Litecoin suffered a major holder exodus in early 2023, with on-chain analytics firm Santiment reporting that 199,000 LTC wallets have dumped their holdings already this year. The rapid 10-day plunge marks 2023’s most severe drop so far after a difficult latter half of 2022.

What you'll learn 👉

Consolidation Precedes Steep Decline

In the days leading up to the wallet dump, Litecoin traded rangebound between roughly $69 and $75. Though far below its all-time high above $400 from 2021’s blow-off top, LTC had at least stabilized after declining momentum in previous months.

Its rangebound action showed balance on the charts, with buyers defending support around $69 and sellers pressuring resistance at $75. However, this fleeting equilibrium rapidly deteriorated.

199K Holders Bail in 10 Days

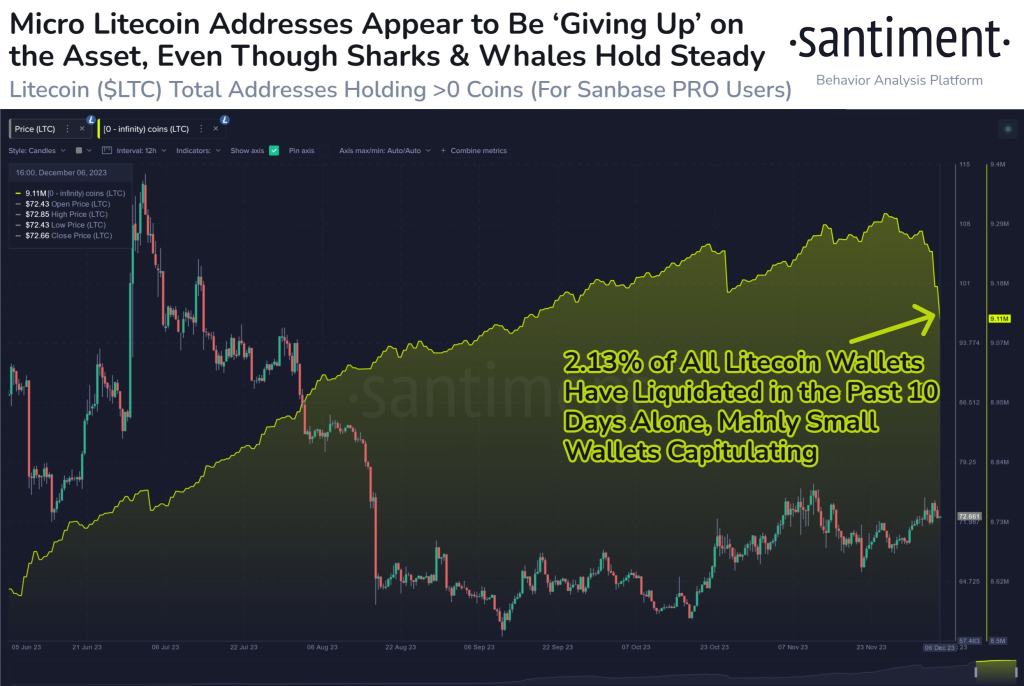

Per Santiment, the number of LTC holders shedding their positions exploded in the past few days 2023. Approximately 199,000 wallets that held tokens merely 10 days ago had sold off everything by the time Santiment published its analysis.

Source: Santiment – Start using it today

The massive holder exodus marks 2023’s steepest drop already, outpacing the increased FUD and selling pressure seen since October 2022 when broader macro conditions began deteriorating significantly.

Oversold Conditions Could Spark LTC Reversal

However, Santiment suggests that extreme fear and holder capitulation often markchet bottoms for cryptoassets like LTC. And with so many investors panicking and running for the exits, buyer exhaustion may soon pave the way for an influx of dip-buyers.

Read also:

- Bitcoin (BTC) Skyrocketed The Last Three Times This Bullish Signal Appeared

- Solana Loses Uptrend; Analyst Warns Failure to Hold Support Could Result in SOL Falling to This Price

- End-of-Year Crypto Boom: Mantle, Filecoin, and Rebel Satoshi Poised for Growth

Especially given Litecoin’s substantial 55% decline against Bitcoin over the past five months alone, opportunistic traders likely have their eyes on LTC for mean reversion plays. Now having washed out nearly 200,000 holders already in 2023, the major tailrisk event and selling mania may already be priced in at this point.

So if holders remain resilient going forward and dip-demand returns to scoop up discounted LTC, bearish momentum could soon shift.CopyRetry

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.