Cryptocurrency analyst Michaël van de Poppe believes that Bitcoin and altcoins are entering their first bull cycle since the crypto winter of 2022.

In today’s X (Twitter) thread, Poppe laid out his thesis that Bitcoin has completed its one-year accumulation period following the crash from the all-time high of $69,000 in November 2021. He notes that Bitcoin bottomed around $15,000 in November 2022, almost exactly one year after hitting its peak.

During Bitcoin’s accumulation, altcoins suffered heavy losses. But now Poppe believes it’s time for them to shine.

“The markets tend to behave in cycles, just like every market does,” Poppe explained. “In this aspect, Bitcoin moves in a one-year bear market modus.”

He divides the crypto market cycles into four phases – bear market, accumulation, bull market, and mania. According to his analysis, Bitcoin has completed the one-year accumulation phase and is now entering its bull run. Meanwhile, altcoins are exiting their bear market and starting their own bull cycle.

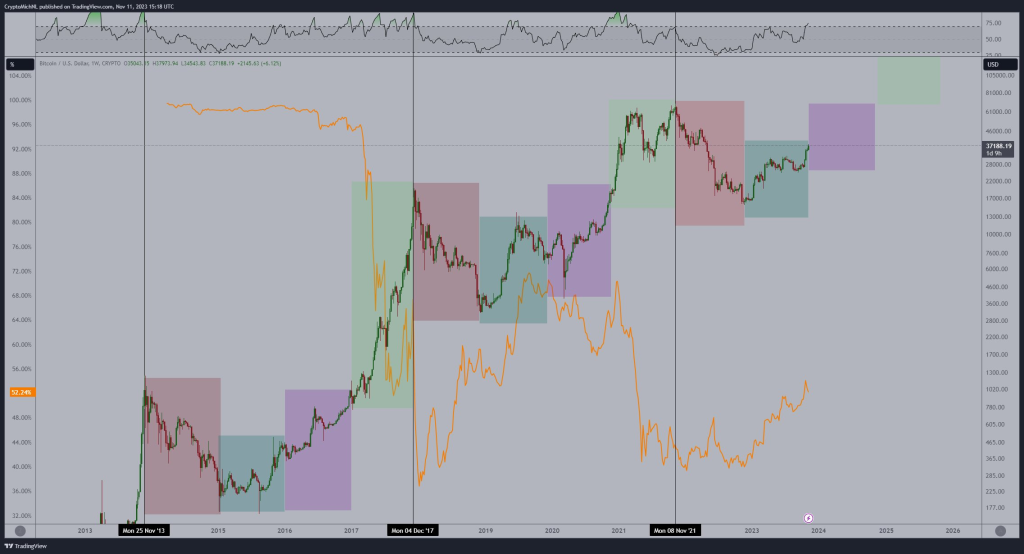

Poppe’s chart shows the crypto market cycles in colored boxes:

- Red box: 1 year bear market for Bitcoin

- Blue/Green box: 1 year accumulation period for Bitcoin, while altcoins are in a bear market

- Purple box: 1 year bull phase for both Bitcoin and altcoins

- Light Green box: 1 year mania phase for Bitcoin and altcoins

Poppe points to altcoins like Chainlink, Solana, and Injective Protocol which have seen massive gains recently as evidence the altcoin bull run is underway. He believes this means altcoin prices are unlikely to return to their lows from two months ago.

“It’s the start of the bull cycle and in that period it often provides: Massive and higher returns on altcoin positions as liquidity is thin and bear market bias sticks heavily,” Poppe wrote.

The analyst believes this new altcoin bull cycle could rival 2017 based on positive developments like the approval of a Bitcoin ETF and the upcoming Bitcoin halving in 2024. He expects Bitcoin dominance to drop as money flows into altcoins.

Poppe advises traders to take a more aggressive stance in this market environment but to be cautious chasing assets up 500-1000%. He suggests looking for cryptos that can provide upside while managing risk.

Playing the early stage of a bull run is essential for maximizing returns later in the cycle, according to Poppe. Now is the time to position for the major altcoin gains he expects over the coming years.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.