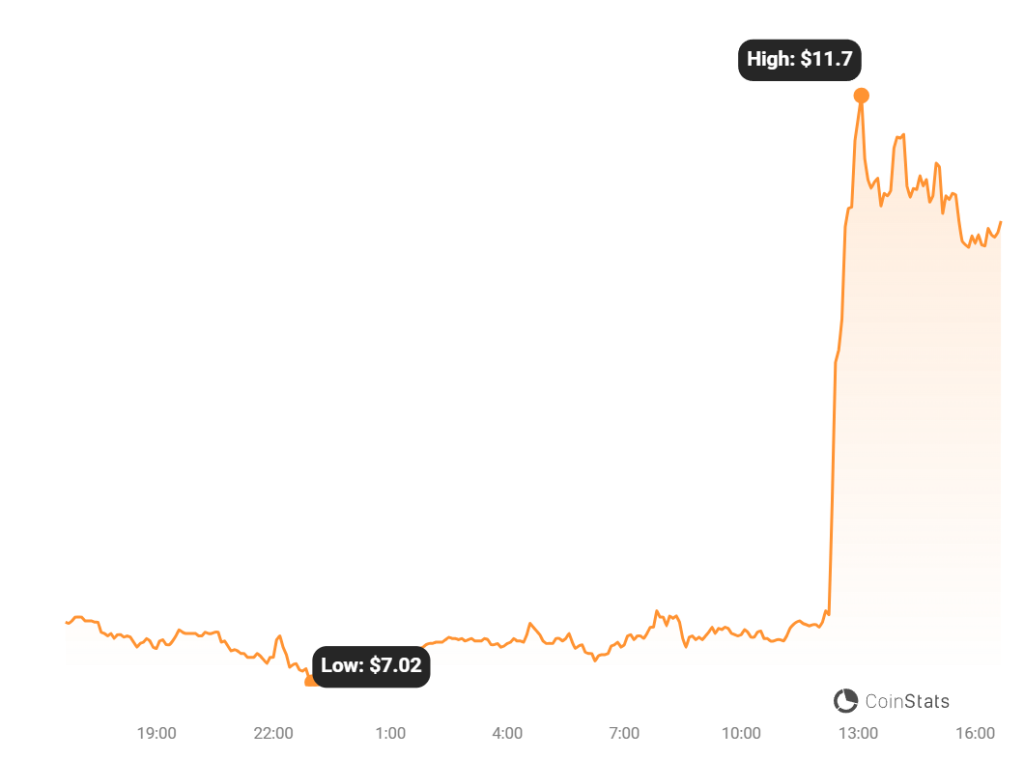

The price of ORDI, the native token for the Bitcoin Ordinals protocol, jumped 50% in the past 24 hours following its listing on major crypto exchange Binance. ORDI soared from around $7 on Monday to over $11.64 at its peak on Tuesday.

Binance announced the listing of ORDI under its “Innovation Zone,” which features emerging crypto assets. However, the exchange designated ORDI with its “Seed” tag, indicating an experimental project with higher risk and volatility.

Binance advised users to exercise caution when trading ORDI, given its new status and limited track record so far. The exchange will require passing mandatory quizzes every 90 days for continued ORDI trading access.

Source: CoinStats – Start using it today

Despite the warnings, ORDI saw immediate and intense interest, with trading volumes exceeding $153 million in the first 24 hours, drastically above previous norms.

The surge comes amidst controversy over the Ordinals protocol’s purpose and utility. Ordinals allow issuing tokens and NFTs directly on the Bitcoin blockchain by embedding small amounts of data into ordinary transactions.

Read also:

- Kaspa Price Flip and Mining Rewards Reduction Could Lead to Further Upside For KAS: Expert

- Is Chainlink’s Soaring Price to $12.50 Linked to a Record Number of Wallets Holding 1,000 LINK?

- Why You Should Invest in the eTukTuk ($TUK) Presale

The Binance listing represents a major victory for the fledgling Ordinals protocol regardless of the controversy. Gaining support from the largest cryptocurrency exchange offers legitimacy and exposure to drive further adoption.

But Binance’s warnings imply risk management will be imperative for ORDI traders given the unknowns surrounding the project’s scope. For now, the token’s volatile price action matches the divisive nature of its ambitious but unproven concept.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.