Bitcoin trading can be a volatile and unpredictable endeavor, with the potential for significant gains and losses. However, there are strategies and tools that can help traders avoid getting “rekt” (a term used in the crypto community to describe significant losses). In a recent tweet, Philip Swift, a prominent figure in the crypto space, shared some valuable insights on how to navigate the world of Bitcoin trading. Let’s explore his recommendations in detail.

What you'll learn 👉

Tracking Internal and External Data

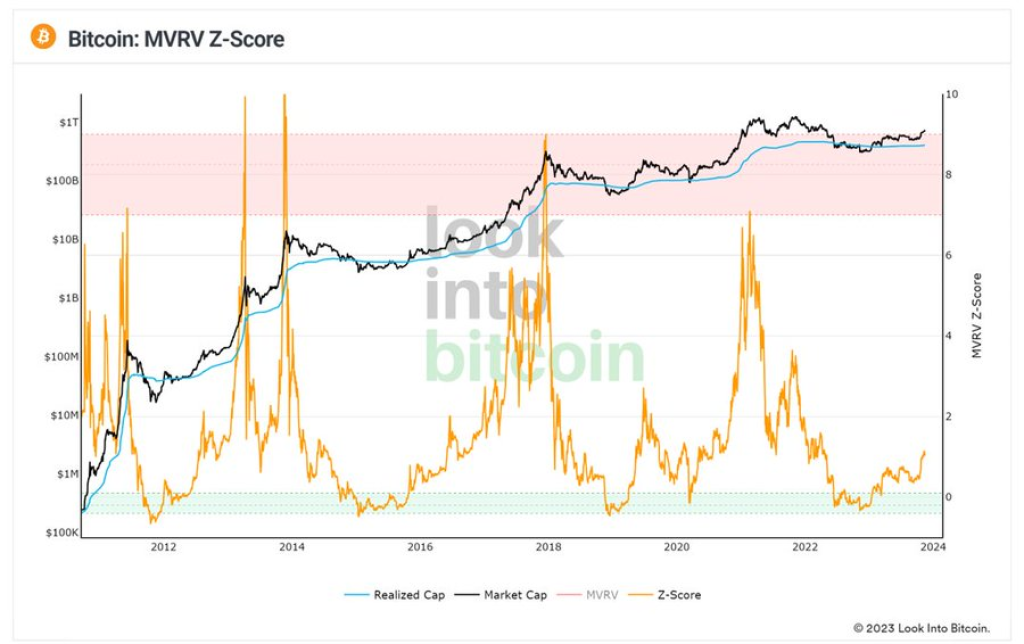

One of the first steps in avoiding losses while trading Bitcoin is to track both internal and external data. Internal data refers to on-chain metrics, which provide insights into the activity happening on the Bitcoin blockchain. This includes metrics such as transaction volume, network congestion, and the number of active addresses. By monitoring these metrics, traders can gain a better understanding of the overall health and sentiment of the network.

On the other hand, external data refers to global macroeconomic factors that can impact the price of Bitcoin. This includes news events, government regulations, and market sentiment. By staying informed about these external factors, traders can make more informed decisions and anticipate potential market movements.

Managing Emotions and Utilizing Portfolio Tools

Emotional decision-making is a common pitfall in trading, and it can lead to impulsive and irrational actions. To avoid falling victim to emotional trading, it is crucial to have a disciplined approach and utilize portfolio tools. These tools can help traders set clear investment goals, diversify their portfolios, and implement risk management strategies.

Additionally, subscribing to trustworthy newsletters and following reliable sources of information can provide traders with valuable insights and analysis. By staying informed about market trends and expert opinions, traders can make more rational and calculated decisions.

Being Prepared at Key Moments

Timing is crucial in Bitcoin trading, and being prepared at key moments can make a significant difference. Swift suggests setting up alerts to be notified of important market developments, such as price movements, major news events, or significant shifts in on-chain metrics. This allows traders to react quickly and make informed decisions based on real-time information.

In the fast-paced world of Bitcoin trading, being proactive and prepared can help traders avoid potential losses and capitalize on profitable opportunities.

As Philip Swift aptly summarizes, “Anyone can avoid getting rekt by getting clarity about Bitcoin.” By tracking internal and external data, managing emotions through portfolio tools, and being prepared at key moments, traders can navigate the Bitcoin market with more confidence and reduce the risk of significant losses.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.