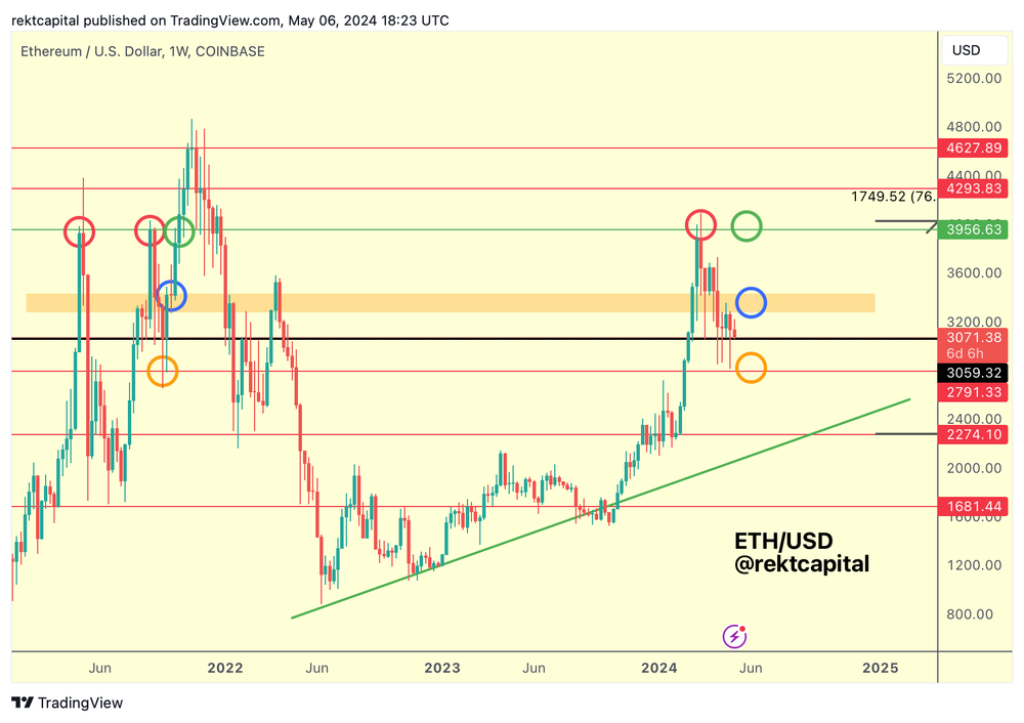

Ethereum has entered a volatile phase, falling into a crucial price level, sparking investor concern. Rekt Capital’s analysis predicted the decline following a potential rejection from a higher price zone identified as the blue-circled area around $3,500. Notably, although Ethereum rebounded from the lower orange-circled level at $2,800, it has struggled to sustain this recovery.

What you'll learn 👉

Current Technical Stance of Ethereum

Ethereum now teeters on the brink at a pivotal black level at $3,000, which serves as a mid-point in its current trading range. This level’s significance is heightened as it acts as a barrier preventing further drops to lower supports at $2,800.

Moreover, a breach here could signal weakening strength and lead to a more pronounced bearish trend. The cryptocurrency’s ability to maintain this midpoint is crucial for stabilizing its near-term market performance.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +External Influences on Price Movement

Adding to the complexity of Ethereum’s market dynamics, Michaël van de Poppe, a top cryptocurrency analyst, pointed out external factors that could pressure Ethereum’s price. On X, he noted the potential for Ethereum to test lower levels again, driven by a delay or denial in the approval of an Ethereum-related ETF. Van de Poppe anticipates that the ETF, if approved in August, could precipitate a final market correction, further influencing Ethereum’s price actions.

Read also: Ethereum (ETH) Price Trajectory: Expert Pinpoints This Level as Key for Continued Bull Run

Ethereum’s immediate future seems fraught with challenges both from within the crypto market’s infrastructure and external economic factors. The critical support at the black level and the pending ETF decision will play pivotal roles in determining Ethereum’s price direction in the upcoming weeks. The experts advise Investors and traders to keep a close watch on these developments, as they could have implications for Ethereum’s valuation and overall market stability

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.