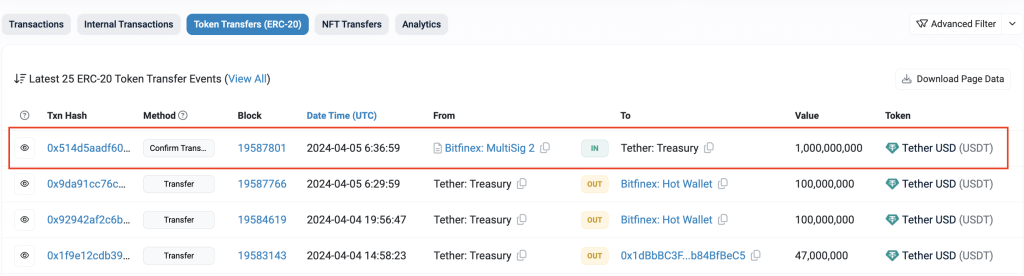

The news relased by Spotonchain that Tether Treasury, the issuer of the USDT stablecoin, minted another 1 billion USDT tokens on the Ethereum blockchain has birthed speculations. This comes just days after the company minted 2 billion USDT on the TRON network.

The fresh minting of 1 billion USDT was confirmed through an Ethereum transaction with the hash: 0x514d5aadf60ae93cf2a5901318c46b8716b099f2cc76ea7dbe20723b6246ec28. The tokens were issued to the address: 0x5754284f345afc66a98fbb0a0afe71e0f007b949.

For those unfamiliar, USDT or Tether is a stablecoin, a type of cryptocurrency designed to maintain a stable value relative to an underlying asset, in this case the US dollar. As such, each USDT token is meant to be backed by $1 in reserves.

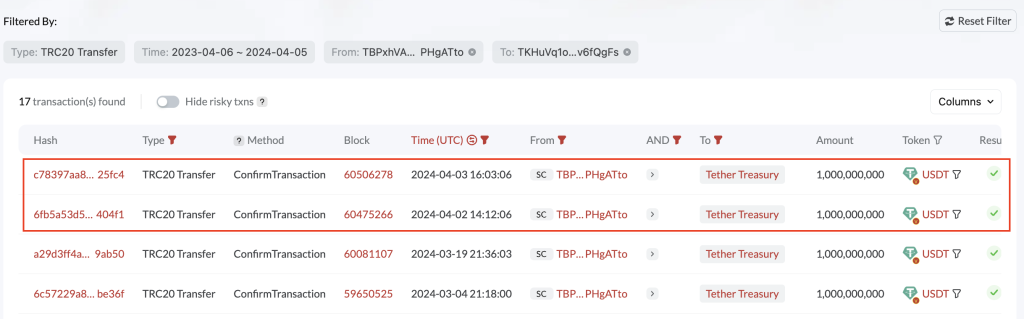

The recent minting activity has raised eyebrows in the crypto community, with speculation rife about Tether Treasury’s motives. Over the past three days alone, the company has injected a whopping 3 billion new USDT into circulation across the Ethereum and TRON blockchains.

On the TRON network, 2 billion USDT were minted and sent to the address: TKHuVq1oKVruCGLvqVexFs6dawKv6fQgFs.

While Tether has not officially commented on the reasons behind this massive issuance, there have been theories around this. It could be that the company is anticipating a surge in demand for USDT, perhaps due to increased trading activity or capital inflows into the crypto market.

It could also be that Tether is aiming to bolster liquidity and market depth, ensuring ample supply of the stablecoin to facilitate seamless trading and transactions across various cryptocurrency exchanges and platforms.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +It’s worth noting that Tether has faced scrutiny in the past regarding the transparency of its reserves and the actual backing of USDT tokens. As such, some analysts view the recent minting spree with skepticism, questioning whether Tether indeed has the necessary dollar reserves to back the newly issued tokens.

The impact of this USDT issuance on the broader cryptocurrency market remains to be seen. While an influx of stablecoins could potentially increase trading volumes and liquidity, concerns over Tether’s reserves and the company’s adherence to its $1 peg could also sow doubts and fuel market volatility.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.