The price of Bitcoin is starting to show the first signs of weakness after dipping beneath the $37,000 level this week.

The cryptocurrency has been on an epic bullish streak since mid-October, but the latest rejection above $38,000 might suggest a retracement is imminent.

With Bitcoin looking fragile in the short term, traders are turning their attention to an alternative project that provides direct exposure to the Bitcoin ETF approval event.

Bitcoin ETF ($BTCETF) allows traders to ready their wallets and get positioned to profit from Bitcoin’s most anticipated event in history, and traders see it as a better alternative for ETF approval exposure.

What you'll learn 👉

Bitcoin Starts Week in Red After Dipping Below $37,000

Bitcoin has started the week in the read after dipping below the $37,000 support level numerous times over the past 24 hours.

The cryptocurrency still looks very strong as it trades above an ascending trend line but shows signs of weakness as it struggles to break resistance at $38,000.

In addition, the weakness is compounded by the RSI showing bearish divergence, which is usually a sign that an imminent reversal is coming.

Looking ahead, if Bitcoin closes beneath the $37,000 level, the first level of support lies at the rising trend line – currently around $36,000.

This is followed by support at $35,200, $35,000, $33,520, and $32,950 (Jan 2022 lows).

If the bears continue to drag $BTC beneath $32,000, added support lies at $31,650, $31,000, and $30,000.

On the other side, the first strong resistance lies at $38,000. This is followed by resistance at $39,490 (early-June highs), $40,000, $40,600 (1.414 Fib Extension), $42,000 (Jan 2021 highs), and $42,885 (1.618 Fib Extension).

Why Are Traders Backing This Alternative to Bitcoin?

As Bitcoin shows signs of imminent weakness, traders are starting to turn their attention to a newly emerging alternative that provides direct exposure to the Bitcoin ETF approval.

Bitcoin ETF ($BTCETF) continues to gain popularity as traders are starting to see it as an alternative vehicle to profit from the SEC approval of the first Bitcoin spot ETF in US Markets.

With the project’s token supply linked to real-world milestones, traders expect 10x returns by the time the ETF is approved – currently expected by January 10th, according to Bloomberg analysts.

Bitcoin ETF Token Provides Direct Exposure to SEC Approval

Bitcoin ETF ($BTCETF) has raised a staggering $1.9 million in just three weeks, demonstrating the building momentum behind the project.

Bitcoin ETF is a DeFi project that provides direct exposure to the Bitcoin ETF approval from the SEC, allowing investors to profit from the major milestone in Bitcoin’s history.

The project incorporates an intuitive burning mechanism linked to real-world milestones related to the SEC approval.

As a result, the $BTCETF token gets more scarce the closer the ETF is to being approved.

With the SEC expected to approve the Bitcoin ETF by January 10th, it’s clear that investors are backing this project as a strong alternative to gain exposure to the event.

Real-World Milestones Linked to Token Surges

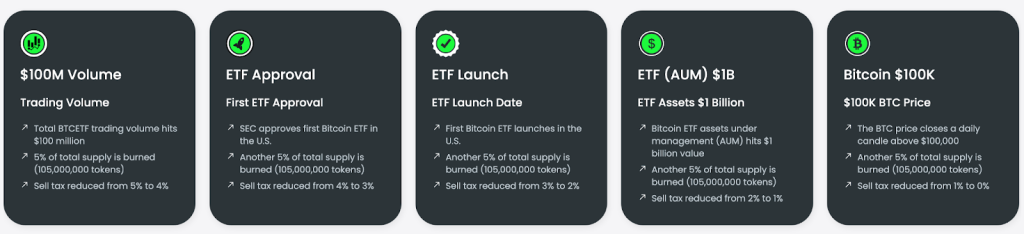

Bitcoin ETF integrates five real-world milestones that create deflationary pressure on the token when reached.

The predetermined milestones include the following;

- 24-hour trading volume in $BTCETF reaches $100 million

- SEC approves the first Bitcoin ETF in the US

- First Bitcoin ETF launches in the US

- Assets under management in Bitcoin ETFs reach $1 billion

- Bitcoin price closes a daily candlestick above $100,000

When each milestone is reached, the smart contract will burn 5% of the supply – resulting in a 25% deflation when all five milestones are achieved.

As a result, investors are expecting huge price pumps as each milestone is reached, creating 10x potential.

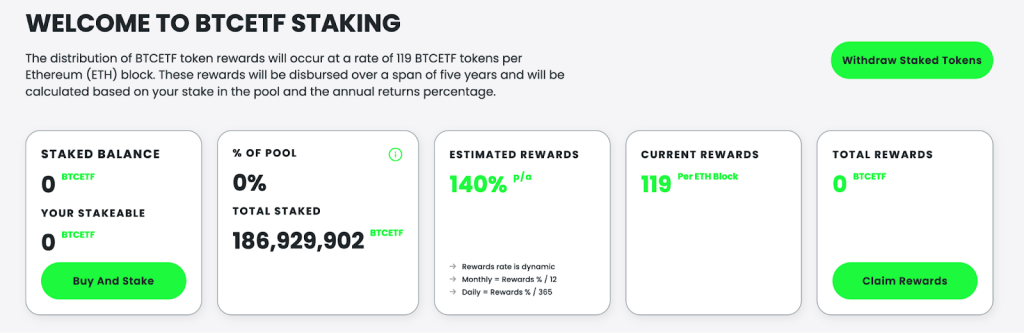

Furthermore, there’s also a sales tax and a staking mechanism to incentivize long-term holding of the token.

Starting at 5%, the sales tax will be reduced by 1% as each milestone is reached.

The staking mechanism provides an impressive 133% APY for stakers.

These mechanisms are expected to help $BTCETF see significant gains for early adopters.

Furthermore, the entire circulating supply will be in the hands of the community, with 40% sold in the presale, 25% set aside for burning, 25% for community rewards, and 10% for exchange liquidity.

Interested investors can currently purchase $BTCETF for $0.006. However, there’s a rising pricing strategy that means the cost of the token will increase during subsequent phases.

Overall, with the Bitcoin ETF narrative driving markets, Bitcoin ETF is set for considerably upward momentum in the coming weeks.

Visit Bitcoin ETF Presale Today

Disclaimer: CaptainAltcoin does not endorse investing in any project mentioned in this article. Exercise caution and do thorough research before investing your money. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the reader. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.