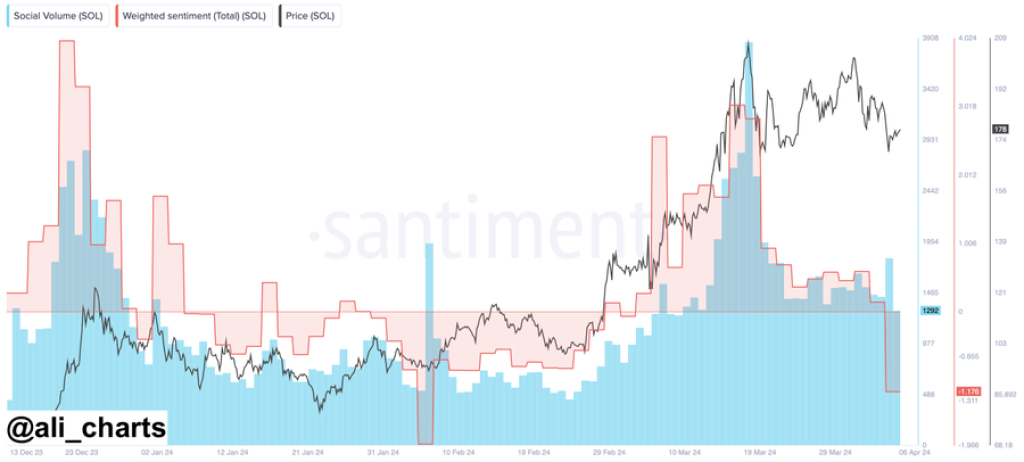

Sentiment around the Solana blockchain has hit its lowest point in two months, according to market analyst Ali, reigniting debates around the network’s reliability and scalability challenges. The downturn in crowd sentiment coincides with a recent network outage on February 6th, which disrupted transactions and dented confidence in the high-throughput protocol.

“Crowd sentiment for $SOL hasn’t been this low since the #Solana network outage on February 6,” Ali, who goes by the Twitter handle @ali_charts, noted in a recent tweet that has garnered significant traction among crypto enthusiasts.

The analyst suggests that being a “contrarian” – essentially, going against the prevailing market sentiment – might pay off for investors willing to buck the trend and accumulate Solana’s native token, SOL, amid the current lull in sentiment.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +But what does it mean to be a contrarian in this context?

In financial markets, contrarian investors often make investing decisions that contradict the predominant market sentiment or consensus opinion. By going against the herd mentality, contrarians aim to capitalize on potential overreactions or mispriced assets, betting that the market will eventually correct itself and move in their favor.

Ali’s suggestion that being a contrarian “might just pay off” implies that the current negative sentiment surrounding Solana could be an overreaction, presenting a potential buying opportunity for those willing to go against the grain.

However, it’s important to note that contrarian strategies carry inherent risks, as they involve defying the market’s collective wisdom, which may or may not be justified.

The recent bout of negative sentiment towards Solana is likely fueled by the network’s recurring technical issues and outages, which have raised concerns about its ability to handle high transaction volumes reliably. As a high-performance blockchain designed for decentralized applications (dApps) and Web3 projects, Solana’s scalability and uptime are critical factors that impact its adoption and long-term viability.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.