Bitcoin has struggled to fall below the key $50,000 support level recently, despite some periods of sideways price action. The resilience around $50k suggests the market currently sees it as “fair value” for Bitcoin. The influx of institutional investors thanks to new Bitcoin ETF products is helping cement $50k as the new price floor.

Institutional Interest Providing Strong Support

As Kevin Svenson noted on Twitter, “Bitcoin demand is very high right now. Price unable to cross below $50,000. Despite the sideways action, what’s clear is that the market currently considers $50,000 ‘fair value.'”

The approval of Bitcoin ETFs has allowed major financial players like BlackRock and Fidelity to invest in Bitcoin. These institutions recognize the value for their clients in diversifying into cryptocurrency. The accessibility of Bitcoin ETFs makes it easier for them to gain Bitcoin exposure without needing to directly hold the asset.

On-Chain Data Shows Institutional Accumulation

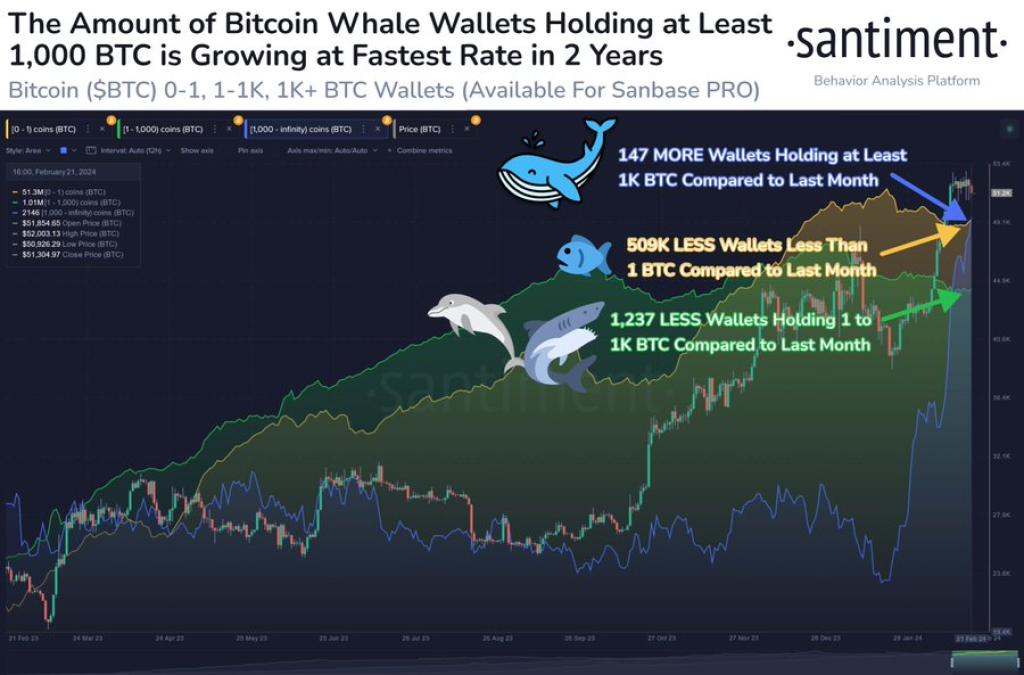

On-chain data from Santiment reveals how larger players are accumulating Bitcoin. Over the past 30 days, wallets holding over 1,000 BTC have risen by 7.4%. Meanwhile, smaller retail holders with less than 1 BTC have declined. This suggests institutions are buying the dip, making it hard for Bitcoin to break decisively below $50,000.

Conclusion

In summary, increased institutional interest and on-chain accumulation are providing strong support around today’s $50,000 Bitcoin price level. As more major players buy Bitcoin via ETF products, the market is signaling $50k as the new “fair value” baseline for Bitcoin. This makes it increasingly difficult for bears to push the top cryptocurrency significantly below this key threshold.

You may also be interested in:

- Why is XAI Token Surging? Analyst Says ‘Consolidation Breakout Retested’ – Here’s His Outlook

- Starkent (STRK) and Filecoin (FIL) Prices Pumping – Here’s Why

- Meet The Viral Cryptos – Bitcoin Minetrix and BlockDAG (BDAG) Raise Millions In Their Ongoing Presales While Jupiter Surges

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.