The current mini bull market is mostly fueled by one thing: Bitcoin ETF anticipation, according to crypto analyst Stacy Muur. Once approved, a Bitcoin ETF has the potential to inject billions into the Web3 market capitalization.

What you'll learn 👉

Comparing Bitcoin ETFs to Gold

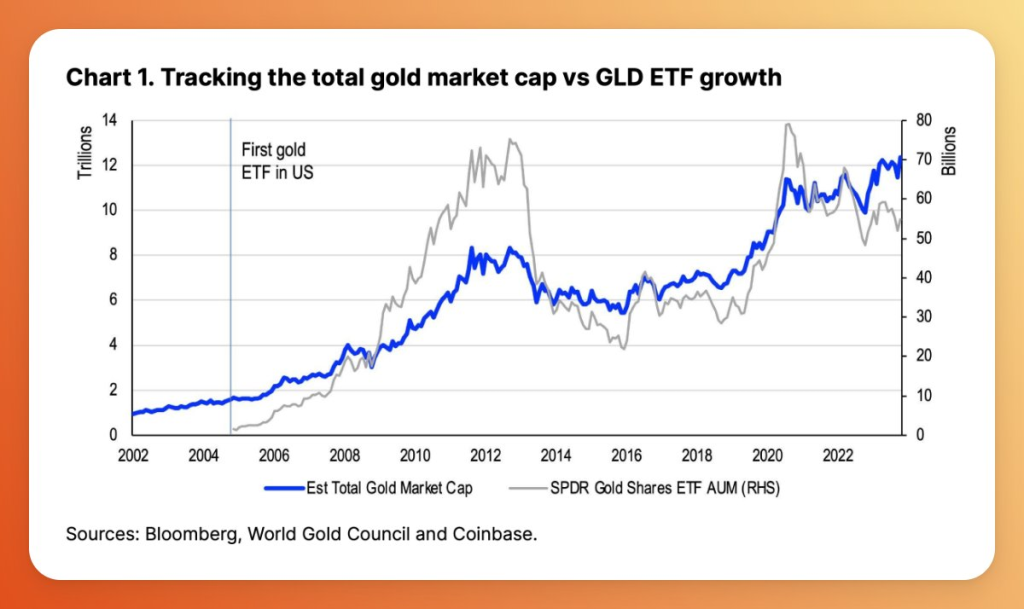

Some people compare the adoption of Bitcoin ETFs to Gold ETFs, explains Stacy Muur. The SPDR Gold Shares ETF GLD launched in October 2004, making it easier for US clients to access and store physical gold. The case for Bitcoin is strikingly similar.

Stacy Muur says Bitcoin ETFs bring crypto into the financial mainstream by offering easy access to crypto for both individual and institutional investors, eliminating the need to buy or hold digital assets directly, same as with Gold ETFs. However, Bitcoin ETFs outshine gold for a few key reasons: Bitcoin’s supply is fixed, making it less elastic; and it’s backed by cutting-edge technology. These factors mean that BTC can have a distinct role in portfolios with its unique protection from systematic risk.

Moreover, it is worth considering that monetary policy in numerous G10 countries currently faces a heightened risk of being influenced by fiscal dominance, adds Stacy Muur. This situation could potentially lead to an increase in global M2 money supply, bolstering the performance of BTC.

Importance for Market Growth

While mainstream access to Bitcoin is already widespread, Stacy Muur says the role of ETFs in expanding this access cannot be understated. Many large asset managers rely on ETFs for building investment strategies, making Bitcoin ETFs crucial for the broader investment community. This is especially relevant in the U.S., where a significant portion of wealth is managed by institutions that may not directly buy and custody Bitcoin. In short, ETFs are super important for the crypto market to grow and flourish according to Stacy Muur.

Read also:

- The Most Accurate Price Band for Bitcoin Shows BTC’s Bull Surge Isn’t Over, Reveals Target Price

- Biggest Meme Coins, Dogecoin and Shiba Inu, Gear Up for Massive Bullish Rallies, but There’s a Catch

- Breaking: Investors Shift from TRON to Emerging Crypto Star for Promising Returns

Stacy Muur says that according to Coinbase, chances have sharply improved that one or more spot bitcoin ETFs may be approved by the SEC before the end of 4Q23. Over the past few weeks, several applicants have been revising their prospectuses with updated language, indicating a significant level of communication between these teams and the SEC. While this practice is common for applications in other asset classes, it marks a groundbreaking occurrence for the crypto industry

As Astarion from BG3 says, “Let’s hope for Bitcoin”. Hopium drives actions. Actions drive yields. Bullish!

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.