Crypto analyst Rekt Capital highlights a significant event: Chainlink’s break from its macro downtrend a few weeks ago. However, to truly embark on a macro uptrend, Chainlink needs to accomplish another feat: breaking out of its macro range. Currently, LINK is facing resistance at the upper boundary of this range. The possibility of a retest of the macro-downtrend looms large.

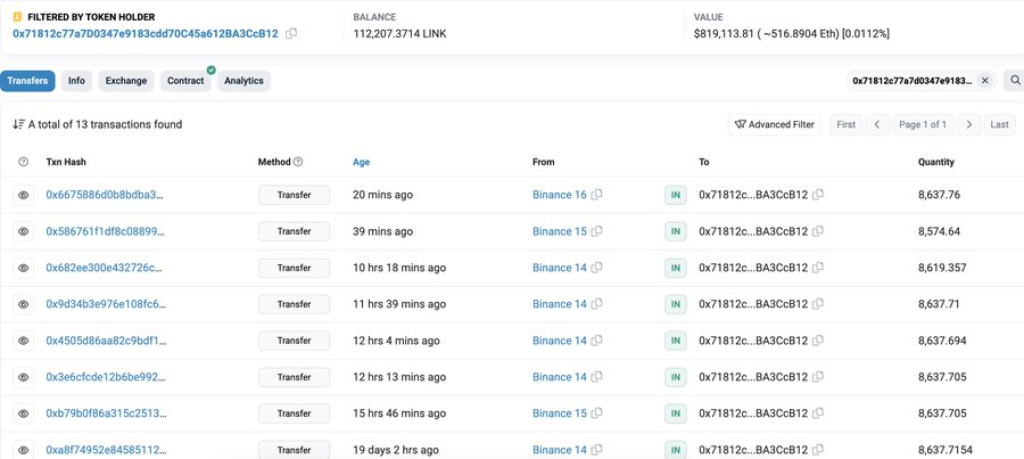

However, on-chain data by Lookonchain reveals an institution has aggressively accumulated LINK across numerous wallets when prices drop. Over $56 million worth of LINK has been acquired from Binance since mid-September.

This institutional buying counterbalances Chainlink’s lackluster price action, signaling long-term conviction even amid stagnation. It may limit the downside if support levels are tested again.

The technical aspect of Chainlink’s price action reveals a compelling narrative. For over a year, LINK has been consolidating below the $9 mark. Despite repeated attempts to breach this critical level, it has remained elusive.

The recent rally towards this level was met with resistance at $8.2, causing a minor pullback. However, the asset managed to maintain support above $7.4, indicating the potential for a breakout beyond $8 in the coming week.

Furthermore, if the bulls regain control of the market, there is the possibility of LINK reaching and testing the $9 zone. However, it’s important to note that sustaining gains at this level may prove challenging in the long run.

In conclusion, Chainlink’s journey toward a macro uptrend hangs in the balance as it grapples with the macro range’s upper boundary. Meanwhile, institutional interest continues to grow, adding a bullish tone to the narrative. From a technical perspective, the $9 mark remains a crucial level to watch, with the potential for both upside and downside movements in the near term.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.