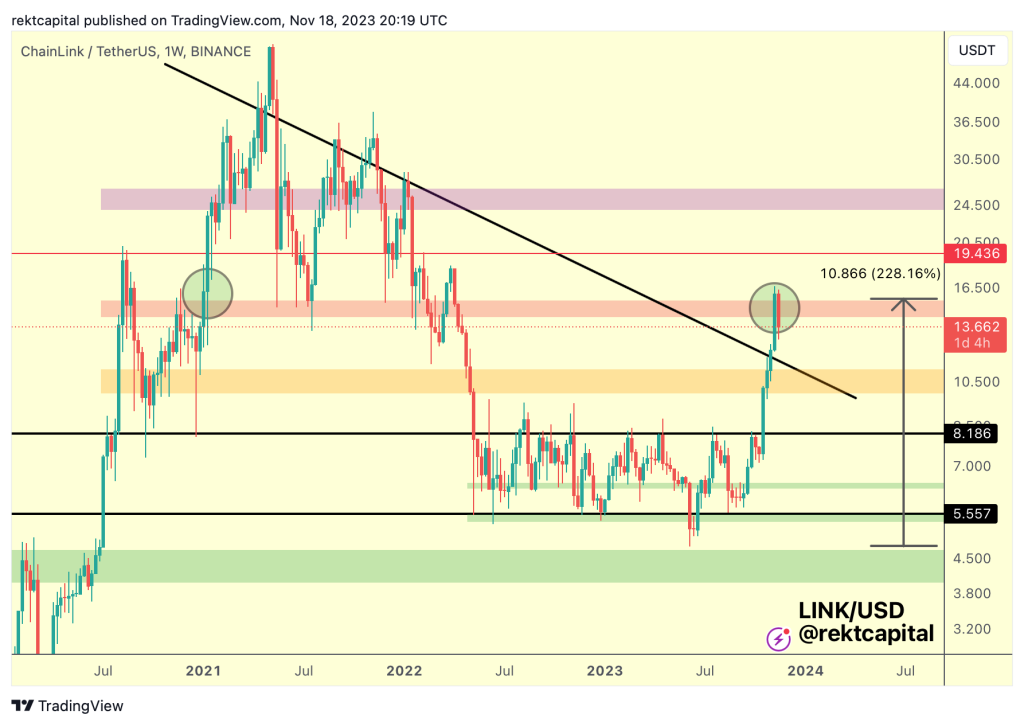

Chainlink’s LINK token has seen a bounce back over the last few days, trading above the $14 mark after finding support around $13. However, LINK faces some key resistance levels that could limit further gains in the short-term.

According to popular crypto analyst Rekt Capital, LINK is currently failing to retest weekly close above a key red resistance region. If unable to close above this level, Rekt Capital notes that the zone could turn into strong resistance and force LINK to retest downtrend support.

On the daily chart, RSI readings are elevated around 67 which suggests LINK is getting overbought in the short-term. Some pullback from current levels is likely needed before LINK can make a renewed push higher.

Analytics firm altFINS remains bullish on LINK’s long-term prospects, noting its position as a leading oracle data provider should allow it to benefit from growing demand for real-world asset tokenization. However, altFINS points out that the strong rally from under $11 to over $14 in early November has left LINK very overbought.

Profit-taking led to a pullback which altFINS views as a potential swing entry opportunity within the uptrend. Key upside targets are seen at $18 and then psychological resistance around $19.50.

In summary, while Chainlink’s fundamentals remain strong, the technical picture suggests some consolidation or minor downside is likely in the coming days and weeks. Key support to watch is around the $13 level, while resistance is seen around $14.50 and $15. Patient traders may look to buy any dips as LINK builds a base before its next leg higher.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.