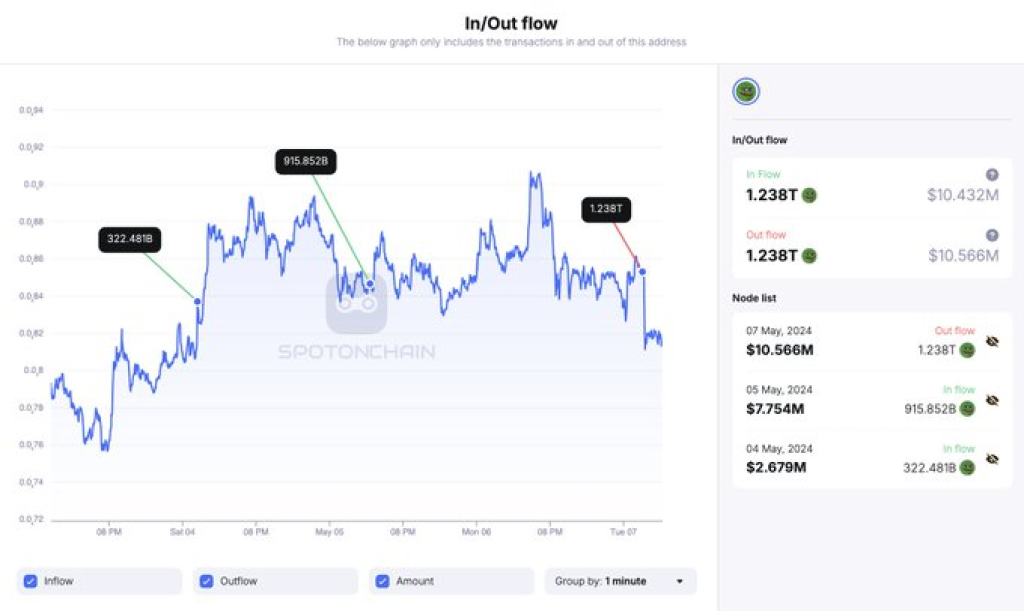

A notable development in the PEPE market has caught the attention of on-chain data analyst Spot On Chain. Few hours ago, a multisig wallet deposited 1.238 trillion PEPE tokens, worth approximately $10.6 million, to Binance. This substantial transfer caused an abrupt 5.2% drop in the price of PEPE, raising questions about the whale’s intentions and market sentiment.

What you'll learn 👉

Short-Term Hold and Minimal Profit Realization

Interestingly, the whale had only held the 1.238 trillion PEPE tokens for a mere three days before transferring them to Binance. If the whale were to sell the entire holdings, they would realize a small profit of only $134,000, representing a 1.28% gain.

This short-term hold and minimal profit realization have led to speculation about the whale’s motives and potential bearish sentiment towards PEPE.

PEPE Price Performance and Market Reaction

In the wake of the multisig wallet transfer and subsequent price drop, PEPE is currently trading at $0.000007839, down 7.07% over the past 24 hours. The token has experienced a volatile trading range, with a low of $0.000007759 and a high of $0.000008465 during this period.

The market’s reaction to the whale’s actions has been swift, with the price drop extending beyond the initial 5.2% decline immediately following the transfer. This suggests that market participants are closely monitoring whale activity and adjusting their positions accordingly.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The sudden transfer of such a large amount of PEPE tokens to Binance has raised questions about the whale’s intentions and potential insider knowledge. Spot On Chain poses the question, “Did the whale know something and therefore become bearish with $PEPE?”

Several theories have emerged regarding the whale’s actions:

- Profit-Taking: Despite the minimal profit realized, the whale may have decided to take profits and exit their position, possibly due to concerns about future price movements or a change in market sentiment.

- Risk Management: The whale may have transferred the tokens to Binance as a risk management strategy, potentially seeking to diversify their holdings or mitigate potential losses in case of a market downturn.

- Market Manipulation: Some speculate that the whale may have intentionally transferred the tokens to Binance to trigger a price drop, possibly to accumulate more PEPE at a lower price or to benefit from short positions.

However, without further information or confirmation from the whale, these theories remain speculative.

Read more: Experts Say VeChain (VET) is ‘Cooking Something’ in the Real World Asset industry – Here’s Why

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.