Late Wednesday night, the SEC finally approved several applications for Bitcoin exchange-traded funds (ETFs) in the United States.

This move marks a major milestone for the cryptocurrency industry, lending increased mainstream legitimacy and opening crypto up to more investors. However, the price of Bitcoin curiously remained flat around $46,000 in the 12 hours following the news.

The approval of Bitcoin ETFs signals growing regulatory acceptance of digital assets and could attract significant institutional capital into the space. So why didn’t we see Bitcoin immediately surge on this long-awaited news? There are several likely reasons, we’ll list 4 of them:

- Investors who wanted Bitcoin exposure through an ETF may have already purchased BTC in anticipation.

- Trading has not yet begun for these new ETFs, which start on Thursday (today). Capital inflows may follow after they officially launch.

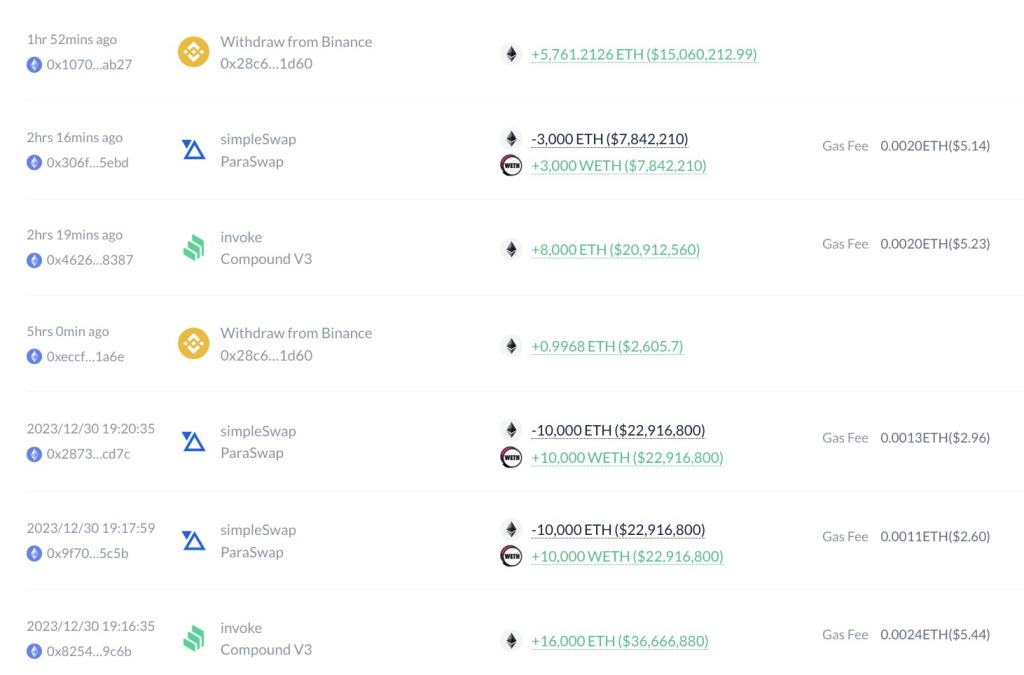

- Money has rotated into Ethereum and its booming DeFi ecosystem. ETH gained 10% and crossed $2,600 as projects like Arbitrum and Rocket Pool surged over 20% alongside altcoins.

- The constant delays and drawn-out ETF approval process exhausted some crypto investors. After years of anticipation around a Bitcoin ETF, the CFTC and SEC took over six months to review several applications before finally giving the green light. This story dragged on so long that the news fell slightly flat for portions of the community.

As Michael van de Poppe noted to his 670,000 Twitter followers, “Congratulations, This ETF Approval for Bitcoin means that Bitcoin won’t go away. It’s legitimacy that’s required for global adoption. Additionally, the Ethereum ecosystem is taking off heavily. That’s the ride for the coming 1-2 months.”

In one example, an anonymous whale borrowed $28.95 million worth of Wrapped Bitcoin and swapped it for 11,663 ETH to go long on the ETH/BTC ratio according to on-chain data site LookOnChain.

As analyst Layergg tweeted, “Reasoning why I de-risked: Because ETF approvals have historically been followed by a “Sell the News” event (this chart proves it). Nevertheless, Reasoning why I #HODL: Again, history proves it. The next phase, Bitcoin Halving will take us into the Super Cycle.”

In other words, he sold some Bitcoin after the initial ETF announcement based on previous “sell the news” dumps following similar approvals.

However, Layergg remains bullish longer-term due to the upcoming halving in April 2024 which he believes will catalyze Bitcoin’s next parabolic bull run phase or “super cycle.” This halving remains a major factor looming over the market that could drive new all-time highs.

What you'll learn 👉

Halving Draws Attention to Bitcoin Minetrix Cloud Mining

With Bitcoin ETFs approved, the market can now set sights on Bitcoin’s upcoming halving event in April 2024. The halving will cut mining rewards from 6.25 BTC to 3.125 BTC per block, drastically reducing miner profits. In response, BTC mining firms aim to aggressively expand operations prior to the event.

Amid this backdrop, a groundbreaking new decentralized platform called Bitcoin Minetrix is attracting enormous investor attention and capital as miners scramble to boost production.

Decentralized Bitcoin Cloud Mining

Unfortunately, cloud mining has a infamous reputation for fraud, with countless victims paying money for contracts that deliver nothing. Bitcoin Minetrix differs because everything occurs transparently on-chain through a unique smart contract that allocates mining credits.

As a tokenized cloud mining ecosystem built on Ethereum, Bitcoin Minetrix (BTCMTX) emphasizes efficiency, security, and ease-of-use. Users can seamlessly acquire and stake BTCMTX with wallets like MetaMask to earn Bitcoin mining rewards.

This platform democratizes mining for the average individual. By staking BTCMTX, anyone can earn credits to mine Bitcoin without expensive hardware or technical know-how. This enhances accessibility and provides a reliable alternative to problematic cloud mining schemes.

Advantages of Bitcoin Minetrix

The project touts numerous benefits, including:

- Low startup costs

- Secure, user-friendly interface

- Straightforward onboarding process

- Transparent on-chain credit allocation

To begin, users simply purchase BTCMTX, opt for “buy-and-stake”, and start earning BTC rewards.

Roadmap and Future Developments

Moving forward after the presale, Bitcoin Minetrix plans include exchange listings, marketing campaigns, and building mobile/desktop apps as they expand the team. Ongoing partnerships with mining farms also signal strong growth potential.

In later stages, the project will launch staking dashboards, facilitate Bitcoin withdrawals to users’ wallets, and eventually allow exchanging mining credits for hashing power. Future priorities revolve around marketing and strategic expansions like cloud mining rentals.

Presale Success and Token Price

Big News Alert! 📣#BitcoinMinetrix has passed the $8,000,000 raise milestone! pic.twitter.com/MNdhQOYzfJ

— Bitcoinminetrix (@bitcoinminetrix) January 10, 2024

During its presale, Bitcoin Minetrix achieved key milestones. BTCMTX currently trades at $0.0128 after raising over $8.2 million.

As miners flock to capitalize on high pre-halving profits, Bitcoin Minetrix offers an accessible and secure solution for participating in Bitcoin’s mining ecosystem.

Disclaimer: CaptainAltcoin does not endorse investing in any project mentioned in this article. Exercise caution and do thorough research before investing your money. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the reader. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.