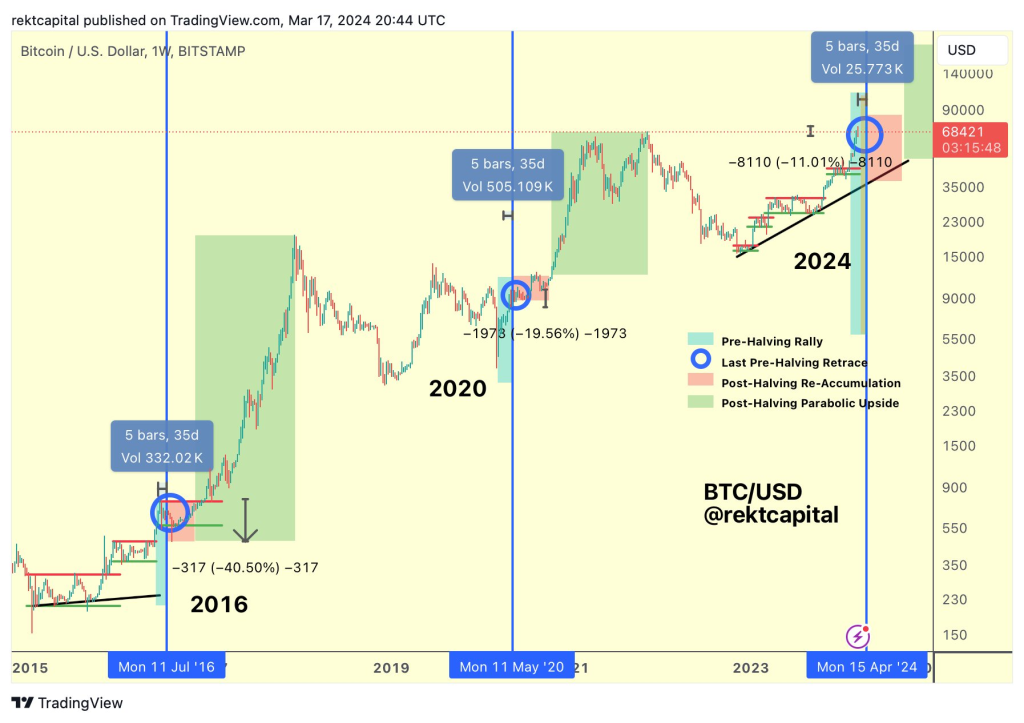

Rekt Capital, a renowned analyst, has dubbed this crucial period “the Danger Zone” for Bitcoin. This zone, which historically begins 14–28 days before the Bitcoin halving, has been characterized by significant price retraces in previous cycles.

What you'll learn 👉

Historical Pre-Halving Retraces

According to Rekt Capital, Bitcoin has experienced notable pre-halving retraces in the past. In 2020, the retrace was -20% deep, while in 2016, it was even more pronounced at -40%. Currently, Bitcoin is just 30 days away from the upcoming halving and has already pulled back -11% this week.

As the market anticipates the halving, which is expected to reduce the block reward and potentially impact Bitcoin’s supply dynamics, investors and traders are closely monitoring the cryptocurrency’s price action for any signs of a more substantial retrace.

FOMC Meeting and Bitcoin’s Possible Moves

Trader CrypNuevo has highlighted the importance of the upcoming Federal Open Market Committee (FOMC) meeting, scheduled for next Wednesday. The meeting will include a new dot-plot, which reveals the intentions of FED members regarding future interest rate cuts.

The bond market is currently pricing in expectation of the FED starting to cut rates from June onwards. Any change in the FED’s narrative during the FOMC meeting could significantly impact the markets, including Bitcoin. CrypNuevo advises caution for anyone holding open positions on Wednesday evening.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Key Resistance and Support Levels

Bitcoin is currently testing the 4-hour 50 EMA (Exponential Moving Average) as resistance. If the cryptocurrency faces rejection at this level, CrypNuevo anticipates a new lower low, where strong support is expected to hold. A potential reversal signal, such as a W formation, could appear at this support level.

Alternatively, if Bitcoin manages to flip the 4-hour 50 EMA into support (a resistance/support flip), the cryptocurrency could target the $70,000 level once again. The one-month liquidation heatmap reveals a liquidation cluster at $74,100, which could serve as a natural upside target.

As Bitcoin enters the historically significant “Danger Zone” before the halving, the cryptocurrency market is bracing for potential volatility. With the FOMC meeting on the horizon and key resistance and support levels in play, investors and traders are advised to exercise caution and wait for the market makers to reveal their intentions before making any significant moves.

The coming weeks will be crucial for Bitcoin, as the cryptocurrency navigates the pre-halving period and reacts to macroeconomic developments.

You may also be interested in:

- Experts Interpret Solana’s (SOL) Market Trajectory: Indicator of Major Upcoming Shifts in Crypto? Here’s their Outlook

- Top Bitcoin Analyst Maps Out BTC’s Potential Correction with This Strategy

- EOS (EOS) Recovers Stolen Tokens; Filecoin (FIL) Liquid Staking Soars; Algotech (ALGT) Presale Blasts 275%

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.