An emerging on-chain trend highlights the outsized value captured by oracle network Chainlink (LINK) relative to valuations, according to analyst commentary.

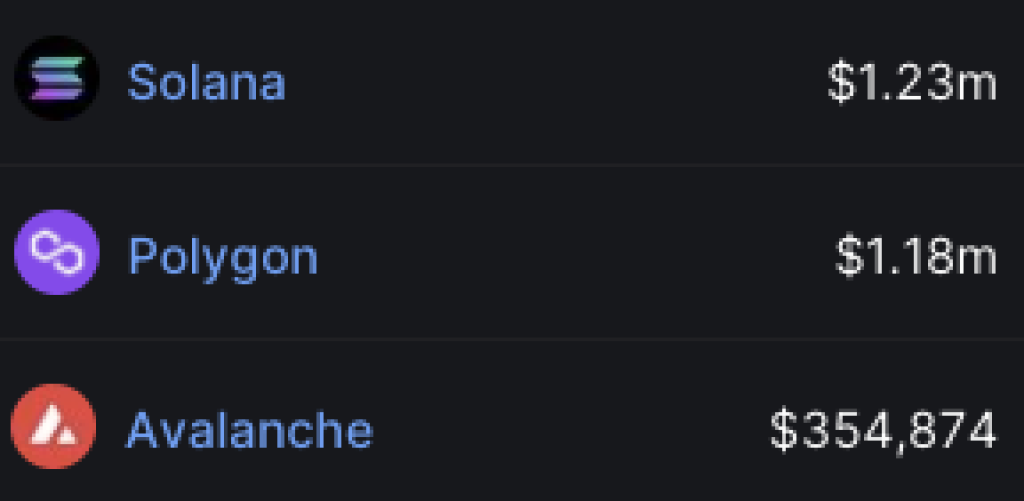

Over the past 30 days, Chainlink generated nearly as much total fee revenue as blockchains Solana, Polygon, and Avalanche combined, despite the latter platforms having a cumulative market cap over 4X larger.

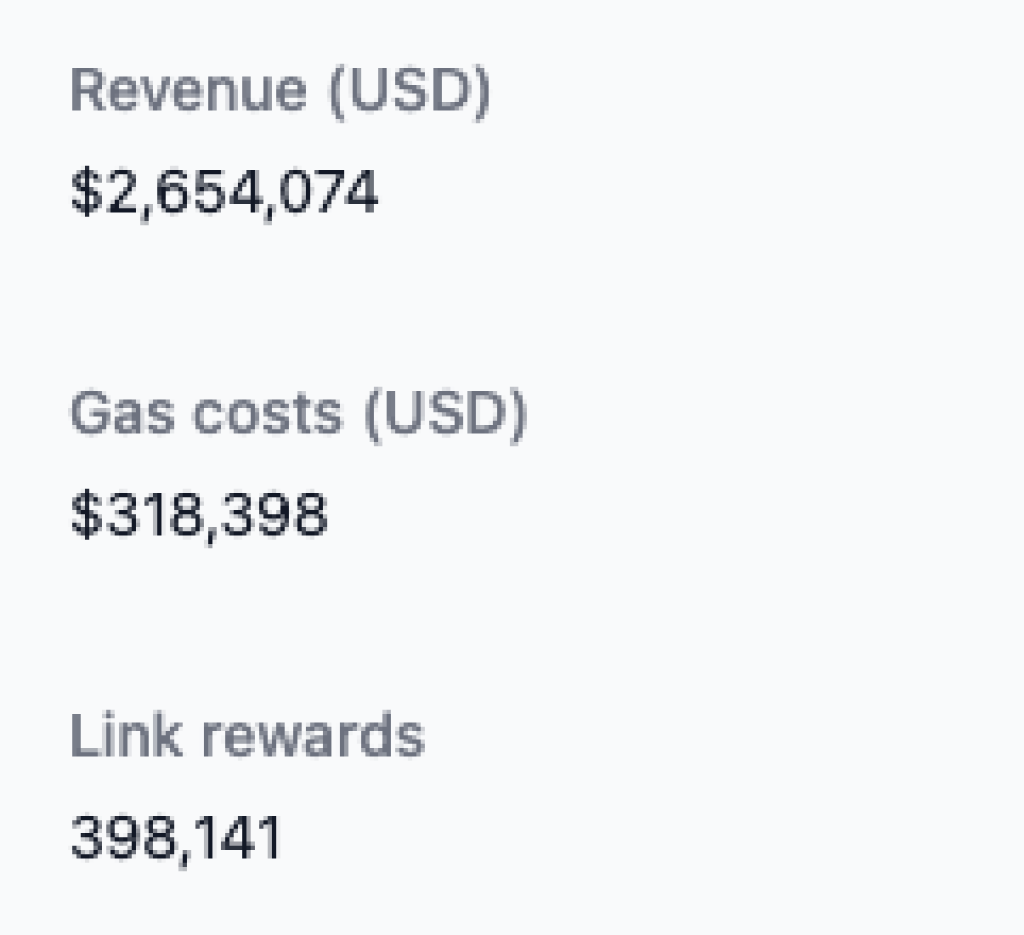

As of October 2023, LINK’s network fees totaled $4.4 million over the trailing month, based on data from Token Terminal. In comparison, SOL, MATIC, and AVAX combined for $5 million in aggregate revenue. Yet their combined market capitalization equals roughly $17 billion.

Meanwhile, Chainlink’s current market value sits around $4 billion. This means LINK is managing to capture a comparable level of network value to platforms worth multiples more.

The dynamic highlights Chainlink’s greatly undervalued network effects relative to its competitors interoperability platforms. Despite its pivotal role in cross-chain connectivity and real-world data feeds, LINK continues to lag in market cap versus other major layer 1s.

As DeFi and Web3 applications expand across fragmented networks, Chainlink’s established oracle infrastructure stands to benefit tremendously. The ongoing revenue figures suggest the protocol is already successfully monetizing its network specialization.

For traders, this monetization edge makes LINK an intriguing speculative bet if its valuation ever gravitates more closely toward on-chain financial realities.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.