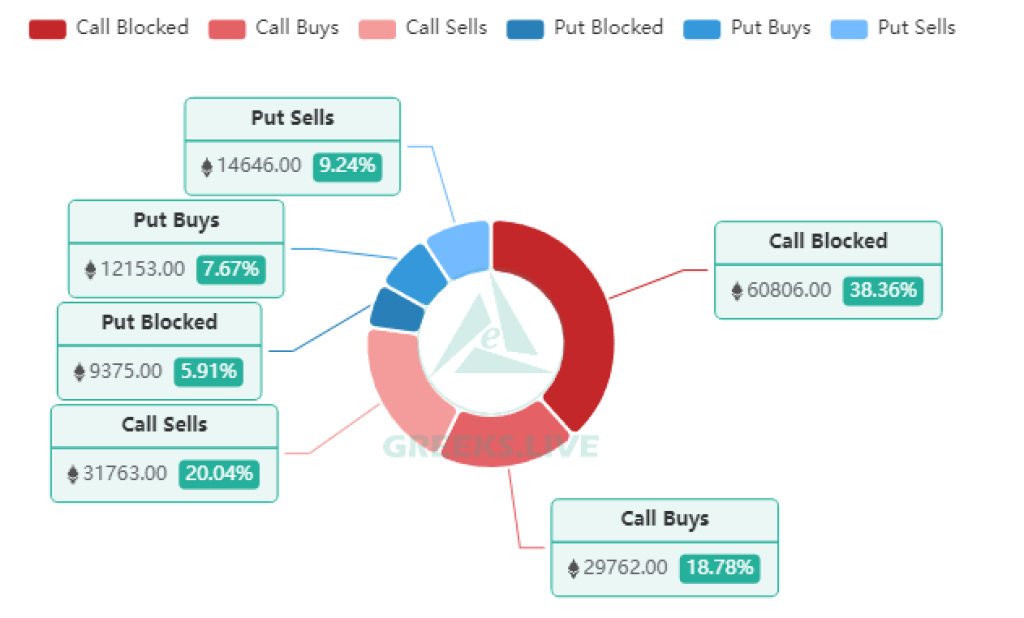

Ethereum saw an increase in block trade activity on Monday, according to a post by Greek.live. Block trades are large orders that are negotiated privately instead of on public exchanges.

On Monday, around 60,000 Ethereum options contracts were traded via block trades, accounting for 40% of the total options volume for the day. The notional value of these block trades was around $120 million.

Many of the block trades were for December call options, which give the holder the right to buy Ethereum at a set price in December. Several of the orders were large naked buys of in-the-money call options worth around $50 million each.

According to Greek.live, these large block trades likely represent whale investors closing out previous market maker positions. Earlier in the Ethereum bull market that started in October, some whales had taken large long positions and profited as the price rose.

The fact that these whales have not closed their long positions and are continuing to buy more call options signals they remain bullish on Ethereum. The December call buys allow them to capitalize if Ethereum’s price continues climbing into the end of the year.

This bullish options activity comes as Ethereum has weathered recent broader crypto market weakness fairly well. While Bitcoin and other major cryptocurrencies declined over the weekend and on Monday, Ether has held up decently. As of Monday, ETH was trading around $2,100, up approximately 2% in the last 24 hours.

So in summary, the increase in block trade options volume, especially for call buys, indicates large Ethereum investors continue to be optimistic about more upside for ETH in the near-term. The bullish trading activity aligns with Ethereum’s relative strength compared to the broader crypto market lately.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.