The crypto markets experienced a significant downturn over the past week, leaving investors wondering about the driving forces behind the crash and whether the bearish momentum will persist in the coming days. According to Nic, the CEO and Co-founder of CoinBureau, a confluence of factors is responsible for the recent market turmoil.

In his analysis shared on X, Nic highlighted that the crypto crash was primarily driven by macroeconomic factors, including higher-than-expected inflation and escalating geopolitical tensions. The disappointing earnings guidance from financial giant JPMorgan Chase seems to have taken the lead in sending U.S. markets lower, further exacerbating the risk-off sentiment.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The macro environment appears bleak, with interest rate expectations showing no pivot until at least September, and geopolitical threats heating up. Nic pointed out that the ongoing war in Gaza is entering a new phase, which could potentially lead to direct conflict between Iran and Israel, potentially drawing the U.S. into the fray. Such an escalation could have severe implications for oil prices and, consequently, inflation.

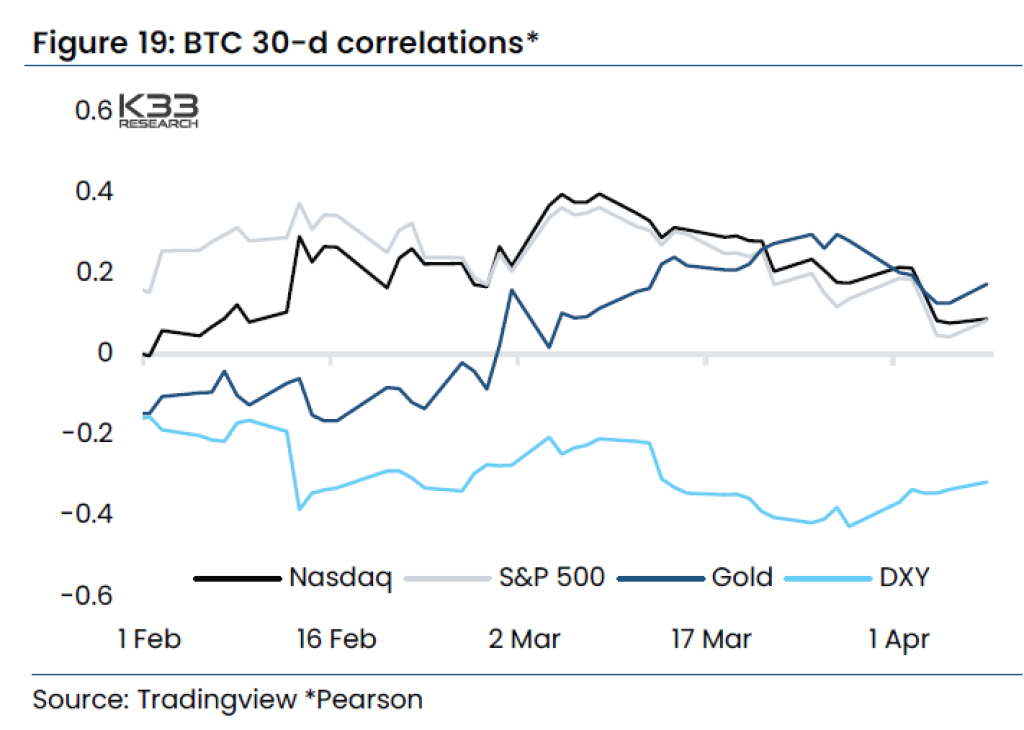

While Bitcoin’s correlation to stocks had trended lower for most of 2023, it appears to be ticking up again, reflecting the general risk-off sentiment that drove all markets, including Bitcoin, lower.

Leverage has also played a significant role in amplifying the market downturn. Nic noted that the intense leverage built up in the system led to large cascading liquidations, with almost $1 billion in total crypto market liquidations, marking the largest washout in a month.

While a reduction in pressure in the futures market could potentially reduce volatility this week, the broader macroeconomic environment remains risk-off, posing challenges for a swift recovery.

Bitcoin ETF flows, which had been a significant driver of price over the past few weeks, saw a net outflow last week, further exacerbating the bearish sentiment.

However, Nic highlighted some potential silver linings. Grayscale outflows can only continue for so long, and the potential launch of spot ETFs in Hong Kong could buoy the market. Additionally, with only six days remaining until the Bitcoin halving event, a retail investing narrative could emerge, potentially providing some support to the markets.

Nic concluded by stating that whether these positive factors will be enough to counteract the prevailing macroeconomic headwinds remains to be seen, setting the stage for an interesting week ahead in the crypto markets.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.