In their recent Twitter thread, Cryptonary dove into a more in-depth technical analysis of SOL and its price action over the past day. Let’s break down some of their key insights in more detail.

On the 12-hour chart, Cryptonary noted SOL had managed to break above the prior $61 resistance level but faced rejection around $66 resistance. With price now hovering right at $61, this level becomes a convergence point withsupport also provided by an uptrend line.

Should SOL lose the $61 level, especially combined with a break below the uptrend line, Cryptonary sees a pullback as likely toward the major support at $56. Further down, $51 would be the next key levelto watch on further weakness.

When analyzing the RSI, Cryptonary highlighted it remains in overbought territory on all timeframes except the daily and weekly, both of which have been majorly overextended in bullish momentum. The slight decline from $66 has helped to reset the most extreme overheating seen overnight.

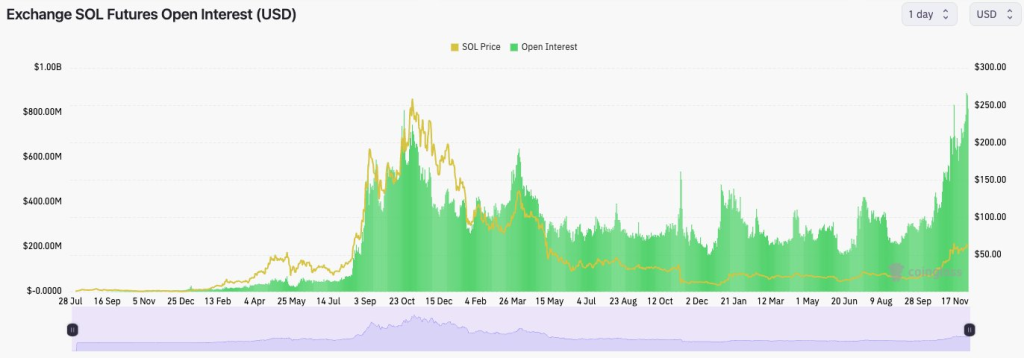

Open interest on SOL futures reached a new all-time high of $993 million, indicating growing institutional interest driving volume. However, funding rates had become massively skewed in favor of long positions, noted Cryptonary.

Since this morning, the funding rate has come down substantially from over 0.08% to around 0.026% as more traders piled into shorts over the last 8 hours. The long/short ratio reflecting this change supports Cryptonary’s view that late shorts drove the pullback.

Should the $61 level fail to hold in the near-term, Cryptonary would see this as an opportunity. They plan to steadily accumulate SOL from $52 to average into their spot holdings. Even lighter buying is eyed around the next support at $56 if retested.

Overall, while monitoring price action very closely, Cryptonary maintains a long-term bull thesis on SOL. Pullbacks are viewed as chances to cost-average into a favorable longer-term outlook.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.