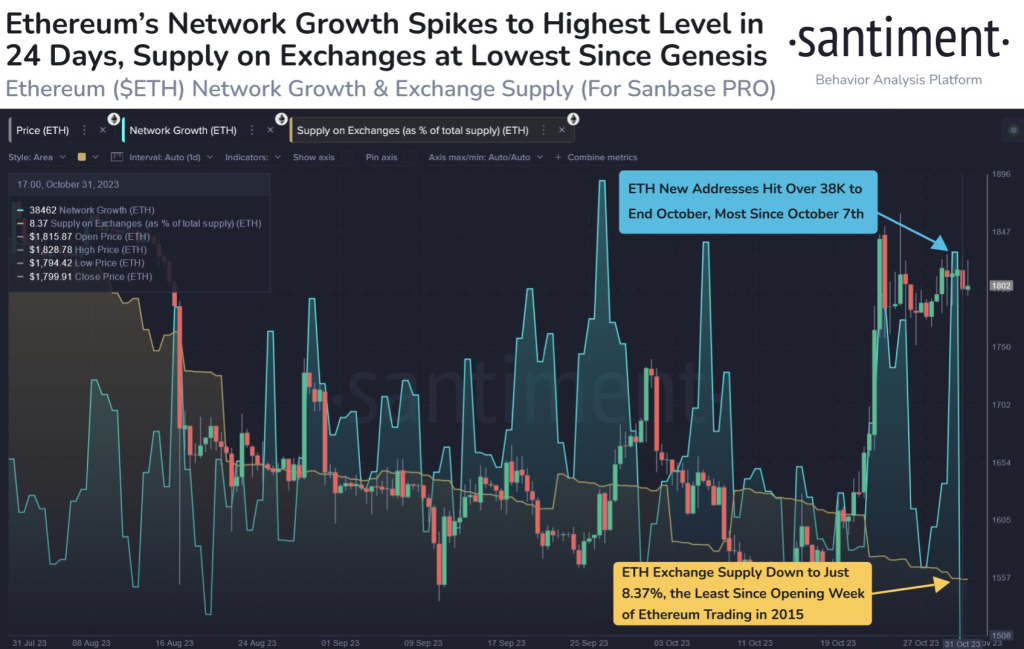

Ethereum’s price rose above $1,800 yesterday, November 1st, aided by the largest single-day increase in new Ethereum addresses created since October 7th, according to data from Santiment.

The creation of new addresses points to growing adoption and use of the Ethereum network.

However, Ethereum’s momentum now appears to be slowing based on technical indicators. The MACD histogram bars are declining, suggesting weakening upside momentum. While the MACD line remains above the signal line in bullish territory and the RSI is holding above 55, indicating positive momentum, these indicators may be peaking.

Ethereum’s price is currently trading below $1,800 again around $1780 as of this writing on November 2nd, facing resistance at the $1,800 level. If bullish network growth and declining exchange supplies continue, Ethereum could justify breaking above $2,000 once again. But the slowing momentum suggests Ethereum may struggle to substantially break out above $1,800 in the short-term.

Key Takeaways:

- Ethereum rose above $1,800 yesterday aided by largest increase in new addresses since October 7th

- Momentum is slowing based on declining MACD histogram bars

- ETH facing resistance currently below $1,800 after momentum peak

- Continued network growth and falling exchange supplies supportive of break above $2,000

- But slowing momentum suggests Ethereum may struggle to break $1,800 short-term

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.