In a recent tweet, Stacy Muur shared a step-by-step guide on how to find low-cap coins with the potential for significant returns. Let’s dive into the details of each step and understand how to navigate the world of cryptocurrency investments.

Step 1: Utilize DeFiLlama to Create a Shortlist

Stacy recommends using DeFiLlama as the first step in the process. DeFiLlama allows users to create a shortlist of tokens that fall below a specific market cap threshold and pre-analyze their core fundamentals. This analysis includes factors such as category, total value locked (TVL), revenue and fees, trading volume, and price-to-sales (P/S) ratio. By considering these fundamental metrics, investors can gain insights into the potential of these low-cap coins.

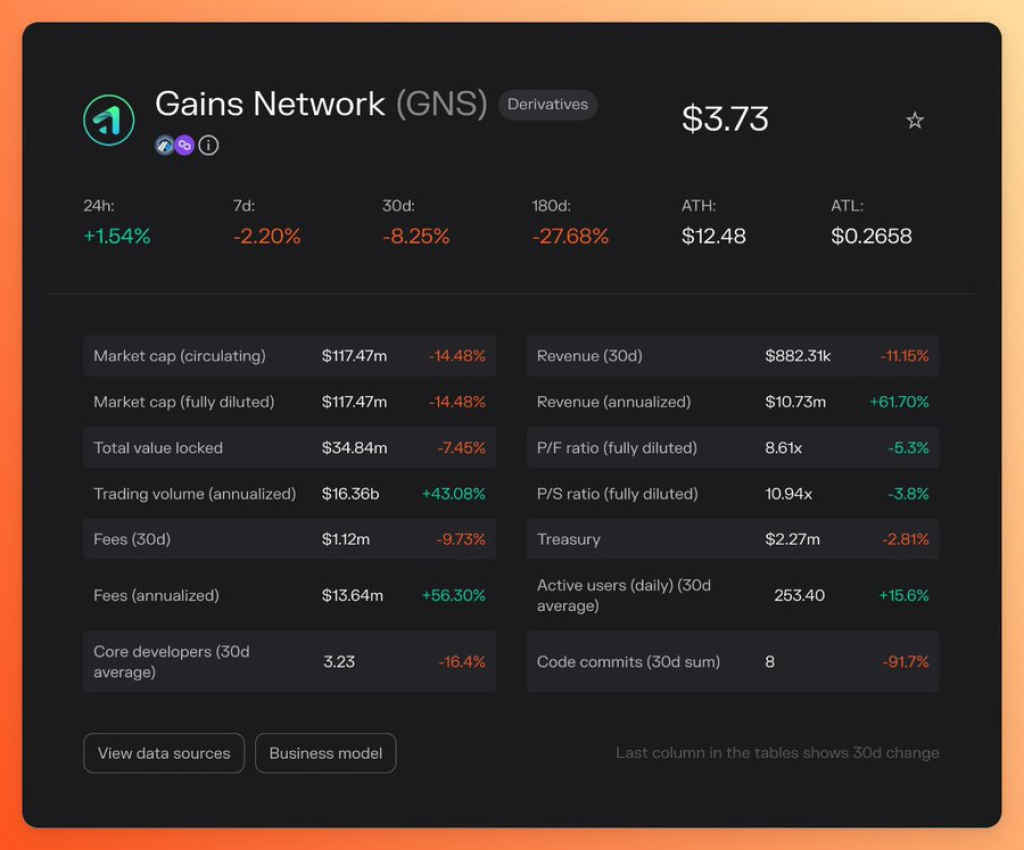

Step 2: Conduct In-Depth Fundamentals Research

Token Terminal is Stacy’s go-to destination for more in-depth fundamentals research. However, she notes that for lower-cap assets, Token Terminal data might be limited. In such cases, it’s worth checking DuneAnalytics dashboards or native protocol analytics to gather additional information. This comprehensive research will provide a deeper understanding of the protocols under consideration.

Step 3: Perform Competitive Analysis

Once a shortlist of protocols has been created, Stacy suggests grouping them by narratives and comparing their fundamentals to determine the leaders in each category. She emphasizes the importance of comparing a protocol against the industry leaders, especially in well-established categories like Derivatives or Lending. By doing so, investors can establish a benchmark for the sector and evaluate the relative market cap of their target protocol.

Step 4: Conduct In-Depth Analysis of Growth Potential

For many protocols, a customized approach is necessary to assess their growth potential. Investors should analyze the unique selling proposition, roadmap, and upcoming releases of the protocols. This analysis will help gauge whether more hype is building around the protocol, potentially indicating future growth.

