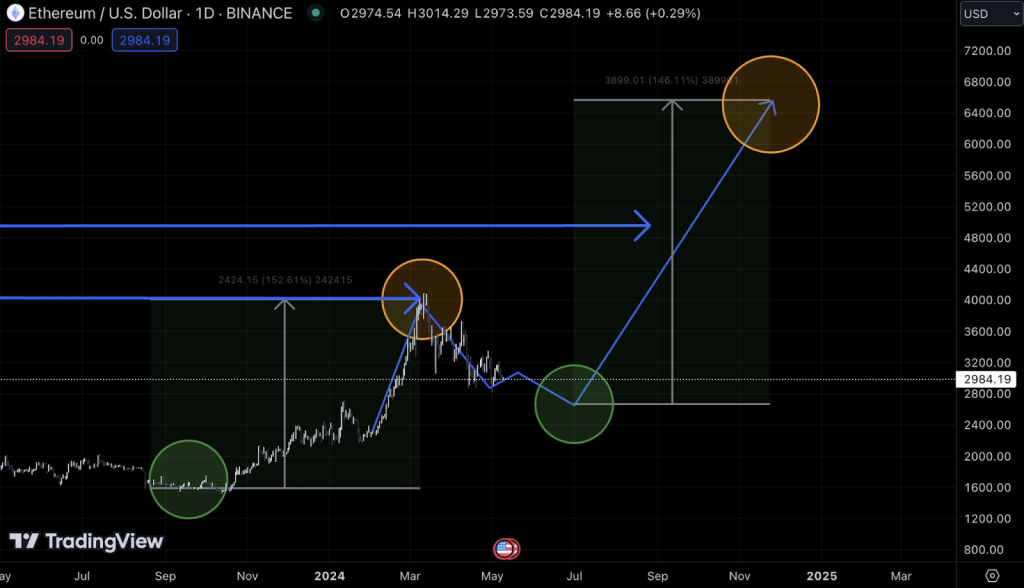

Given this outlook, the analyst advocates accumulating Ethereum (ETH) through a dollar-cost averaging strategy while Bitcoin’s (BTC) chart appears technically weak relative to ETH. Finish sees an opportunity to load up on ETH at potentially lower price levels before the market gets swayed by extreme fear of missing out (FOMO) on the next big run.

Read also: Ethereum (ETH) Price Trajectory: Expert Pinpoints This Level as Key for Continued Bull Run

Identifying Key Narratives for Altseason

When the highly anticipated altseason does arrive, Finish identifies three key narratives he expects will capture investors’ focus and drive outsized gains. Artificial Intelligence (AI) projects, protocols focused on decentralized finance (DeFi) and lending, and blockchain-based gaming initiatives are poised to be the hottest themes elevated by speculative mania.

To maximize upside during this phase, the analyst recommends traders laser in on just 3-5 top altcoin plays across these high-conviction sectors rather than diversifying too broadly. Concentrating capital in a handful of likely winners tends to yield the largest portfolio profits.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Long-Term Perspective on Crypto Investments

Looking beyond the volatile crypto market cycles, Finish encourages investors to keep a long-term perspective, particularly on Bitcoin and Ethereum. Over a 10-year time horizon, he believes the top two crypto assets will outperform traditional investment vehicles like the U.S. dollar given their programmatic supply capping mechanisms and immense growth potential. From this vantage point, the specific price levels to accumulate BTC and ETH may matter less compared to simply getting exposure.

While the crypto markets are unpredictable, Finish is providing a strategic blueprint for how investors can position for an anticipated altcoin surge. His perspectives on accumulation timing, identifying transformative narratives, concentrating capital on top plays, and investing in crypto’s secular growth could resonate with those seeking to capitalize on the market’s next manic phase.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.