The large withdrawal of over 400,000 SOL tokens worth $28 million from Binance by a whale about a month ago, followed by the recent deposit back into Binance of 300,000 SOL worth $32 million, signals that this whale may be taking profits on their SOL holdings reports LookOnChain.

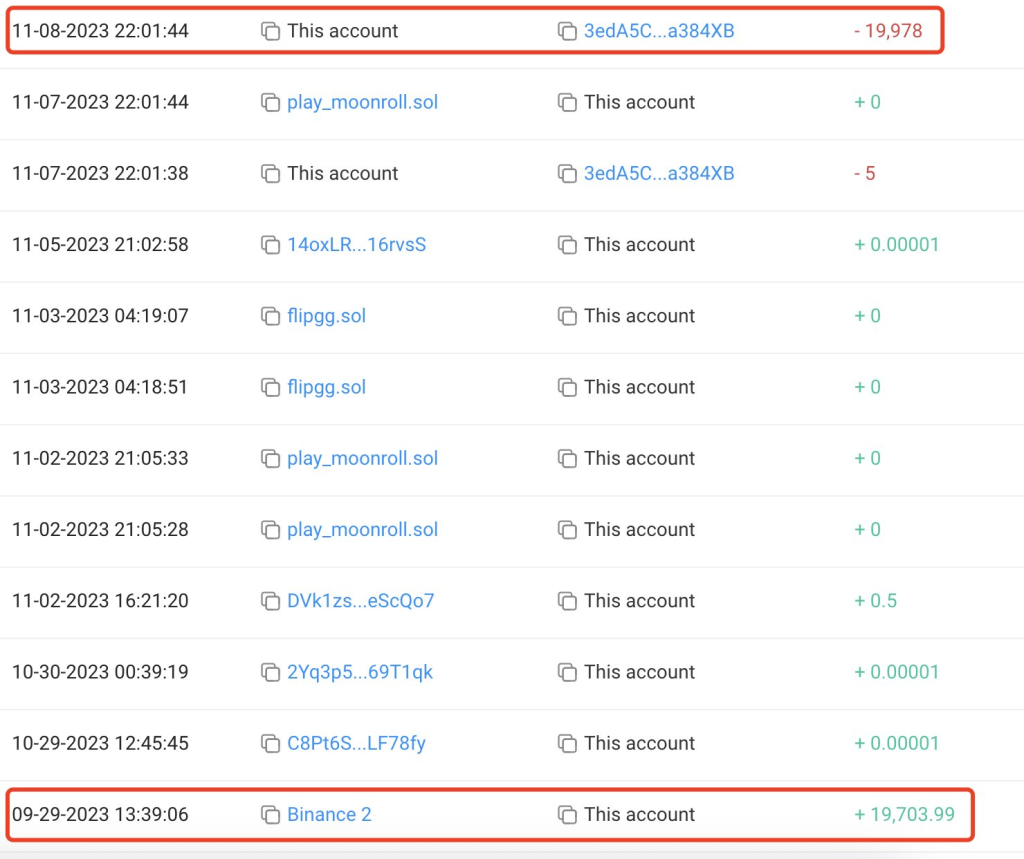

The whale likely purchased the SOL for around $66 back in November when prices were lower. By withdrawing now and depositing at the current price of around $100, this whale may have netted a 50% profit of around $17 million as LookOnChain estimates.

In addition, this whale has another 120,000 SOL worth over $12 million still earning staking rewards, so they have a sizable ongoing exposure to SOL. The new deposit back to Binance means they likely sold at least a portion of their recent withdrawal for a tidy profit.

Big whale deposit activity like this on exchanges is often interpreted as a potential sign of an impending sell-off. If this whale begins dumping their entire SOL holdings, it can put significant downward pressure on the SOL price.

This seems to be playing out already, with SOL down 10% today to under $100. The token did hit new all-time highs recently over $120, so some profit-taking after a strong run up is expected. However, if other major holders join this whale in taking profits, SOL could have further to fall.

The whale likely still believes in the long-term value of the Solana blockchain, as they are still staking a significant amount of SOL. But in the short-term, this activity suggests they are taking advantage of SOL’s price volatility to lock in profits when prices spike upwards. This can signal caution is warranted at current prices despite Solana’s strong growth.

You may also be interested in:

- Analyst Links Ripple’s Current Consolidation to 2017 Bull Run Setup: Is a 600x XRP Surge Inevitable?

- VCs Bet Over $360 Million on Top Projects in Q4 as Crypto Investments Show Signs of Recovery

- Here Are Potentially The Two Biggest Gainers of 2024 – Meme Kombat (MK) and Bitcoin Minetrix (BTCMTX)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.