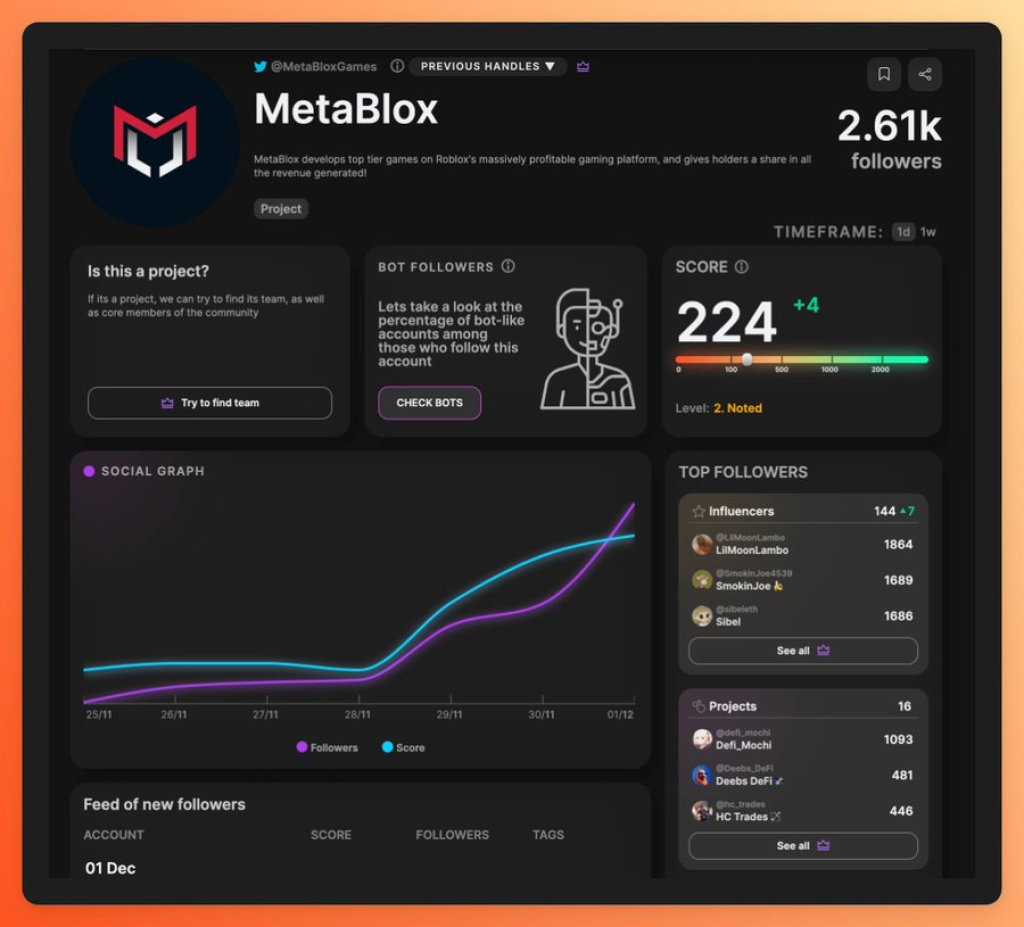

Step 5: Analyze Social Hype

To understand the trend in social interest formation, it is essential to analyze the performance of competitors in the social feed. Stacy recommends using tools like TweetScout.io to monitor the social hype surrounding specific brands. Paying attention to influencers and venture capitalists who are following a particular project can provide valuable insights into its potential.

Step 6: Find a Good Entry Point

The final step involves finding a good entry point to avoid buying at the top. Basic technical analysis can be utilized for this purpose. Stacy personally uses dexscreener for chart analysis and maintains watchlists for future entries. However, any other chart analysis tool can be utilized to identify favorable entry points.

Read also:

- Chainlink Whales Accumulate for a Rally as LINK Turns Bearish Across All Timeframes: Here’s the Next Price Target

- Solana Analyst Remains Bullish Despite Concerning On-Chain Metrics, as SOL Bears Aim to Breakdown This Crucial Resistance

- Why Is Alchemix (ALCX) Pumping? Analysts Confirm Price Still Has up to +100% Room to Run

In conclusion, Stacy Muur’s step-by-step guide provides a framework for finding low-cap coins with the potential for significant returns. By diligently analyzing the fundamental and growth potential of protocols, evaluating social hype, and identifying favorable entry points, investors can make more informed decisions. As Stacy herself states, “Analyzing the protocols within this framework is both fast and efficient. It covers the basics of making sound investment decisions.”

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.