Solana’s price has seen a solid bounce over the past couple days, recovering the key support level of $61. According to prominent crypto analyst Cryptonary, “SOL has had really positive price action in the past few days, having been able to reclaim $61, which is a really key level and invalidates the bearish setup.”

However, Cryptonary cautions that Solana may be due for a pullback in the short-term. As he notes, “The mechanics, however, are getting overheated again, with Longs becoming overweight. We may see a move lower for price in the very short term to flush out the excess Longs that are currently building up.”

Update: As of writing, Solana has broken above the $65 resistance level Cryptonary highlighted, currently trading around $71. So this level has been successfully overcome in the meantime.

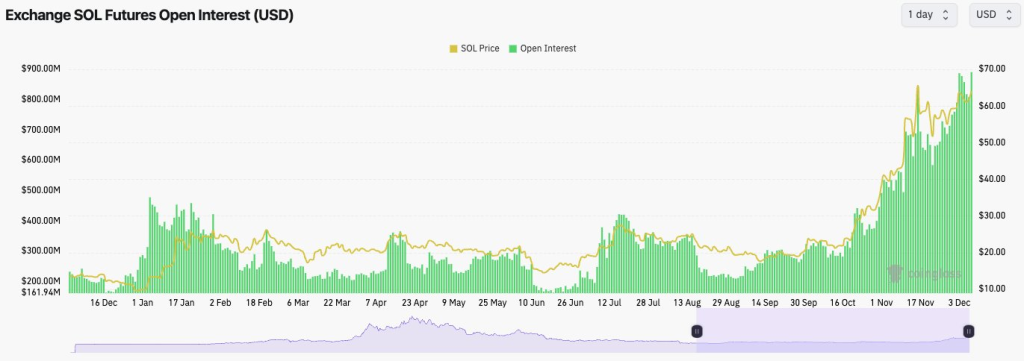

Specifically, Cryptonary points to rising open interest and aggressive increases in funding rates: “Open Interest is now back to new highs. The OI-Weighted Funding Rate did reset yesterday, but as price has moved higher today, Funding has aggressively ramped up. Longs are beginning to look overweight here, and increasingly so if this continues.”

The key technical levels Cryptonary is watching are the recent swing low around $61 as support, and resistance around $65: “What we then need to see is $61 hold as support. We’re not looking for any short-term trades unless Funding continues to increase and the price moves to $66. Then, we may look to take the other side and go Short.”

If Solana can break above $65 decisively, Cryptonary sees room for a move back up to test $69. However, he cautions that “if this level ($61) is broken, we could see a more meaningful decline.”

In terms of new positions, Cryptonary is not looking for short-term trades here, but rather waiting for a deeper pullback to add through dollar-cost averaging: “We will look to DCA on a pullback to $52. Sub $48, we’ll DCA more aggressively.”

Read also:

- Chainlink Could Finally Rebound from Here as 17K Addresses Buy 47 Million LINK at Crucial Support

- Whales Panic, Dump Over $3.5 Million ORDI Following Vulnerability Announcement in the Incoming Bitcoin Core Upgrade

- Overlooked Bitcoin (BTC) and Cardano (ADA)? Explore This Top Crypto Opportunity in 2023

So in summary, Solana is showing technical signs of strength in the recent bounce, but increasing leverage and the potential for long liquidations means a pullback may still be in the cards before we see the next leg higher. Traders should keep an eye on $61 as key support to hold, or else more downside could unfold for SOL.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.